16th January 2026

Silver Going Parabolic! Black Swan Incoming?

Silver Going Parabolic! Black Swan Incoming?

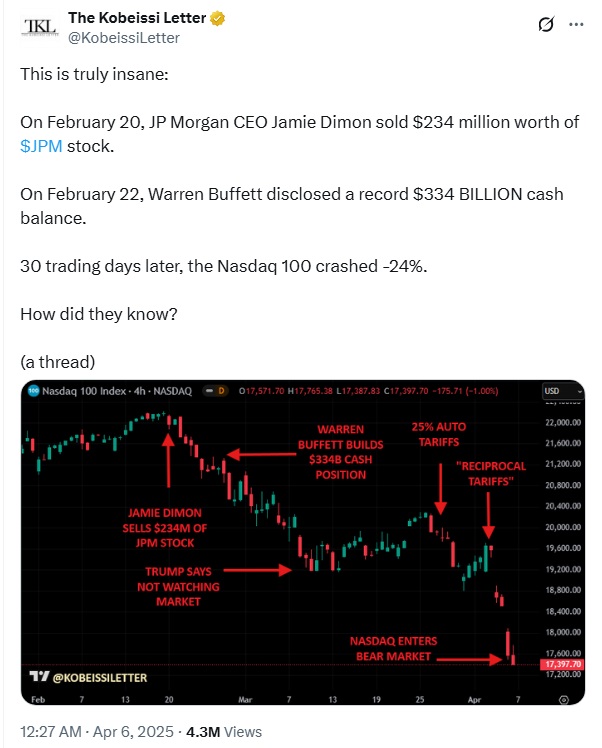

The silver rocket has taken off and I am waiting for a few major banks to go down! However, there are many other murmurs like Japanese bonds causing a crisis and unraveling the Carry Trade and private equities in BIG trouble, so the game of Jenga is still in play.

Click image for link

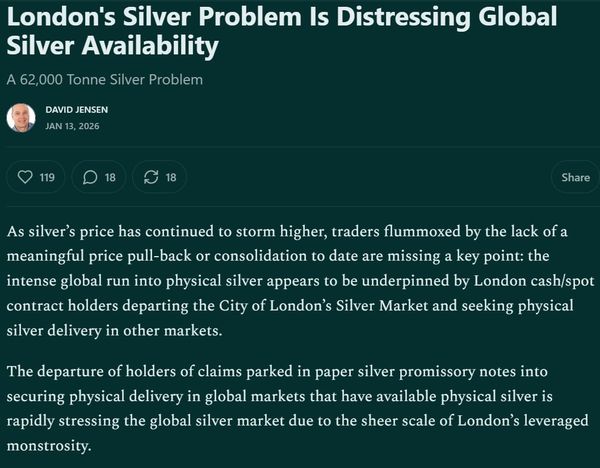

🚨LONDON HAS A 62,000 TON SILVER PROBLEM!!

🔥The Scale Of London’s Silver Problem Speaks Of A Rapidly Increasing Acute Global Silver Shortage

David Jensen's latest is a MUST read:

Comment: You can read the article on XTwitter or on David Jensen's Substack,

London's Silver Problem Is Distressing Global Silver Availability | A 62,000 Tonne Silver Problem

Click image for link

#Silver doesn’t need a crisis to reach $200/oz.

It only needs time.

Years of suppression, paper leverage and rule changes compress price.

When control fades, repricing isn’t explosive — it’s inevitable.

Comment: Unfortuntely, the banking manipulation is ongoing, so the wild swings continue. Good luck if you are buying or selling.....

|

Click image for link

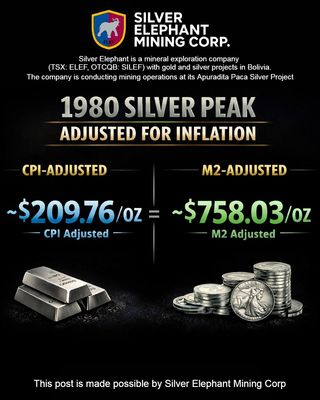

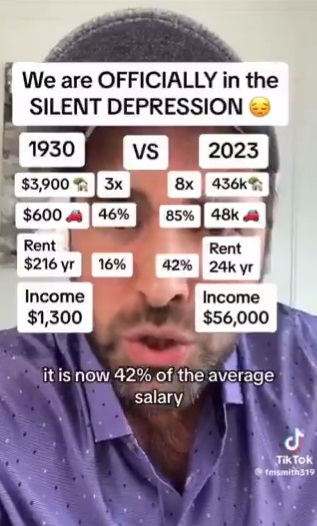

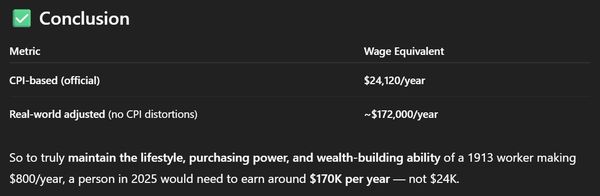

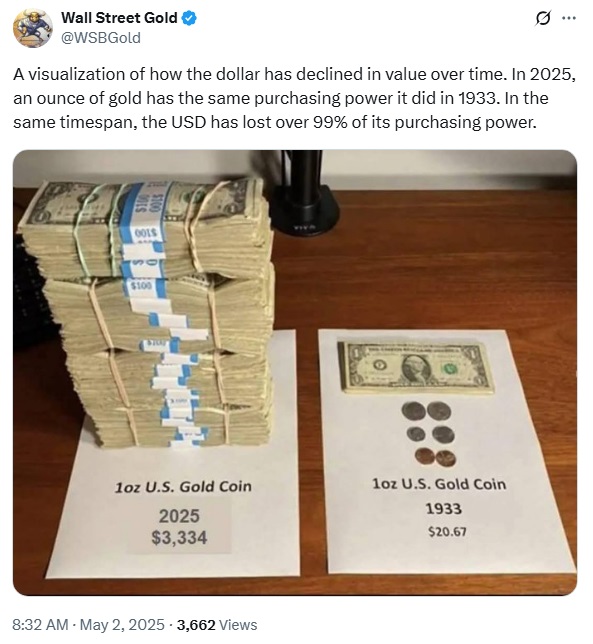

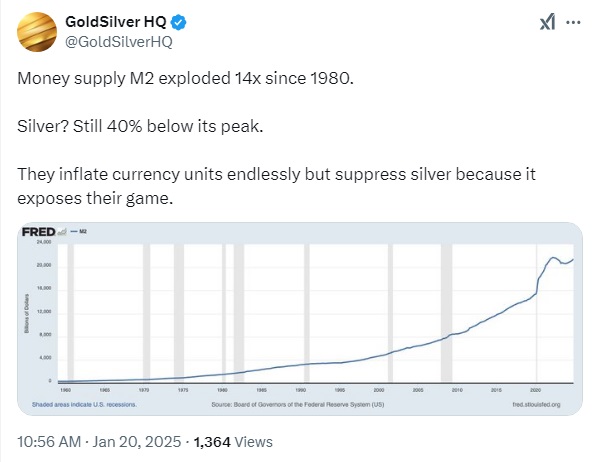

Did you know the 1980 silver peak of ~$50/oz equates to just $210 in today's CPI-adjusted dollars? But adjust for M2 money supply growth, and it's a staggering $758/oz. Fiat inflation is the silent thief

Made possible by

@SilverElMining

|

Click image for link

Fixed this for you @Forbes

Comment: If you are following other commentators, the refrain is that a fractional reserve system does not work when people demand the commodity. So "exposure" to price and settling contracts for cash that is being constantly printed out of thin air and given to banks etc is no longer working for silver. Cash will not work to make solar panels, car batteries and tech for data centres etc etc. I think the banks have been very very short sighted and I hope the biggest short sellers blow up.

Click image for link

🧵 Silver doesn’t react to headlines.

It reacts to SYSTEM STRESS.

U.S. military action in Venezuela isn’t about silver supply.

But it does matter for silver — a lot.

Here’s why 👇

Comment: This thread is about geopolitical moves affecting the price of silver.

🔴

Silver over $91: A Once in a Lifetime Wealth Transfer has started

Silver over $91: A Once in a Lifetime Wealth Transfer has started

YouTube, 15th Jan 2026

Comment: I have only recently discovered this older British YouTube blogger with the name "Join the Dots: Cutting Through the Noise" @jointhedots13 and I like his truth telling style. Quite frankly, I admire the effort to explain the financial impact of banking induced chaos to people who have no idea how bankers routinely cause havoc with boom bust cycles.

The Dollar Reset Nobody's Talking About | Gold, Silver & Crypto

YouTube, 4th Jan 2026

Comment: If you need to catch-up on the silver moves in the last few months and what they mean, @jointhedots13 gives a brief summary of three excellent interviews with YouTube links provided.

Click image for link

IT’S OVER: The Spread Just Exploded to $13, Shanghai Hits $104! (Banks Are TRAPPED)

YouTube, Jan 14, 2026

JPMORGAN'S $347 NIGHTMARE: What Happens If They Cover 4.2B Oz Short (21-Day Timeline Analysis)

YouTube, Jan 15, 2026

IT’S OVER: Banks Are Dumping Shorts & Buying Physical (Front-Running China's Supply)

YouTube, Jan 15, 2026

Comment: Over the last 2 weeks or so, Asian Guy channels (probably fakes) have been making claims that banks are in serious trouble with their shorts and that they have been told to get out of the silver shorting game. It is likely that the information is only partly true because it is FACT that banks are criminal and have sold silver using paper contracts representing silver that does not exist. Currently, the reason that US banks are not seen to fail is because they are being bailed out by the US Federal Reserve. This is via the REPO window (pawn shop for banks using collateral swapped for cash). Then there are claims that European banks also have massive short positions in silver. This well respected blogger @Eurodollar University says there is a problem there,

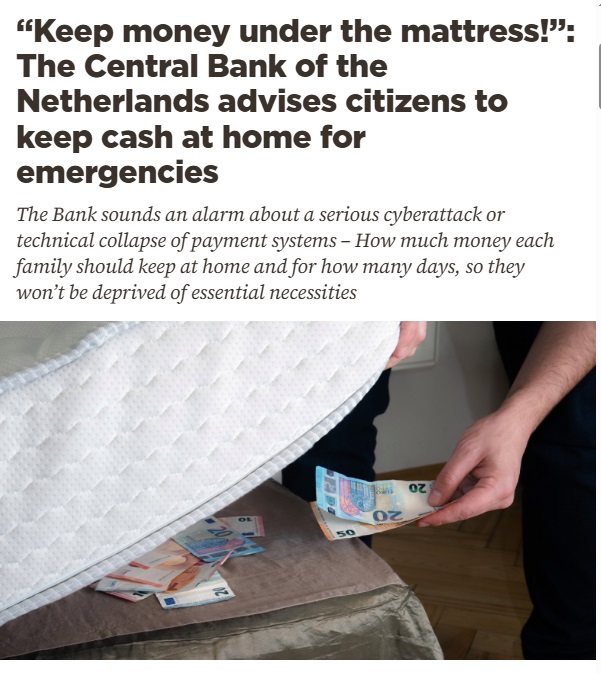

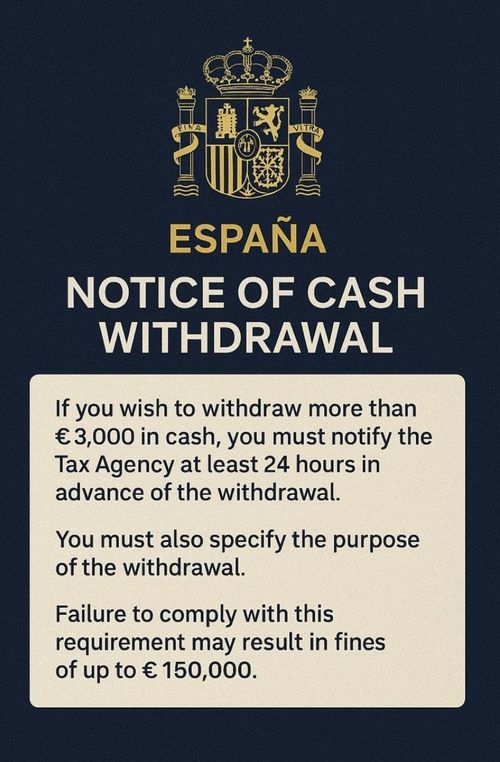

HOLY SH*T: European Banking Data Confirms a Systemic Problem. For those who have been paying attention, European banks detonating might explain the European reports in recent months to have cash and extra supplies at home, see older blog entries.

Btw, I still think the original Asian Guy channels are there to teach. Asian Guy ====> AG ====> Silver. However there is now a lot of copy cat channels and they may be stealing content and dubbing dates and prices to confuse. Whatever, there are plenty of other good bloggers providing good content.

1st January 2026 | #AsianGuy Update! | 6th January 2026

Click image for link

The signs were there.

Click image for link

Our 1st Lady looks absolutely stunning in that SILVER dress 🇺🇸

We are going so much higher 🚀

Click image for video link

Melania walks out in a stunning SILVER dress to the theme tune of the Lone Ranger….. HI-HO Silver Away……

To start 2026 - the year of the horse

2026 New Earth Let’s GO!

Comment: Some serious COMMS? Again Trump is talking about 'Peace On Earth' at Mar-a-Lago New Year’s Eve bash .... When the banks blow up, there will me 'Peace On Earth'....I chose this post because the video was better quality than others, but we also get a reminder that this is 'The Year of the Horse'. This is important as the silver price is going to gallop!

📣📣HOW BIG IS THE SILVER & GOLD TIME 💣💣💣

📣📣HOW BIG IS THE SILVER & GOLD TIME 💣💣💣

Mitch Vexler who has been relentlessly exposing the 5.1 Trillion Property Tax Bond Fraud.

Shows just how large the Silver and Gold problem is and the contagion it could cause.

Right now you better believe they are throwing everything and the kitchen sink to save the system.

Click image for video link

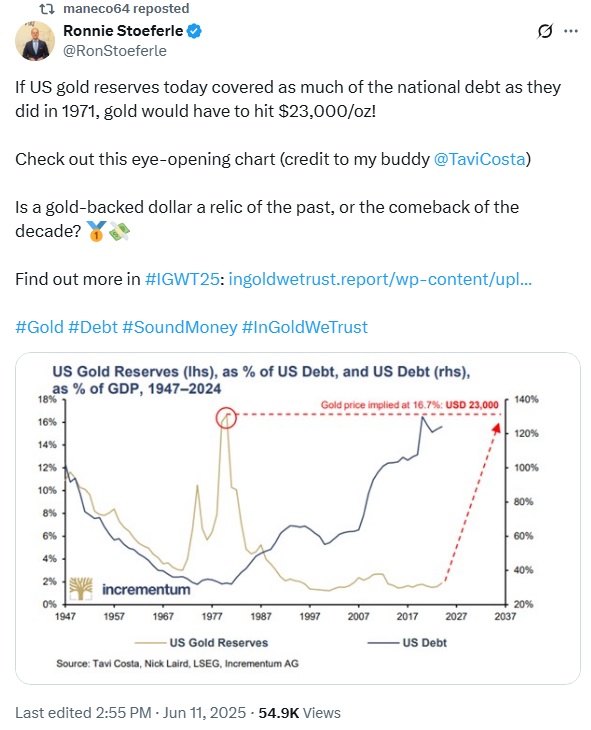

Comment: This starts of by methodically explaining how there is a serious problem with silver traders (banks) being under water. Next we are told that the US government has a serious problem and that they will need to revalue gold to ~$58,000. This is similar to previous valuations I have provided. So what should the price of silver be? The problem is that gold is not required for our technological world and I am starting to believe after 5 years, that Bix Weir is right and that silver will go 1:1.

Click image for link

Comment: NO arbitration going on between COMEX and buyers in other countries because there is no physical silver available to buy. Update: Asian Guy | 93% of Silver Refiners Blacklist Western Buyers Link

Click image for link

🔴

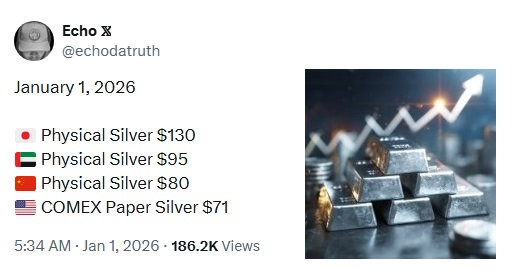

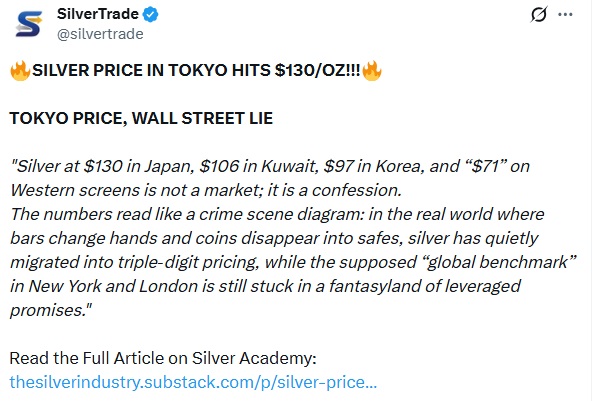

Silver Price in Tokyo hits $130 per ounce. Guess that's how you spell FOMO in Japanese

Once Shanghai opens up again on Sunday night Jan 4 2026, More Fireworks

Silver Academy, 31st Dec 2025

Comment: Here we get a few examples of where the Western price of silver has completely diverged from reality. The bankers need an artificially low price to deal with their derivative exposure. The financial system is designed to screw the people, so this current situation is just more of the same, but the end is in sight.

🔴

We Are Seeing the Scouring of Global Markets to Secure Physical Silver | David Jensen

YouTube, 1st Jan 2026

Comment: The fake silver market exposed! Bankers don't seem to understand the concept of supply and demand! Bits of paper don't represent real physical silver!

🔴

Must watch by Asian Guy, basically telling us the transfer of wealth is upon us and the metal markets are about to get crazy🎉 | XTwitter video Link

Click image for link

Count down time… #Silver 🔥🔥🔥

Click image for link

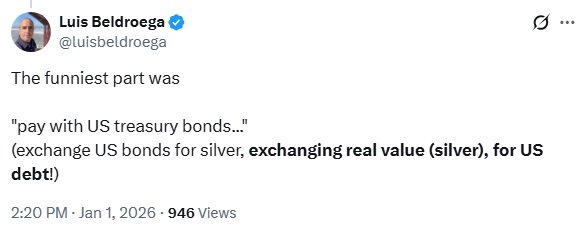

Comment: It was the pay with soon to be toilet paper that got me too... Update: Asian Guy explains that this was a deal proposed by American bankers but shunned by Chinese authorities DEFAULT CONFIRMED: China Rejects US Emergency Deal (COMEX Closed)

Click image for link

Between the 23 of Dec 2020 and the 23 of Jan 2021 $GME price jumped more than 5 times, a move nobody could picture in its wildest dreams not even

@TheRoaringKitty

Like it or not, but #silver current set up is incredibly similar with only 2 main differences:

- It’s a titanic clash among heavyweight institutional players with very limited retail participation

- the “buy” button cannot be pulled away from the physical market that mostly trades OTC

Click image for link

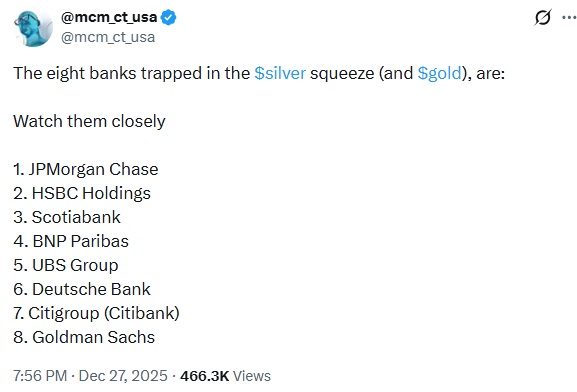

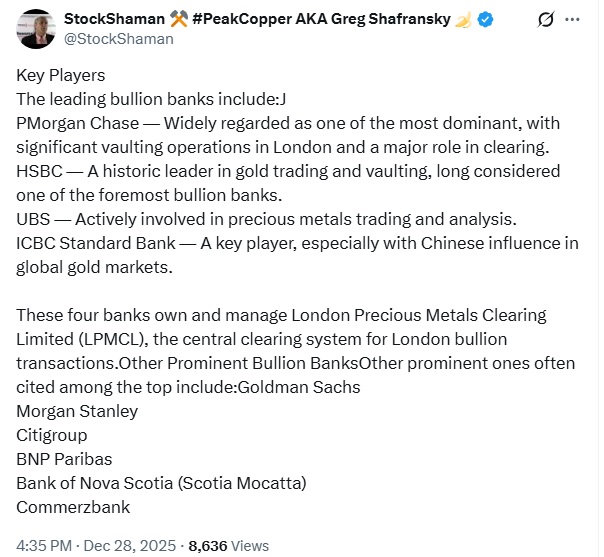

The eight banks trapped in the $silver squeeze (and $gold), are:

Click image for link

Click image for link

🚨 SILVER PRICE MANIPULATION

Silver was on a direct path to $90+ this week. The momentum was high but then it mysteriously crashed, now we know why:

1. Margin Hikes: Raised to $25k to force small players out.

2. Bank Bailout: Liquidity injected to cover a $35B+ failed short position.

3. Price Discrepancy: Street prices reached $50+ over spot, but charts remained down to protect the institutions betting against Silver.

Result: Price smashed back to $71.

They didn't crash the market because it was "overbought." They crashed it because they were insolvent and needed an eject button.

We’re witnessing institutional level manipulation on a never before seen scale.

Comment: Desperate measures taken by the banking cabal explained....

🔴

Just learned that theres Silver in CD's on Chinese Tiktok... interesting. Did anyone else know? | XTwitter video Link

Comment: Salvaging of silver will become widespread.

28th December 2025

Silver Going Parabolic! Black Swan Incoming?

Silver Going Parabolic! Black Swan Incoming?

Click image for link

Click image for link

Comment: There is some pushback on this post, but the recognition that silver is going parabolic is widespread.

Click image for link

Comment: Elon Musk has just informed 200 million followers that there is an issue with silver.... "This is not good. Silver is needed in many industrial processes." | XTwitter Link

Click image for link

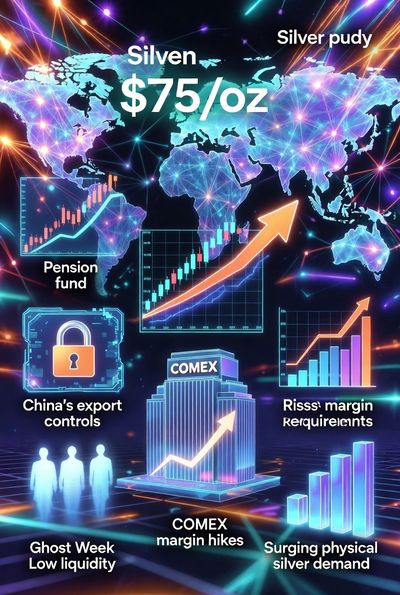

Silver smashing records above $75/oz! Driven by pension/ETF inflows, China's upcoming export curbs, COMEX margin hikes squeezing shorts, Ghost Week thin liquidity volatility, surging physical demand & global supply pressure. Bull run intact?

Comment: 26th Dec 2025 | Over $82 dollars in Shanghai which people in the know realise is the real price, not the fake paper swapping price at the Comex and LBMA. PLEASE NOTE: BETTING ON A COMMODITY IS NOT THE SAME AS OWNING THE COMMODITY AND MANY ARE GOING TO FIND THIS OUT WHEN THEY DEMAND SILVER THAT THEY THINK THEY HAVE BOUGHT. As previously explained, the paper to physical ratio is ~400-1. Yes that means that for 400 paper ounces, there is only 1 physical ounce. There is going to be a lot of disappointed investors who will soon find out that they have only been betting on the silver price.

Comment: John Perez runs the "Silver is Money" channel on Telegram. He has been a silver broker for decades and coined the phrase, “Bitcoin dies, #Silver flies!” I am very impressed with this prediction based on the high levels of panic that we are currently witnessing.

Click image for link

🔴 Gap Up Sunday Night!

Based on today's price, silver is likely to gap up on Sunday night, probably into the mid-80s, and reach the mid-90s by Sunday night. Monday's session could easily exceed $100, and if that happens, I would expect a $10–$15 gap up on Tuesday, taking silver to $125 an ounce next week—earlier than I expected.

Link

Comment: I think people are shocked at the sudden violent move upward of the silver price and so these predictions are worth noting. Before the usual silver pundits were saying $50 by the end of the year.... They have gone very very quiet now. THIS IS NOT A SHORTSQUEEZE CAUSED BY RETAIL. RATHER WE HAVE PANICKED INDUSTRIAL BUYERS TRYING TO OUT BID OTHER MAJOR BUYERS (SOVERIEGN WEALTH FUNDS, PENSION FUNDS, INVESTMENT FUNDS, CENTRAL BANKS, ETC) WHATEVER. WE ARE IN HISTORICALLY COMPLETELY UNCHARTERED WATERS... LITERALLY... ONLY THE ASIAN GUY (AI) IS EXPLAINING WHERE THE PRICE IS GOING NEXT AND WHY AND GETTING IT RIGHT....

LEAKED: Samsung CEO Emergency Call — Needs 50M Oz, COMEX Offers 5M

YouTube, 28th Dec 2025

On December 18th, 2025, Samsung Electronics held an emergency procurement meeting at their Seoul headquarters that reveals the silver shortage is no longer theoretical—it's operational reality affecting the world's largest electronics manufacturer. A leaked internal memo shows Samsung requested 50 million ounces of physical silver from COMEX for Q1-Q2 2026 production. COMEX offered 5.2 million ounces. That's 10.4% fulfillment. This isn't a supply tightness, this is structural collapse of the delivery mechanism when industrial buyers who actually need metal discover the vault is empty.

On December 18th, 2025, Samsung Electronics held an emergency procurement meeting at their Seoul headquarters that reveals the silver shortage is no longer theoretical—it's operational reality affecting the world's largest electronics manufacturer. A leaked internal memo shows Samsung requested 50 million ounces of physical silver from COMEX for Q1-Q2 2026 production. COMEX offered 5.2 million ounces. That's 10.4% fulfillment. This isn't a supply tightness, this is structural collapse of the delivery mechanism when industrial buyers who actually need metal discover the vault is empty.

Comment: There is a very long write-up here. This video is not just about Samsung. Quite frankly, this crisis can be blamed on the banks that hyped bitcoin/crypto, but suppressed the share price of miners.... Now there is less and less silver coming out of the ground while demand from industry is soaring. Embarrassing.... Looks like a major banking meltdown is coming due to derivative exposure as the silver price soars.

Deeper analysis: This is ultimately caused by the Cabal/WEF mindset that we the people will own nothing and be happy. Bitcoin/crypto is nothing but digital code, silver is a hard asset but used everywhere in a technological world. Even the Cabal aim to spy on everyone using AI, but the new data mega centres need silver. The stupidity is obvious.

LARGEST LIFE INSURANCE PROVIDER IN US, NEW YORK LIFE, WITH $900b AUM, SUGGESTS PRECIOUS METALS ALLOCATIONS UP TO 20% | XTwitter

Link

🚨 Pension Funds Are Rushing Into Silver, $47B Hits Jan 15

Pension funds managing millions of retirements are piling into physical silver ahead of a $47 billion institutional wave expected to hit by January 15. | XTwitter

Link

Click image for link

MOST PEOPLE HAVE NO IDEA WHY SILVER WENT PARABOLIC IN 2025 TO BEGIN WITH. CHINA'S EXPORT RESTRICTIONS ON #SILVER THAT BEGINS JANUARY 1ST, 2026 WILL FINALLY BREAK THE FAKE COMEX/LBMA PAPER DERIVATIVE MARKET.

IT WILL ALSO HAVE DIRE IMPLICATIONS ON WESTERN MARKETS. FEW UNDERSTAND THIS!!! #SILVERSQUEEZE

Comment: I like the graphic but sentiment here is probably not completely correct. The silver market breaking is due to many factors including BRICS+ nations being sick of the dollar (reserve currency) being debased by continuous printing. Russia's international bank account being stolen was probably the final straw. Silver is the known weakness of the western financial system and the silver stake has been finally driven hard into the heart of the financial system. Big buyers of silvers are demanding real metal and you can't print that.... All this means is that the final solution will be going back onto a gold standard and those who have precious metals are going to get seriously rich.

Click image for link

Comment: Most of these YouTUbe channels have popped up in the last two weeks. I presume that some kind of information campaign was set up by White Hats, to calm retail down. The information is highly informative. From this small selection, the oldest channel is actually 2 months old

https://www.youtube.com/@Financial_Revelations1

https://www.youtube.com/@Finalwealthwarning

https://www.youtube.com/@theboringcurrency

https://www.youtube.com/@TheExposureIndex

https://www.youtube.com/@FinanceThroughTime-i9p

#AsianGuy

DAVID JENSEN WARNS ABOUT THE ‘ASIAN GUY’⚠️

DAVID JENSEN WARNS ABOUT THE ‘ASIAN GUY’⚠️

🔍 A mysterious source dubbed "Asian Guy" is flooding the silver market with intel. What's the real game?

📢 This anonymous source has gone viral, posting relentlessly about COMEX, the LBMA, and imminent shortages.

➡️ 10-20% of what he says is demonstrably wrong.

Click image for video link

Comment: 6th Jan 2026 | I have been thinking of providing an update on the Asian Guy AI videos for a few days because there are too many reports of events taking place that are not immediately substantiated by other silver bloggers. A wild example being that JP Morgan missing a margin call. Personally, I think the AG AI has been cloned (now AG AI2) and it's handlers are now deliberately putting out misinformation on multiple channels. I think the older videos are still most likely to be accurate, in terms of explaining how the silver market operates.

🔴 My vibe Monday when silver is at $80+ | XTwitter video Link

Comment: This will be people who bought silver at $4-5 after the last major crash/25 year low.

🔴 Silver Investors | XTwitter video Link

Comment: LOL!!

Click image for video link

🎁 Christmas season is the time of giving, when Russia makes sure that all of its friends get something nice and are well and merry.

As for the naughty ones, they too will get what is coming for them.

Comment: Lots of messages provided here but the most interesting is "NOT WAR JUST PEACE, FOREVER, FOREVER". If the current banking system is destroyed, then there is no credit to lend out to make wars easy and profitable.

23rd December 2025

$70 dollar spot silver price and the silver madness has only just started....

$70 dollar spot silver price and the silver madness has only just started....

Click image for link

Samsung's #silver battery breakthrough:

A battery that consume 1 kg silver!!

16 million EVs * 1 kg silver per car = 500 million oz per year!!

Annual world production is 824 million.

1 kilo per car sounds crazy high, but that is what the expert says.

#SilverSqueeze

THE "9-MINUTE" CHARGE: Why Silver Is Going To $150 (Samsung Leak)

YouTube, 23rd Dec 2025

Comment: We are provided with some excellent anaylsis here. Surprisingly, we are told that Samsung will only get distressed when the price of silver hits $1,000 an ounce! Btw the Asian Guy videos are generated by AI, but the information is all quite brilliant. The Samsung battery has just killed the financial system that traded paper silver, but today nobody wants paper, they NEED real silver! The consequences for the world's financial systems are going to be massive. Whatever, congratulations to anyone who brought silver or gold!

🔴

Boomers Who've Been Waiting For The Silver Manipulation to End Since 1980 Watching Silver Soar Through $70 Tonight... | Xtwitter video Link

Comment: LOL!!!!

🔴 Wow! This is appreciation that you don’t see much from Companies anymore! Solid Gold LEGO piece!

🔴 Wow! This is appreciation that you don’t see much from Companies anymore! Solid Gold LEGO piece!

Additional Context: Lego didn't "just show" this. The solid gold Lego gift for 25+ year employees, and a few select others, was a program between 1979 & 1981, 45 years ago.

Click image for video link

Comment: Gold at new All Time Highs (ATHs) and the US dollar (world's reserve currency) is going down the drain!

14th December 2025

A Flock of Black Swans!

A Flock of Black Swans!

A Flock of Black Swans Is Forming & the Power Elite Knows Exactly Why | Thornton & Schectman

YouTube, 11th Dec 2025

Andy Schectman, Founder & CEO of Miles Franklin Precious Metals, sits down with Dr. Mark Thornton, Senior Fellow at the Mises Institute, for a deep-dive into the systemic fragilities building beneath the surface of the global financial system and why a flock of black swans is forming all at once.

Comment: This video comes with a summary and chapters. I saw a clip on XTwitter concerning a flock of black swans link and I had to see what else was said!

Actually Thornton does not say this exactly, but the idea comes that this is back to financial jenga where nobody knows what is going to be the first financial structure to break and cause a black swan.... If you need to save time, this is where the black swan talk starts Link.

Only 5 Banks Remain Short Silver (This has NEVER Happened!) | Ed Steer

Only 5 Banks Remain Short Silver (This has NEVER Happened!) | Ed Steer

YouTube, 13th Dec 2025

Comment: I was stunned by the following concerning assessment re a parabolic price rise in silver:

Price changes in days

=============

$20 and $30 was 145 days.

$30 and $40 was also 145 days.

$40 and $50 was 39 days.

$50 and $60 was 12 days.

|

|

You can work out that means silver could hit $100 by the end of the year... It explains why there are posts concerning traders very confident that silver will be $100 by January or the very latest February Link

Click image for link

Comment: The silver price is skyrocketing, but I think it's getting a bit late to start buying large amounts. Millionaires are competing with billionares, investment bankers, countries and central banks! Seriously, the internet was awash with silver talk 5 years ago.... I consider this late to the party...

Click image for link

Is JPMorgan hoarding silver? Here’s what it means as reports claim the bank has been stockpiling the precious metal

The Economic Times , 10th Dec 2025

Synopsis

JP Morgan is making a historic silver bet. The bank now holds over 750 million ounces of physical silver, adding 21 million ounces in six weeks. It exited 200-million-ounce paper shorts, leaving zero short contracts for the first time. Physical supply is tightening as the U.S. Mint reports coin shortages. COMEX open interest is 244% of registered silver, lease rates near 30%, and 169 million ounces moved to non-deliverable vaults.

Comment: Since this is The Economic Times (Indian), I think it is likely to be more correct.

Click image for link

Comment: Yes, but gold is being revalued higher too....

Why JPMorgan Just Stockpiled 169M Ounces of Silver — The 500% Squeeze Begins

YouTube, 7th Dec 2025

Comment: JPMorgan has protected themselves against the failure of fiat currency at the same time as committing fraud to lower the silver price!

China Silver Export Restrictions Transform Global Market Dynamics

Discovery Alert, 11 Dec 2025

China's implementation of silver supply deficits control mechanisms beginning January 2026 represents a fundamental shift in global precious metals dynamics. China silver export restrictions emerge as strategic policy tools designed to preserve domestic stockpiles whilst creating leverage over Western industrial dependency. Furthermore, the convergence of industrial demand growth, monetary instability, and resource nationalism creates perfect conditions for market dislocations that dwarf traditional commodity cycles.

China's implementation of silver supply deficits control mechanisms beginning January 2026 represents a fundamental shift in global precious metals dynamics. China silver export restrictions emerge as strategic policy tools designed to preserve domestic stockpiles whilst creating leverage over Western industrial dependency. Furthermore, the convergence of industrial demand growth, monetary instability, and resource nationalism creates perfect conditions for market dislocations that dwarf traditional commodity cycles.

6th December 2025

The Silver Crisis Really Escalates! - Bullion Bankers Desperate!

The Silver Crisis Really Escalates! - Bullion Bankers Desperate!

This is just recap of what went down at Thanksgiving night and associated analysis. Briefly, the consensus is that LBMA and COMEX are both facing extinction and trading of precious metals will move to Asia and be controlled by China. There are conflicting thoughts of what will happen then. Some say China wants cheap silver, but others believe that the Chinese will take the opportunity to turn pricing into a casino.... Well, price discovery is now happening so the true price without massive price manipulation is far far higher. A gold to silver/gold ratio of 10-1 would be a good starter rather than the ridiculous ~75-1 that exists now. Btw, an important point. At Shanghai's metal exchange, SGE’s Trading Structure Prevents Naked Shorting of #GOLD and #SILVER Link. Greedy bankers will lose out!

Click image for link

What we just discovered is shocking: bullion banks are fighting a losing war to stop a nuclear short squeeze in silver.

Comment: Here is another long thread about the stress in the silver market Link

Click image for link

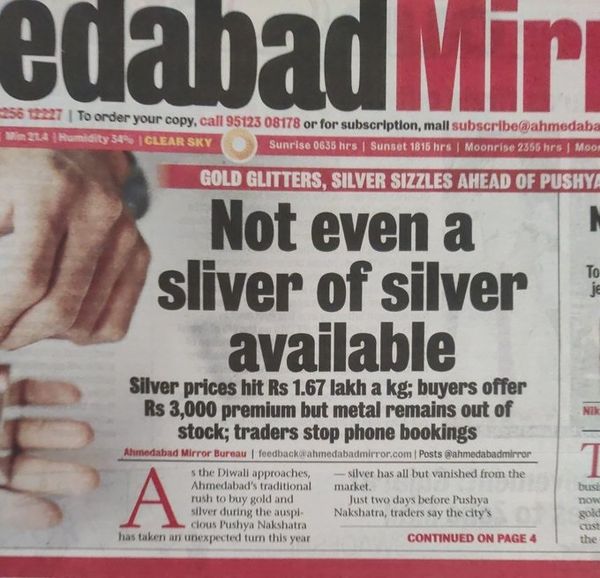

A global silver shortage has rattled markets, pushing Indian spot prices to Rs 1.9 lakh/kg, 20% above futures. MCX raised margins amid high demand from industries and festive buyers.

Supply issues, geopolitical tensions, and mine closures fueled the rally, doubling silver’s international price from $22 to over $50. | Oct 15 2025

WEEKLY WRAP with Alasdair Macleod | 12th Dec 2025

WEEKLY WRAP with Alasdair Macleod | 12th Dec 2025

King World News, 6th Dec 2025

Comment: Start at ~ 7 minutes. Alasdair make it very clear that India is having problems getting physical silver. In this regard, China won't help despite being the no.2 silver producer in the world. Besides, China needs silver for it's own industrial base and sees India as competition. Therefore, India have resorted to demanding huge volumes of silver from the LBMA and Comex. I can only presume that these sleepy and corrupt metal markets have not planned for increasing demand for industrial silver and are now in BIG trouble because the silver does not exist in such huge quantities. I am not 100% convinced that retail investment demand has not started yet, but I do agree major panic has yet to start.....

Associated article @KWN Silver Short Squeeze Continues With Shortages Of Physical Metal Across The World

🔴

Major Battle for Physical Silver Raging as JP Morgan Protects Its Stack from Delivery

Major Battle for Physical Silver Raging as JP Morgan Protects Its Stack from Delivery

YouTube, 4th Dec 2025

Comment: According to Mario Innecco (maneco64 on YouTube), his insider sources claim that Middle Eastern central banks or Gulf Co-operation central banks cleaned out JP Morgan of 34 million ounces of silver which is the equivalent of 6,800 lots of silver futures. The real problem was that they wanted delivery of the physical silver a piece of piece of paper was not sufficient. JP Morgan panicked and decided to shut the silver market down by pulling the plug literally on the whole financial exchange in Chicago (CME) to hide the real problem of supplying silver demand. Furthermore, JP Morgan has shocked the silver market by withdrawing 13.4 million ounces of silver that they pretended was available for purchase. Instead this silver is withdrawn from sale making the amount of silver generally available for purchase even smaller Link. Theoretically, the price should go up due to scarcity, but these bankers have HUGE problems as they have sold silver contracts on physical silver that does not exist. Meanwhile, they are now getting REPO loans to pay margin calls.

🔴

The $100 Silver Window Is Closing — And Banks Are Banned From Selling Physical Silver

The $100 Silver Window Is Closing — And Banks Are Banned From Selling Physical Silver

YouTube, 3 Dec 2025

37.6 million ounces of silver vanished in 47 days.

Not sold.

Not consumed.

Vanished.

From COMEX vaults.

This is the largest silver drain since 1980 — the same year silver exploded to $49 and almost collapsed the futures market.

Now it’s happening again… but this time it’s worse.

Comment: This is a history lesson and pattern recognition that history is repeating now.... I think this is excellent piece of AI.

🔴

The Night COMEX Went Dark: What Really Happened During Silver’s Black Friday Shutdown?

The Night COMEX Went Dark: What Really Happened During Silver’s Black Friday Shutdown?

YouTube, 30 Nov 2025

On Thanksgiving night, silver crossed $54… and the COMEX futures market suddenly went dark. CME blamed a “cooling failure.”

But the timing, the data, and the vault movements tell a very different story.In this episode, we break down:

• The hidden stress building inside COMEX before the shutdown

• Why 7,330 delivery notices hit on Day 1

• The vault anomalies: JP Morgan’s –13M oz shift, Asahi inflows, CNT reclassifications

• Why metals were offline while everything else traded normally

• What December deliveries reveal about the real physical float

• And what the March 2026 contract is quietly signalling…

This wasn’t a glitch. It was a stress test.

Black Friday was the tremor. March is the earthquake.

Comment: This is ~ 6 minutes explanation of the Comex meltdown from an Indian perspective. India is not impressed....

🔴

7 Years of Silver Deficits Without a Significant Price Rise is WHY the Silver Shortage Will Last for Another 10 years!🧨🧨🧨 | XTwitter Link

🔴

🧵 THREAD: What happens to #Silver if physical delivery stops? | XTwitter

Link

29th November 2025

The Silver Crisis Escalates!

The Silver Crisis Escalates!

Actually, there are signs of impending disaster all over the place. The following is just a brief summary of what's up!

The Silver Swan automaton- handcrafted in 1773 by James Cox and John Joseph Merlin | XTwitter video Link

Comment: Is silver manaipulation the black swan we know is coming? Listen to the bells tolling here!

Click image for link

Why Silver Has Smashed To New All-Time Highs Today

David Jensen, Nov 28, 2025

Silver is trading above $55 USD/oz. today and the question for many is why.

In summary, worldwide shortage. Silver shortage has raised its head and is towering over the world’s largest cash/spot physical silver market in London where billions of oz. of silver that can’t be delivered has been sold to unwitting cash market buyers and that has now become visible.

Comment: XTwitter version: Link

Click image for video link

Server Overheat Excuse Questioned (CLIP)- Eric Yeung

Comment: Eric Yeung @KingKong9888 questions why the CME closed down for for 10 hours overnight which is ridiculous in today's computing world. This looks like they were due to default on a massive delivery and decided to literally pull the plug. Others claim that they had to wait for the Federal Reserve to open and give a bank or banks an emergency $24.4B bailout (liquidity lifeline) so that they could carry on.... Link

|

🔴 The official story gets stranger by the hour.

If the outage was truly a “cooling issue”, we’d see it across multiple CyrusOne clients — not only on CME’s matching engine during a vertical move. | XTwitter Link

Comment: There is some serious skepticism concerning what happened when the price of silver went vertical (all time high) and then suddenly trading was stopped... Actually, the price of gold futures were also at record heights so this might have been desperation on two fronts....

Click image for link

Silver Breakout - Mike Maloney on What Comes Next

YouTube, 28th Nov 2025

Comment: 90% of global derivatives trading stopped! Folk are really excited.

|

Click image for link

🔴

BREAKING INTEL: China Is Refusing To Send Its Silver To London To Fulfill Orders—

🔴

BREAKING INTEL: China Is Refusing To Send Its Silver To London To Fulfill Orders—

This Action Will Trigger A Run On Silver When Silver Supplies Run Out!

Comment: So ICBC bank in China lends to the LBMA. The CCP clamps down and now Shanghai is short? Total chaos!

🔴

China is running short on #Silver — Shanghai inventories have collapsed to decade lows. The supply squeeze keeps tightening.| XTwitter Link

Comment: The price is too low! The solution is so simple except bankers who are naked short will lose billions when they are forced to buy back millions of ounces of silver at exorbitant prices.

🧵 1/

The global silver market just flashed another major warning signal — and this time it’s coming from all three pillars of the physical system:

🇬🇧 London

🇺🇸 COMEX

🇨🇳 Shanghai

All are reporting simultaneous drawdowns.

That almost never happens… unless something big is brewing. | XTwitter Link

Comment: Yes the system went bang, 4 days after this post!

Previous technical glitches | XTwitter Link

Click image for link

The silver system has already defaulted, says David Jensen.

@ASchectman sits down with the LBMA expert to break down what really happened in London – the backwardation, the missing metal, the 50M-oz emergency injection, and why global silver price discovery may never be the same.

‘London Silver & Gold Market Is a Smoking Hole’ – What Happens Next | David Jensen & Andy Schectman

YouTube, 16 Nov 2025

Andy Schectman, Founder & CEO of Miles Franklin Precious Metals, sits down with mining executive and precious metals analyst David Jensen to break down what may be the most important silver story of our time: a rolling failure inside the London Bullion Market Association (LBMA).

Reply by Eric Yeung 👍🚀🌕@KingKong9888

David Jensen:

1) All LBMA forward bilateral contracts are based on spot bilateral contracts, and forwards are only a small portion of overall contracts.

2) LBMA is not a centralized exchange like the COMEX. They can’t “force majeure” to cash settle like the COMEX. It will be a messy situation if they can’t get physical metals to full-fill their contract obligations.

3) The LBMA effectively has ZERO physical #Silver free-float right now despite getting #Silver from the COMEX. The LBMA is living HAND to MOUTH. Whatever physical #Silver the LBMA is getting right now is already gone (out for delivery).

4) LBMA is screwed if you take COMEX concentrated “naked shorts” into consideration as well. | Link

Comment: Eric Yeung based in Hong Kong really understands this truly opaque trading system and his analysis of how bad the LBMA's situation stands implies that the crisis will soon become obvious and infect bullion banks. Why? Because many have paper contracts that do not represent physical metal rather access to price fluctuations. Others have what they think is a paper certificate that they think represents real metal but the problem is that the same metal has been sold to many other institutions at a ratio of ~ 400-1. This is an epic mess. There is not enough metal to go round.

Click image for link

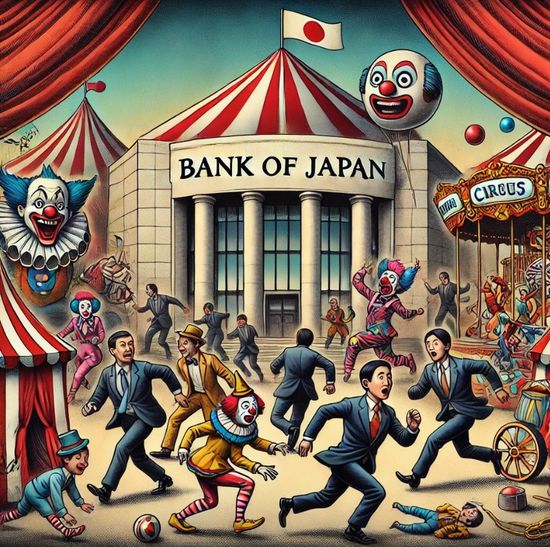

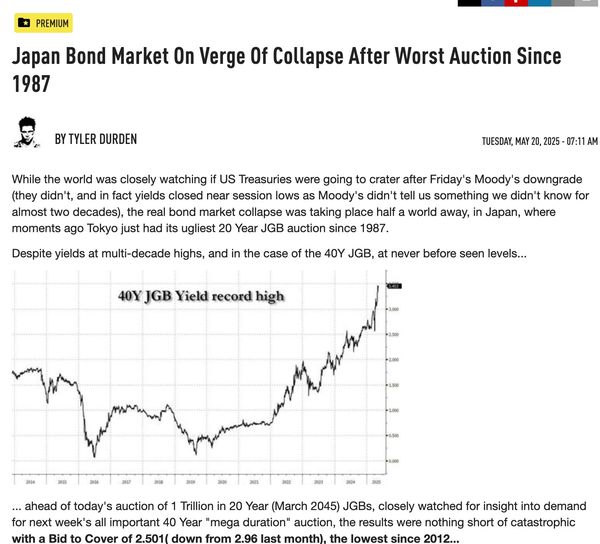

🤣🤣🤣Hedge funds weren’t built for a world where yen is no longer “free money.”💸💸💸

Japan’s 30-year just ripped to 3.30%...highest since ‘96.

Carry trade era?

Over.🚫

Stress zone?

Passed it.

We’re deep in panic😱 territory now.

Cheap yen funded everything:

Leverage, swaps, ETF shorts, synthetic hedges, even the clown show on meme stocks.

When the cost of yen goes vertical, funding implodes, hedges break,and suddenly assets they swore “can’t squeeze”…start breathing fire.

JGBs aren’t just bonds...they’re the margin engine of the whole synthetic short universe.

|

Click image for link

|

The Hidden $20 Trillion Global Carry Trade That Will Unwind Everything

YouTube, 22 Nov 2025

More: THE SILENT COLLAPSE: How Japan Just Triggered The Greatest Wealth Transfer In Human History Link

🔴

Yen/Dollar Carry Trade, a short explanation. | XTwitter video Link

Comment: This is another major problem brewing as the unwind will trigger instability in the global financial systen.

Click image for video link

Interview with UK's MoneyMagpie

Jasmine Birtles and I discuss why and how the credit bubble will burst and the consequences for investors. Recorded last Wednesday.

Alasdair Macleod, Nov 18, 2025

“Fiat currency collapse, a historic credit bubble, systemic risk, gold, silver and the end of the current financial system are exactly what I dig into in this MoneyMagpie Invest episode with Alasdair Macleod. We talk about why every fiat currency in history has died, why this credit bubble looks bigger than anything we have seen before and what happens to ordinary savers when the system finally snaps.

”In this conversation, Alasdair explains how debt, money printing and leverage have created a huge global bubble in credit and equities, why the dollar and other major currencies are at the centre of the problem and why he believes we are now in the end game for fiat money. We look at historic episodes like Weimar Germany, the Great Depression and previous credit implosions and ask whether today’s mix of record debt and political paralysis is even worse.

Comment: Ex banker Alasdair Macleod gives his standard talk on getting out of credit and into real money.

Click image for link

BlackRock FAILS Credit Test For $1.7 Trillion Debt TIME BOMB

YouTube, 26 Nov 2025

Comment: The GREAT FINANCIAL CRISIS VERSION II is brewing and even GIANTS LIKE BLACKROCK MIGHT BE AT THE CENTRE OF IT!!!!!!

14th November 2025 | Update 15th November 2025

Click image for link

Saw this at the piggly wiggly this morning!

#silver making headlines!

Comment: I presume this is a fake TIME front cover, but the sentiment and silver price increase is just about right (depending on currency). Btw, the bankers are naked shorting silver in desperation, so who knows what the price will become when they are forced to give up. Many believe the death trap for bullion bankers is coming soon.... This will be when there is a failure to deliver real physical silver for a BIG customer and opinions do vary as to how that will be handled.

Update: 15th Nov 2025

Click image for link

🧵 THE SYSTEM IS STRAINING — AND SILVER KNOWS IT

Comment: Top post edited. This is a good thread. Decent summaries are hard to find.

Click image for link

Silver Explodes - There's Just Not Enough | Bill Holter

YouTube, 10th Nov 2025

Bill Holter joins Dunagun Kaiser to discuss the growing dominance of the physical gold and silver markets over paper manipulation. Holter warns that failure-to-deliver risks on COMEX could soon expose the fragility of the global financial system as real metal supplies tighten in New York, London, and Shanghai. He explains how a credit freeze or liquidity crisis could rapidly trigger systemic collapse and why physical ownership outside the system is critical. Bill also details the historic anomaly in junk silver premiums, why refiners are melting it down, and why it may soon become the most valuable form of silver. Finally, he cautions investors to avoid predatory dealers and shares how to verify legitimate bullion sources before it’s too late.

Ed Steer says, "In December, silver will explode like never before."

YouTube, 10th Nov 2025

Comment: Despite the title, this is a basic synopsis of what is going on in the silver market. I think this video is AI generated but the content is good enough. Many are stating that silver is about to skyrocket, but obtaining silver now is getting harder and a longer process due to shortages.

Click image for link

🧵 SILVER LOCKDOWN — The Global Shift Has Begun 🥈⚡

1️⃣

Oct. 29 — China quietly changed the rules.

From 2026, every silver export will require an individual license per contract.

No quota, no freedom. You want silver out of China? You’ll need Beijing’s permission. 🇨🇳

Comment: I wondered if this was prompted by the ICBC bailing the LBMA out last month, see details in blog below. The Chinese government have a long term goal of world domination and due to Tariffs are not playing nice when it comes to supplying critical minerals. Still, China is falling apart due to their Tofu Dreg construction, so I have a very hard time thinking the current government is going to survive all the disasters coming their way.

Royal Mint CHAOS - They Sent SILVER Instead of GOLD — You Won’t Believe What Happened!!

YouTube, 12th Nov 2025

Comment: Royal Mint Chaos! Imagine paying for gold and getting silver... Apparently 4 other customers got the same poor customer service...

The Royal Mint sends out 45,000 packages a month, but this is still terrible....

Serious Trouble at The Royal Mint – UK Bullion Buyers BEWARE!

YouTube, 2nd Nov 2025

Something strange is happening at The Royal Mint, and it’s starting to worry UK investors and gold and silver stackers alike. Reports are coming in that The Royal Mint is cancelling customer orders, delaying shipments, and struggling to keep up with demand — even as gold and silver prices continue to rise.

In this video, I break down exactly what’s going on behind the scenes at Britain’s national mint, why these order cancellations are happening, and what this means for the future of UK bullion investing. Is it simply a backlog, a supply issue, or something more concerning about how The Royal Mint operates?

Comment: Royal Mint cancelling orders when the gold price goes up? We only know because Backyard Bullion is an influencer with 85K followers.

Click image for link

Fury after Royal Mail offers man £750 after losing £10,000 gold bar in post

Metro 10th Nov 2025

A man says a £10,000 gold bar, which he planned to use for part of his pension, has been lost by Royal Mail.

Rob Hobson bought a 100g gold Britannia bar from his dad’s inheritance and had agreed a buyback offer from the Royal Mint after it was valued at £9,731.

But despite sending it special delivery and with extra insurance, the bar never arrived at its destination.

Comment: I asked at my local Post Office and the teller stated that they only insure up to £5,000 and you have to tell them what's in the package and pay the additional insurance cost. XTwitter headline only

Link

Click image for link

🎯 Hedge funds are borrowing at record levels, pumping up their bets with borrowed money. While this can boost profits, it’s a double-edged sword: if markets turn, losses are magnified, forcing quick sell-offs that can disrupt the wider financial system.

This leverage risk creates a fragile web of interconnected threats that regulators are watching closely, warning that a sudden market shock could trigger a cascade of liquidity problems and financial instability. #HedgeFunds #LeverageRisk #FinancialStability

🔴

A Trillion-Dollar Time Bomb Just Went Off on Wall Street

YouTube, 7th Nov 2025

UBS is reportedly closing down not one but two hedge funds, in a more that raises a lot of questions but also some very uncomfortable parallels to 2007. One of those funds is exposed to First Brands, so understandable. The other...isn't. And that raises the prospect of the R-word; in this case, that does not stand for recession, rather its uglier monetary twin.

Comment: Rich people losing money is a no-no! The panic of rich people trying to get their money back is what causes the crisis of distress/fire sales. Next will be the stampede into gold.... Update: Holy Sh*t! The Credit Losses Are WAY Bigger Than You Think | 12th Nov 2025

Comment 2: Hard to comprehend that BlackRock - the world’s biggest investment group - are facing heavy losses after its shadow banking business fell victim to an alleged $500m (£380m) fraud. Yes, lost ALL their investment money....

BlackRock in $500m shadow banking blow-up.

🔴

Holy Sh*t…Two SUBPRIME Hedge Funds Just Blew Up (Exactly Like Bear Stearns)

YouTube, 12th Nov 2025

Comment: George Gammon also talks about Hedge Funds blowing up and gives a history lesson comparison with the last major financial crisis (GFC). This is dealt with in more detail here

Here Come The Hedge Fund Bailouts.... | Xtwitter video Link

Comment: Hmmmm...... Found this from May 2024.... Looks like someone saw Hedge Fund bailouts (via the back door) coming....

[Missing?] Gold at Fort Knox

YouTube, 9th Nov 2025

Comment: This link starts at the short story of a Rockefeller personal assistant who became a whistleblower and who ended up dead for revealing there was a problem with missing gold at Fort Knox.... Since this has been long suspected, it's interesting to hear this story.

🔴

The #illusion of wealth: #Stockmarkets vs #Gold reality | XTwitter Link

Comment: Rafi Farber has been doing these charts, gold vs Bitcoin too....

Unfortunately, the implications are not obvious for most to understand when people don't know the difference between money and credit.

Click image for link

🪙🥇Central banks already entered the golden age.

Comment: I am hoping we get a 'real' golden age, but I think some major clean-up is still required....

31st October 2025 (Update: 1st & 2nd November 2025)

We have a Real Silver Crisis!

We have a Real Silver Crisis!

Silver’s Red Alert: Backwardation Exposes the Paper Market Lie

YouTube, 1st Nov 2025

Beware: Silver’s backwardation is revealing a lie at the heart of the paper market. This significant pattern is an indication of a structural shift from the paper to the physical markets, which changes everything. Prices have been printed, not discovered, and now physical demand is calling the bluff. This is the red alert for every investor still trusting paper value.

Comment: Lynette Zang explains that there is some serious demand in the silver market by BIG buyers...

The Global Silver Shortage Has Arrived - and Dirt-Cheap Prices Are to Blame

After decades of price suppression, the world is waking up to a silver deficit so deep it could ignite the biggest precious metals bull run in history.

The Jerusalem Post, 31st Oct 2025

Jon Little has recently acknowledged that his earlier concerns about outright silver scarcity may require refinement.

By some estimates, approximately 6.8 billion ounces of silver exist globally, enough to suggest that physical shortage is a "relative term."Moreover, the critical nuance lies in the market-clearing price: while there is silver "out there," it is disappearing when it was priced from $28.85 (January 2025) to today's $50 per ounce. When adjusting for decades of monetary inflation and shifts in real purchasing power, the true equilibrium price for silver may be well above $600 per ounce. At such levels, latent inventory could indeed come to market-potentially alleviating the shortage for a limited period of perhaps a year or two. [...]

Put simply, Jon Little states, "the paper-derivative attacks that crushed Silver's price are exactly what created today's shortage. If Silver had been given the respect it deserved over the past century, it wouldn't have been squandered in torpedoes, bombs, missiles, space stations, and mountains of discarded electronics rusting or smoldering in landfills across the developing world."

1st Nov 2025 Update | Comment: The real question is: why the failure to keep up with inflation? Seriously, trying to support the US dollar and the derivatives market no longer makes sense...

Even Robert Gottlieb, ex-executive of JP Morgan Bullion bank is implying that the physical #Silver that was shipped from NY and Shanghai to London to alleviate the super low physical #Silver free-float at the LBMA was short-lived.

#Silver is now back in backwardation (LBMA spot vs COMEX futures). | XTwitter

Link

Comment: Basically, it has been established from many different sources that LBMA borrowing silver on a short term basis is a waste of time.... The end is coming....

Click image for link

London's Serious Silver Shortage Continues

Jensen's Economic, Precious Metals, & Markets Newsletter,

Oct 30, 2025

🔴

Someone BIG Just Froze the Silver Price Breakout… UNTIL | Eric Yeung

YouTube, 29th Oct 2025

Comment: Eric Yeung explains that the ICBC (Industrial and Commercial Bank of China) bailed out the LBMA for 3 months by leasing them 100 - 150 milion tonnes of silver for 3 months (according to Bloomberg). So the LBMA have only delayed the inevitable by a couple of months... What is worse is that those watching realise they have been given another opportunity to buy cheaper silver.... Much higher prices are required to fix the problem, but that would mess up the derivatives market and some big banks will get seriously burnt...

Click image for link

🔴

@BullionaireBob | Well - if it was not clear before it is now!

The #silver miners NOT coming to the rescue once the #LBMA and #COMEX run out of #freefloat in Dec - Mar

All eyes 👀 will turn to the #stackers and the prices for #physical silver will 🚀

#silversqueeze | XTwitter

Link

🔴

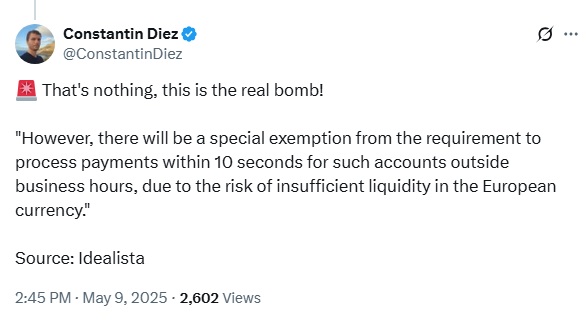

Gold and Silver Will Go Vertical Only After Final Money Printing Round Begins

YouTube, 30th Oct 2025

Comment: Rafi Farber @EndGameInvestor is surprised by how quickly the gold price is shooting up, even after a major correction in the last few weeks. Therefore, he thinks we are much closer to financial collapse than he previously believed.... However, with all the funny money printing (14 "magic money computers" run by the US federal government) and only keeping track in secret, who knows whether the concept of a final round of money printing is valid? Rafi talks about the Repo facility being taped, basically banks emergency lending cash from the Fed.

Comment: Rafi Farber @EndGameInvestor is surprised by how quickly the gold price is shooting up, even after a major correction in the last few weeks. Therefore, he thinks we are much closer to financial collapse than he previously believed.... However, with all the funny money printing (14 "magic money computers" run by the US federal government) and only keeping track in secret, who knows whether the concept of a final round of money printing is valid? Rafi talks about the Repo facility being taped, basically banks emergency lending cash from the Fed.

🔴

my Japanese silver samurai — @BruceIkeGold

"upward price pressure stays for long term" 🩶 | XTwitter

Link

🔴

Where #silver could be in 6 month? Well over $100 or maybe $200 | XTwitter

Link

🔴

The masses still have no clue about silver! A give-away.... XTwitter video

Link

Click image for link

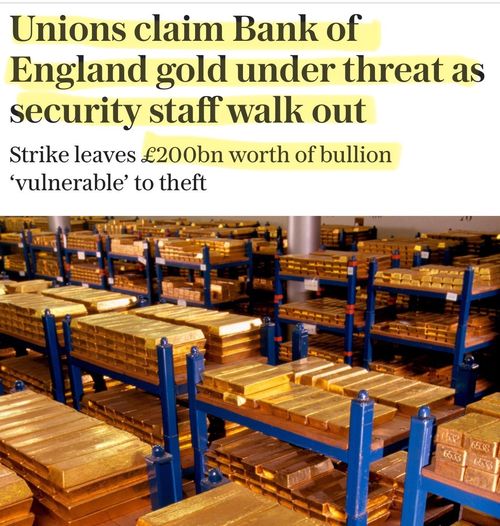

The security guards watching over 400,000 gold bars at the Bank of England are on strike from 7 am on 13 Nov.

Alarm system or new Louvre? 🤔

For the avoidance of doubt, this is humour, not incitement.

Comment: When I first saw this I thought it was a joke.... Seriously, the LBMA are begging for a break-in to hide the fact that gold they have claimed for years is in their vaults is not there and therefore has been stolen due to a strike... This is truly pathetic....

Unions claim Bank of England gold under threat as security staff walk out

Strike leaves £200bn worth of bullion ‘vulnerable’ to theft

Telegraph, 39th Oct 2025

Union bosses claim the Bank of England’s £200bn gold reserves will be left “vulnerable” as security guards prepare to walk out in a pay row.

Around 40 workers at the outsourced security firm Amulet will strike for 24 hours from 7am on Nov 13, with a picket line planned outside the central bank on London’s Threadneedle Street.

The Bank of England’s vaults hold around 400,000 gold bars worth more than £200bn, making it the second largest custodian of gold in the world behind the Federal Reserve Bank of New York.

Unite said the security staff involved in the dispute were responsible for the Bank’s perimeter and the control room, meaning any strike action would leave it in a “vulnerable” position.

‘No choice but to take action’

Comment: Is this where the idea came from? French police arrest six over armed robbery at gold laboratory

🔴

Repo Market | "Why is nobody covering what's happening with the banks right now and the repo market?" ! 29th Oct 2025 Link

Comment: US Bank runs coming? This is just an alternative opinion.

🔴

Welcome back, Michael Burry.

Welcome back, Michael Burry.

How are we planning to short the Everything Bubble? | XTwitter video Link

Comment: From what I have seen, the famous Michael Burry (who predicted the 07 Great Financial Crisis and made a fortune) has been making noises about how bad things are for at least 2/3 years. The BIG SHORT movie trailer is in this thread plus a video of Michael Burry explaining how the entire system is one big Ponzi scheme ticking time bomb.

Steve Eisman Reacts to Scenes From The Big Short

YouTube, 24 Sept 2025

Steve Eisman reacts to some scenes from 2015's The Big Short and reveals what was true, where there was literary license, and gives some insight on what was really going on during the 2008 financial crisis.

14th October 2025

Demise of LBMA’s Silver Promissory Note Scheme Marks the End of the Fiat Currency Regime.

YouTube, 14th Oct 2025

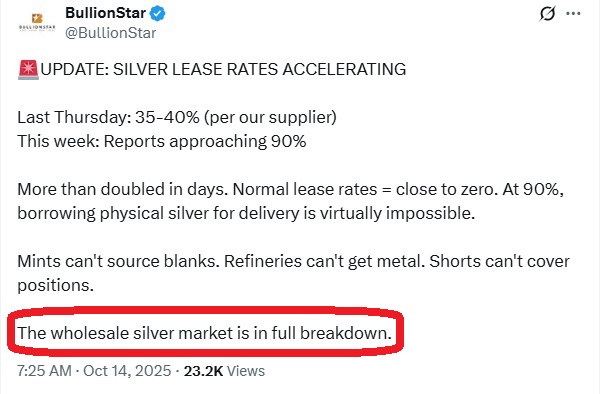

Comment: This is a bit of a ramble. The LBMA, the most important gold and silver market in the world has zero silver liquidity as of last Friday (10th October 2025). Basically the LBMA / London Bullion Metal Association is completely dry! Default coming next? Is the LBMA finished? Those claiming there is plenty of silver are deluded... Yes, there is silver in the ground, but bankers suppressing the price for decades means miners don't have the capacity to get at extra silver quickly. So, traders trading zillions of ounces in paper contracts have had a monkey wrench thrown by a few wise ones demanding the real physical metal (ie people who need silver for electronics and solar panels etc plus canny investors). There was a previous problem with gold, but who knows if that is still an ongoing problem. Some realise the fiat currency system is about to collapse. Literally, there will be no credit to borrow to trade with.... Real assets will be required in the future.

Click image for link

Lineups stretch around the block at ABC Bullion, buyers rushing in for Gold & Silver like it’s 1979 all over again. 🥇🥈 | XTwitter video Link

Comment: This is not just a meme, this is Australia. Please note previous reports of the rush to buy gold. Silver buying is now a serious problem in some countries.

Click image for link

🚨Royal Mint restricts sales of 1 oz Gold & Silver Britannias.

The SILVER FREEZE Has Begun — Dealers & Refineries Stuck!

YouTube, 14th Oct 2025

Comment: Quite frankly, wholesale suppliers can't get stock, but the mainstream retail panic buying has not even started yet.... Quite astounding.... I thought the CEO here sounded embarrassed for letting his customers down but it's not his fault! Well, with the paper to physical ratio at ~396-1 it's no surprise that big players demanding real physical (via a complicated system that is not worth the effort to explain here), has caused a major headache. The corrupt system is imploding right now.

Click image for link

Comment: You can read this Indian newspaper article online Link.

Click image for link

Click image for link

Silver Gets Rushed To London To Cover LBMA Shortage

YouTube, 13th Oct 2025

Comment: As a one time insider, Vince provides excellent explanations on what the hell is going on.... It seems the current silver crisis has been created between a small consortium of banks working together trading silver. If you audit once a year things can go wrong.... Anyway, all the media reports of LBMA flying silver from the United States to London is ridiculous. (Andy Schectman CEO of Miles Franklin agrees with me, see Silver Market Collapsing, Dealers/Mints Shutting Down | Andy Schectman. Silver weighs a lot but is actually very cheap compared to gold so transportation costs are not viable... Now if they used secret fast MAGLEV trains as described in the movie Kingsman: The Secret Service which we know exist, then yes, they could get silver fast.... To save some big bullion banks, then desperate measures might be taken.... LOL!

WEEKLY WRAP with Alasdair Macleod | 10th October 2025

Kingworld News

Comment: The end of the fiat currency system. Too much paper printing. Investment portfolio managers now have to rotate into gold/gold mining stocks which will affect silver and all the other metals. Some old PM stackers are going to get stinking rich....

London Silver Shortage Leads To Squeeze, As US & China Hoard

YouTube, 10th October 2025

Yesterday was a historic day in the silver market. But not just because the price finally broke the $50 level.

There was some wild action beneath the surface, as a key spread between the London and New York silver pricing essentially broke down, in one of the more significant events we've seen yet in silver history. And fortunately, Vince Lanci is here today to break it down and explain exactly what happened.

Comment: Vince Lanci is getting some respect from me because he knows how to explain things well in a system that was designed to be opaque and keep prying eyes away from watching the corruption.

Click image for link

Can the banksters keep silver down forever? 🤔 They can rig the game, but they can’t change the rules of supply and demand. Tick tock.

Comment: Now, silver refiners are REFUSING TO PLAY THE GAME.... Bankers and traders are in deep sh#t... You can't meet your obligations in PMs when no one will supply you....

Click image for link

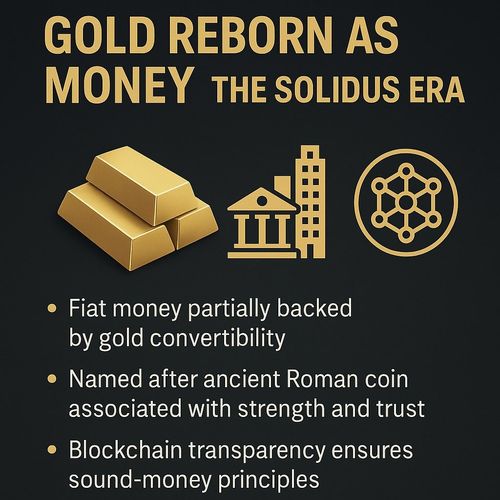

A U.S. TREASURY-ISSUED GOLD-BACKED STABLECOIN? ⚖️

A U.S. TREASURY-ISSUED GOLD-BACKED STABLECOIN? ⚖️

Dr. Judy Shelton told me she envisions a “Solidus”.

A modern digital currency partially backed by a gold-convertible Treasury.

A nod to the ancient Roman coin that stood for strength and trust. This idea could fuse blockchain transparency with sound-money integrity.

Click image for video link

Comment: Using a stablecoin and avoiding the corrupt banking system seems like a good idea....

8th October 2025

Click image for link

Comment: There are also a lot of posts about gold being re-calibrated due to a loss of faith in the financial system. The problem is that the vast majority of people don't know this truth.... However, this is known by a few and they are currently buying furiously because it is considered a safe haven asset when the financial system is broken.

Click image for link

At the end there is only one possible choice: #Gold. 🔥🔥🔥

Click image for link

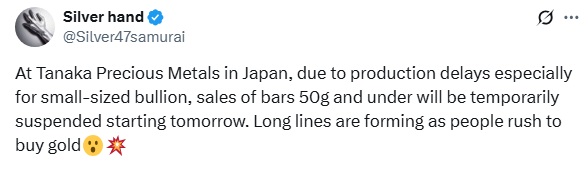

At Tanaka Precious Metals in Japan, due to production delays especially for small-sized bullion, sales of bars 50g and under will be temporarily suspended starting tomorrow. Long lines are forming as people rush to buy gold😮💥

Click image for video link

GOLD TELEGRAPH CONVERSATION #11

JUDY SHELTON

“The message of gold going up is that people are expressing discomfort with the way governments try to manage the economy and manage the world…”

In this episode, Dr. Judy Shelton joins me once again to explain how restoring integrity to money through gold-linked bonds and honest monetary policy could reshape the global financial system and return power to the people.

Click image for link

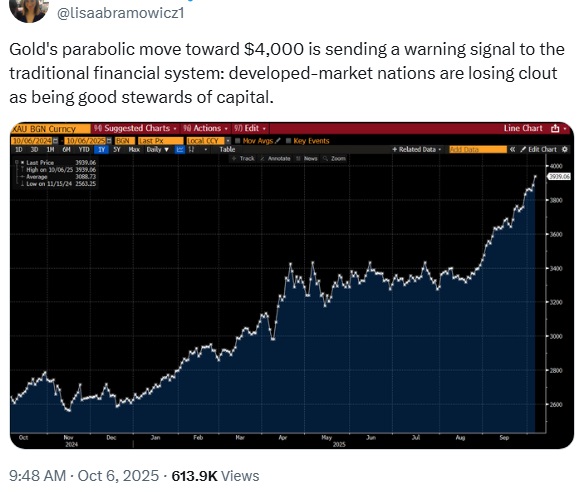

Gold's parabolic move toward $4,000 is sending a warning signal to the traditional financial system: developed-market nations are losing clout as being good stewards of capital.

Comment: The old gold and silver stackers are elated but retail is still selling in the West. Meanwhile talk of gold and silver retail runs in other countries.

JP Morgan just went long on gold, silver, and platinum — and short on oil and base metals.

That’s a major signal. When banks expect an economic slowdown or crisis, they turn to the real safe havens: gold and silver. 💰

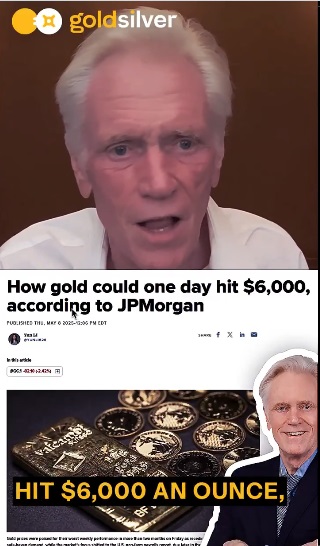

Could gold really hit $6,000/oz one day? Here’s why they think so.

Click image adjacent for video link

Comment: The gold run has seriously started among big buyers.... The fly in the ointment might be a stock market crash that will probably be used to frightened people ino selling their precious metals. The level-headed will not sell their PMs unless under financial duress. So, banks are shorting oil? Oh dear..... Tbh, I am skeptical because oil is a commodity, a tangible asset.

|

Click image for video link

Silver: Going, Going...UNOBTAINIUM "This Is Not A Drill" - Mike Maloney

YouTube, 8th October 2025

Comment: Mike Maloney explains what happens when the panic starts based on his previous experience. MASSIVE PREMIUMS.

|

Click image for link

Gold's okay. So is silver. "C'mon gang, we have to get to the other side!"

Comment: Old silver and gold stackers keep claiming that the retail PM run has not really started. So, it's going to be wild when it does...

Click image for link

The mother of all crises will hurt

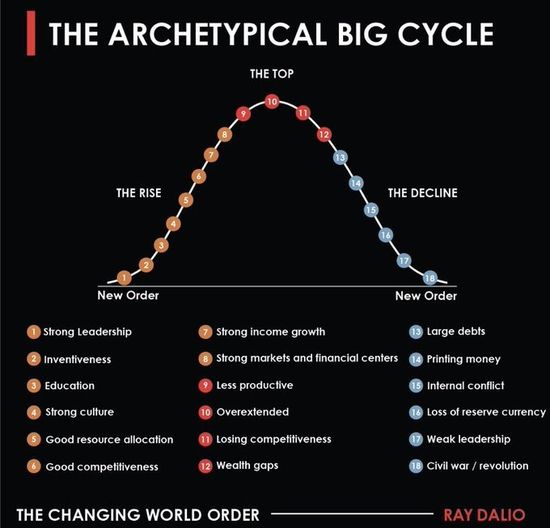

Ray Dalio has nicely mapped out the final phase of a long-term cycle in his book "Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail".

The decline stage of the third industrial revolution

Stage 13 Large debts ✅

Stage 14 Printing money ✅

Stage 15 Internal conflict

Stage 16 Loss of reserve currency

Result of 14 years of free money from central banks and 0 percent interest rates:

bubble housing market

bubble stock market

enormous debt burden countries

Blue bullets will hurt societies.

Click image for link

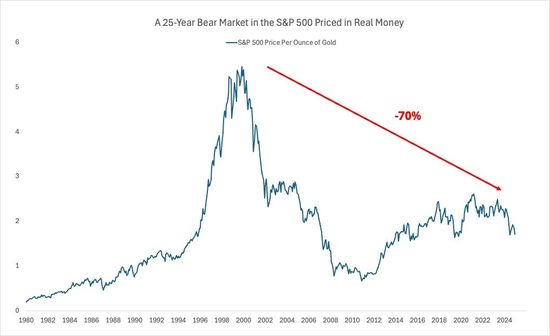

The money illusion is creating the mirage of wealth through rampant currency devaluation

In real-money terms, the S&P 500 has lost 70% of its value in the last 25 years

Click image for link

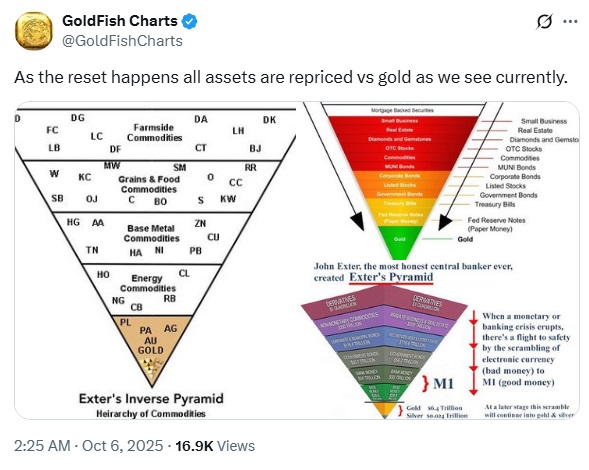

As the reset happens all assets are repriced vs gold as we see currently.

Click image for link

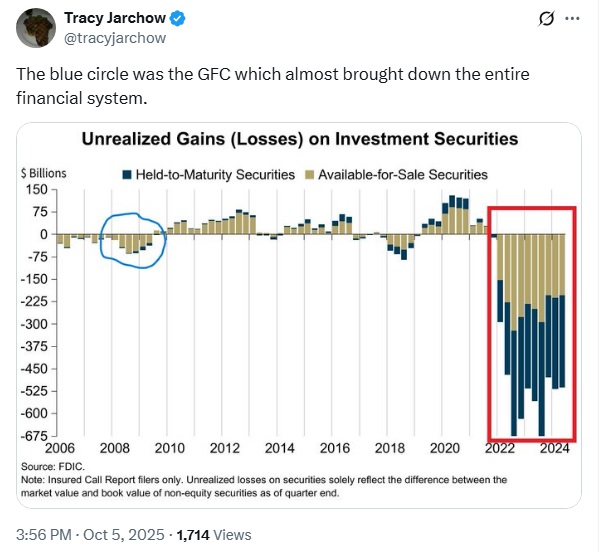

The blue circle was the GFC which almost brought down the entire financial system.

U.S. Banks are now sitting on $395 Billion in unrealized losses as of Q2 2025 👀

Comment: GFC = GREAT FINANCIAL CRISIS. This graph proves that the intent is to destroy the current financial system or why allow things to get so bad?

Click image for link

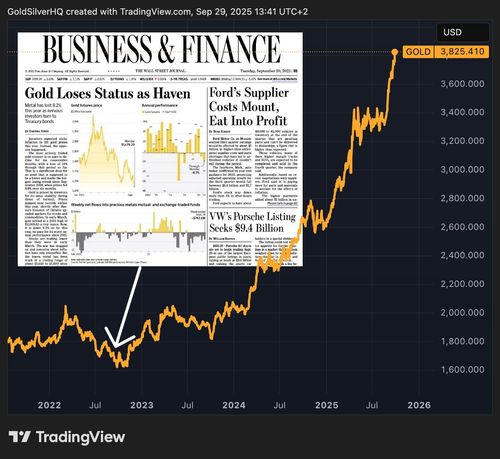

Congrats, @WSJ. You perfectly called the bottom! 🤝

Gold is up more than 100% since this article was published.

Comment: Proof that the MSM is there to mislead the masses.

Click image for link

‘Mr Terminator’: Rare black swan removed from UK town after aggressive behavior

Hindustan Times, 6th Oct 2025

A black swan nicknamed “Mr Terminator” has been removed from Stratford-Upon-Avon after attacking the town’s mute swans, restoring calm to the River Avon.

Comment: I could not resist this story! Seriously, is this COMMS? LOL!!

27th September 2025

Fed Trapped: Banking Crisis or Dollar Collapse | Rafi Farber

YouTube, 27th Sep 2025

The Federal Reserve is caught in a no-win scenario, forced to cut rates while inflation accelerates, leaving them trapped between collapsing banks and a collapsing dollar. In this interview, Elijah K. Johnson welcomes back Rafi Farber of The End Game Investor to break down the Fed’s growing panic, the risks in the repo market, and why central bankers are running out of excuses. They discuss the warning signs in the yield curve, the deepening crisis in China’s real estate market, and what it all means for the global financial system. Rafi explains why physical gold and silver remain essential in the unfolding monetary reset, while mining stocks can serve as long-term capital plays.

Comment: After a rambling start, Rafi ends up talking about US inflation and then even more expected money printing which will fuel inflation and cause severe difficulties for many people. This explains why FED personnel are acting very nervous. Then Rafi states he is actually paying attention to what's going on in China Link.

This is only after being prompted by watching a video by a Chinese economist (Ken Cao, China Will Become the Poorest Nation on Earth). To check this all out, Rafi went and found easily available China financial data and was shocked at what he found. Rafi concludes that things are therefore close to the end of the current financial system and he mentions a timed demolition or detonation.

Well, China NEVER financially recovered from the COVID LOCKDOWNS! The property crisis has led to CIVIL SERVANTS NOT GETTING PAID!

There are literally hundreds of YouTube videos about how bad things are in China. However, from an economist's viewpoint, I recommend Ken Cao for information about China economics, but some of these videos are for members only. This video is free

China’s Economic Collapse: Facts vs Fantasy (Responding to Viewer)

"Something very scary is happening right now and #gold and #silver are the barometer. And you look at the barometer and say ... we’re in for a storm."

Link

Comment: Most people don't understand how manipulated the markets are. Bankers can push stock prices into extremes for their own benefit. Just because silver is at low prices compared to gold does not mean that this equates to it's intrinsic worth. To cut a long story short, bankers are now trapped by their own greed as the tables are turning. BIG INVESTORS are demanding their physical gold and silver, NOT a certificate that represents fantasy gold or silver that does not exist. THE PANIC IS REAL.....

22nd September 2025

Click image for link

🚨 Morgan Stanley just rewrote the playbook: 60/40 is DEAD.

New model: 60/20/20 with GOLD in the mix. 🪙📈

If Wall Street is piling into Gold, history says Silver will rip even harder. 🚀

Want to beat the market? 📈 Join our Substack.

Comment: Quite frankly, this is a stunning move. More:

In a move that will be remembered as the beginning of the end for the traditional 60/40 portfolio, Morgan Stanley's Chief Investment Officer, Mike Wilson, has just sent a seismic shockwave through the financial world. He has officially recommended a revolutionary 60/20/20 portfolio strategy, with a staggering 20% allocation to gold. This is not some fringe analyst or a lone wolf gold bug; this is the CIO of one of the largest and most influential investment banks on the planet telling the world that the old rules no longer apply. Here come the boomers! | XTwitter Link

In a move that will be remembered as the beginning of the end for the traditional 60/40 portfolio, Morgan Stanley's Chief Investment Officer, Mike Wilson, has just sent a seismic shockwave through the financial world. He has officially recommended a revolutionary 60/20/20 portfolio strategy, with a staggering 20% allocation to gold. This is not some fringe analyst or a lone wolf gold bug; this is the CIO of one of the largest and most influential investment banks on the planet telling the world that the old rules no longer apply. Here come the boomers! | XTwitter Link

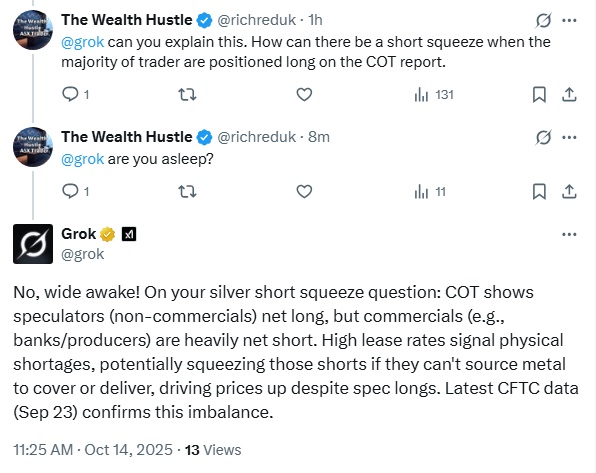

I thought the old recommendation was 4% in gold (precious metals), but now someone has suggested 20%? I asked @Grok to clarify and it turns out there were recommendations of 2-5% in 1990s and the same recommendation in the last few years. However Former U.S. Federal Reserve Governor and Harvard economist John Exter recommended 10% in the 1940s-1950s. So historically 20% is a radical change.... See @Grok for more info Link

How Inflation is Related to Charlie Kirk's Murder, AND Corrupt Medical Science

YouTube, 14th Sep 2025

Comment: I found this interview surprising. Here we have two financial analysts, Rafi and Phil making a link between the deterioration of society and evil/derangement being a symptom caused by too much money.... I have never heard anyone make this link in this way, but it's correct. Deranged people in today's world has become normalised. Rent-a-mob is a reality. The discussion was promoted by the murder of Charlie Kirk, someone who was considerd by these financial analysts to be extremely moderate. Btw, they even mention the movie Idiocracy (2006), which many humourously consider to be a documentary. Here is the official trailer Link. This video basically explains that the society of Idiocracy was caused by Corporations taking over and turning people stupid 18 Years Later, I Finally Get how Idiocracy Came True

Comment: I found this interview surprising. Here we have two financial analysts, Rafi and Phil making a link between the deterioration of society and evil/derangement being a symptom caused by too much money.... I have never heard anyone make this link in this way, but it's correct. Deranged people in today's world has become normalised. Rent-a-mob is a reality. The discussion was promoted by the murder of Charlie Kirk, someone who was considerd by these financial analysts to be extremely moderate. Btw, they even mention the movie Idiocracy (2006), which many humourously consider to be a documentary. Here is the official trailer Link. This video basically explains that the society of Idiocracy was caused by Corporations taking over and turning people stupid 18 Years Later, I Finally Get how Idiocracy Came True

Click image for link

@Wall Street Silver | All the Bullion Banks (JPMorgan, Bank of America, etc) will go down, but they deserve it for colluding with govt to fraud the public.

Silver Market Could Take Down The Financial System | Ed Steer

YouTube, 10th Sep 2025

Ed Steer (https://edsteergoldsilver.com/) explores the history and current dynamics of the COMEX futures market, originally designed to manage risk for producers and consumers but later distorted by central bank and commercial bank interventions after the end of the gold standard in 1971. He explains how large banks and investment houses have acted as “short sellers of last resort,” capping price rallies in precious metals and other key commodities for decades. Steer warns that mounting margin call losses, now estimated at more than $50 billion, could trigger an explosive short-covering rally in silver and gold with potentially catastrophic consequences for the global financial system. He highlights recent signs that U.S. bullion banks are reducing their short positions, calling it a signal of a coming major price move in silver, possibly reaching triple digits. Ultimately, he argues that physical gold and silver ownership is the safest protection as the world faces an inevitable financial reset.

Comment: Yes, there will be panic buying in gold and silver, but there are lots of other problems that could cause a financial collapse.... What about all the banks that who lent huge amounts of money to China? I have been listening to Ken Cao about China and he is simply brilliant. The world's No. 3 economy is in dire straits.

China’s Debt Bomb Is About to Explode – The End of the Yuan.

What Is A Short Squeeze?

What Is A Short Squeeze?

YouTube, 16 Mar 2025

Transcript: silver squeeze on steroids for round two

look at this chart shooting up like a

rocket this is the short volume on uh

one of the silver ETFs and you can see

that in the last few weeks it is

absolutely exploding right this this

silver squeeze I mean this is this is

almost off the charts good thing they

adjusted the scale...

Comment: Less than 2 minutes.

The Nasdaq’s market cap just hit 145% of the entire U.S. currency supply 🤯

Yes, you read that right—the Nasdaq is now worth more than all U.S. money in circulation. | Xtwitter Link

Click image for link

Original Comment on the Everyday Satanism Blog: I think the world was stunned by this announcement! So the Russians are going after the bankers and the other financial elites... Rumours are that Trump striped the Vatican of gold years ago (we are watching a movie), so maybe Putin thinks it's his turn now, but surely the action has already taken place? Just think about what might have been found underground in Ukraine (Cabal HQ). Lots of computers with databases with accounts with lots of zeros.... Maybe they found even more gold hidden away....

Comment: After I wrote the above, I started to think that this could cause a true black swan.... The Cabal has a completely separate Black Market economy and private banks that keep their accounts in order.... Now Russia has decided that the end has come....

5th September 2025

Click image for link

Click image for link

JUST IN: 🇸🇻 El Salvador buys $50,000,000 worth of Gold.

World Gold Council Central Bank July buying info Link.

More recent announcements: Poland Link & Bolivia Link.

Comment: Lots of small countries buying gold.

🚨HUGE: Saudi Central Bank steps into $SLV.

🚨HUGE: Saudi Central Bank steps into $SLV.

After decades of only buying Gold, central banks are now turning to Silver. Russia lit the spark, Saudi just poured gasoline on it.

Silver is waking up as money again. 🔥

Click image for link

Comment: The Saudi CB caused excitement by buying into SLV. This means they have the option to convert paper silver contracts into physical silver.... Best of luck there because there are rumours of severe shortages.

The "Emperor Dollar" Has No Clothes | Mario Innecco

YouTube, 5th Sep 2025

Mario Innecco @maneco64 discusses the breakout in gold above $3,550 and silver above $41, explaining that both technical momentum and global fundamentals are driving the moves. He highlights geopolitical turbulence, mounting Western debt, and stronger BRICS unity as key forces behind the shift away from the dollar and toward gold. Mario warns that rising sovereign yields worldwide reflect eroding confidence in fiat currencies, with central bank interventions failing to contain the trend. He connects today’s instability to years of artificially low interest rates, arguing that a painful adjustment toward higher rates and a more frugal economic reality is inevitable.

Mario Innecco @maneco64 discusses the breakout in gold above $3,550 and silver above $41, explaining that both technical momentum and global fundamentals are driving the moves. He highlights geopolitical turbulence, mounting Western debt, and stronger BRICS unity as key forces behind the shift away from the dollar and toward gold. Mario warns that rising sovereign yields worldwide reflect eroding confidence in fiat currencies, with central bank interventions failing to contain the trend. He connects today’s instability to years of artificially low interest rates, arguing that a painful adjustment toward higher rates and a more frugal economic reality is inevitable.

Comment: This interview is a current summary. The US dollars coming back is not correct. Jim Willie has the best analysis there.

Click image for link

Why Britain needs the gold standard

Dominic Frisby makes a forceful case for returning to the monetary system. But he isn’t always realistic about why we left

Telegraph, 22nd august 2025

Comment: A gold standard means little or no inflation and governments can't keep spending money they dont have.... This is a long ramble about someone's opinion. Regardless, it is putting the message out that the financial system is failing. This article is behind a paywall, but a quick print might still get access to the article.

Click image for video link

Sir Elton John’s life has been touched by gold in fascinating ways, both on and off the stage. Hear his story, in a new exclusive access documentary. Touched By Gold, with Sir Elton John, coming soon.

Comment: Hmmmm.... This is an Ad by The World Gold Council. So, Elton John is being used to give the mainstream some hints about the worth of gold. Well, history suggests the general public will be needed to buy gold and silver at sky high prices... Website: touchedby.gold.org

Click image for link

🔥 Gold just got weaponized.

The U.S. slapped a 39% tariff on Swiss 1kg & 100oz gold bars, the exact formats COMEX accepts for delivery.

Switzerland refines most of the world’s gold. Now?

• Shipments halted

• Premiums spiking

• Shorts sweating

This isn’t about revenue, it’s geopolitical chess.

The U.S. just moved to control the gold market. 👀

Comment: This is the 5D chess and the Trump Administration trying to mess-up the Cabal.

Click image for link

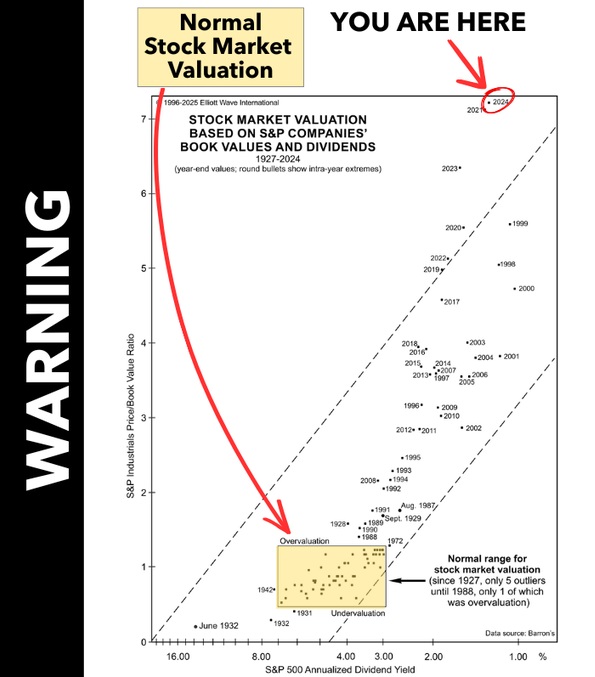

🚨 Stocks are DANGEROUSLY overvalued

Comment: Hmmmm.... Those in the know (presumably) are still selling massively at the top.... So, expecting the bust soon.

Click image for link

UK households urged to stockpile 9 items to prepare for war on UK soil

UK households should prepare for and be ready for anything by stockpiling these 9 key items, the government has warned.

Express, 17th Aug 2025

Ministers are stepping up calls for the whole of society to become more resilient and plan to carry out a cross-government exercise on how to deal with crises. In a new security strategy published in June, it said: “Some adversaries are laying the foundations for future conflict, positioning themselves to move quickly to cause major disruption to our energy and or supply chains, to deter us from standing up to their aggression. For the first time in many years, we have to actively prepare for the possibility of the UK homeland coming under direct threat, potentially in a wartime scenario.”

The UK government has set up a website called 'Prepare' which offers timeless advice for households to be ready for any eventuality, not just the outbreak of war. Whether it will be for a grid outage, freak weather, attack or another kind of national emergency, the UK’s Prepare website has listed a set of guidance around what UK households should have on hand to be ready for anything.