Contents

Introduction

It’s seems obvious and blatant at this point based on available evidence that a new financial world order (that is gold/commodities backed) is being built to takeover from the old Cabal-controlled debt/slave financial system. Originally in the West, the dream of economic fairness on many levels was known as NESARA/GESARA and efforts to make economic and social changes started in the 1970s. Today it is being driven by BRICS. The following provides an overview of why this massive undertaking and overhaul will eventually succeed.

NESARA GESARA Outline & history

The #NESARA Law: A Brief Overview

The NESARA Law stemmed from a landmark ruling by the US Supreme Court following a case brought forth by the Farmers Union. The court concluded that banks were unlawfully seizing land belonging to farmers. Over the years of litigation, it was revealed that the privately-owned Federal Reserve and IRS, controlled by the Rothschild bankers, had been illicitly siphoning money from the American populace since their inception in the early 1900s.

Despite the positive Supreme Court ruling, President Bill Clinton showed no inclination to enact NESARA into law. However, on October 10, 2000, under the directive of US military generals, elite Naval Seals and Delta Force personnel stormed the White House and compelled Clinton, at gunpoint, to sign NESARA into law. This event took place while Secret Service and White House security stood down, disarmed, and under a gag order.

Despite the signing, Clinton and subsequent US presidents failed to implement NESARA until President Trump took office. President Trump incorporated NESARA into the Global Currency Reset, not only for the US but also introduced a similar law known as GESARA for nations worldwide.

GESARA is on the Global scene and NESARA is for the U.S.

Source: Link

NESARA implements the following changes:

1. Zeros out all credit card, mortgage, and other bank debt due to illegal banking and government activities. This is the Federal Reserve’s worst nightmare, a “jubilee” or a forgiveness of debt.

2. Abolishes the income tax.

3. Abolishes the IRS. Employees of the IRS will be transferred into the US Treasury national sales tax area.

4. Creates a 14% flat rate non-essential new items only sales tax revenue for the government. In other words, food and medicine will not be taxed; nor will used items such as old homes.

5. Increases benefits to senior citizens.

6. Returns Constitutional Law to all courts and legal matters.

7. Reinstates the original Title of Nobility amendment.

8. Establishes new Presidential and Congressional elections within 120 days after NESARA’s announcement. The interim government will cancel all National Emergencies and return us back to constitutional law.

9. Monitors elections and prevents illegal election activities of special interest groups.

10. Creates a new U.S. Treasury rainbow currency backed by gold, silver, and platinum precious metals, ending the bankruptcy of the United States initiated by Franklin Roosevelt in 1933.

11. Forbids the sale of American birth certificate records as chattel property bonds by the US Department of Transportation.

12. Initiates new U.S. Treasury Bank System in alignment with Constitutional Law

13. Eliminates the Federal Reserve System. During the transition period the Federal Reserve will be allowed to operate side by side of the U.S. treasury for one year in order to remove all Federal Reserve notes from the money supply.

14. Restores financial privacy.

15. Retrains all judges and attorneys in Constitutional Law.

16. Ceases all aggressive, U.S. government military actions worldwide.

17. Establishes peace throughout the world.

18. Releases enormous sums of money for humanitarian purposes.

19. Enables the release of over 6,000 patents of suppressed technologies that are being withheld from the public under the guise of national security, including free energy devices, antigravity, and sonic healing machines.

The

History of NESARA

in detail is provided on a separate webpage.

The National Economic Stabilization and Recovery Act ( "nesara.pdf ")

(Full text PDF mirror from http://nesara.org)

Yes, I realise there is a discrepancy with the name of the NESARA Act. This has been largely caused by Wikipedia. If you want to find out the background, you can download a free e-book titled: NESARA Global Currency Reset: Drain the Swamp (Free Book)

BRICS

The following is a selection of articles and reports that explains why the ambitions of BRICS nations as a new trading block is such a serious threat to American hegemony. Please note: US hedgemony is controlled by the Cabal. Simply, BRICS nations represent

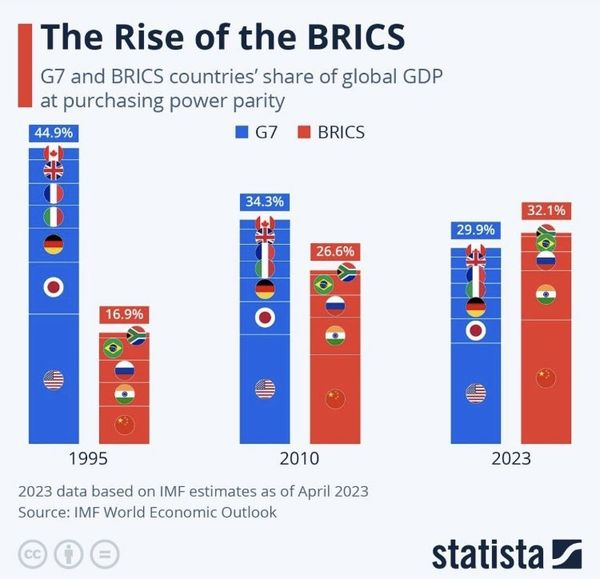

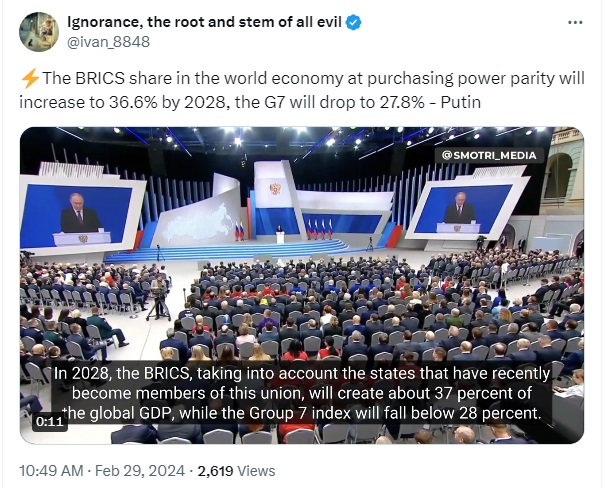

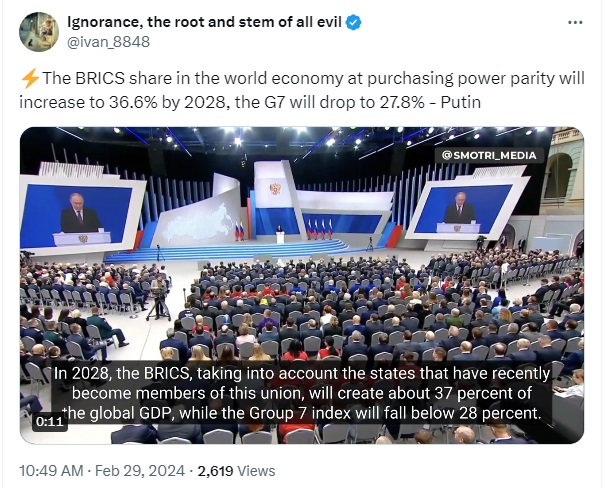

45% of the global population and 36% of global GDP, which outpaces the 30% share of the G7.

Trading among themselves and ditching the dollar means the United States (Cabal) can no longer use the dollar to maintain control and benefit. The current debt based system allows the current worldwide banking system to create fiat dollars out of thin air and force poor countries to buy dollars with real commodities in order to facilitate international trade. The aim of NESARA GESARA was to create a level playing field. This can only be achieved if trade is backed by real commodities and currencies are not subject to financial markets that can destroy the value of currencies at will.

BRICS+

is intergovernmental organization comprising Brazil, Russia, India, China, South Africa, Egypt, Ethiopia, Iran Saudi Arabia, and the United Arab Emirates (FEB 2024).

The BRIC initiative was first instigated by Russia and formed in 2006, with its first summit in 2009. As a union of emerging economies,

the acronym stands for countries of Brazil, Russia, India, and China. BRIC later transformed it into BRICS countries with the addition of South Africa in 2010. Today there are a clamour of countries wanting to join, see South Africa says more than 40 nations expressed interest to join BRICS, with 20 applications in December 2023.

The following XTwitter post gives the best short explanation I have come across that explains the relationship between NESARA GESARA and BRICS.

N- National (G- Global)

N- National (G- Global)

E- Economic

S - Security

A- And

R- Reformation

A- Act

Now ask yourself what countries around the world are doing in order to join the BRICS Nations? They are doing what to meet the requirements neccessary? Changing their NATIONAL ECONOMY by doing REFORMS in the banking & economic system through ACTS they are passing through congress for SECURITY & STABILITY of their country.

You get it now?

Ariel @Prolotario1 Link

Click image for link

The Grant Williams Podcast: Luke Gromen - FULL EPISODE

The Grant Williams Podcast, 12th March 2022

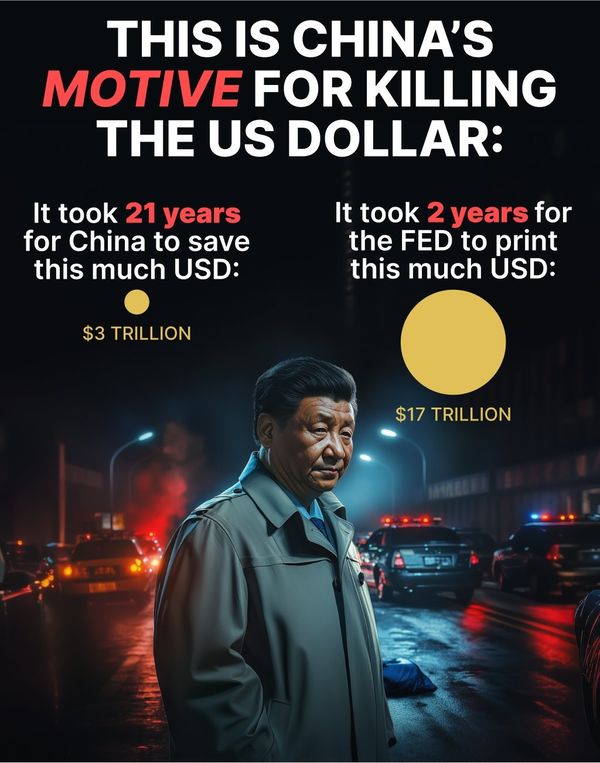

Summary | Luke Grommen gives brilliant context as to why BRICS nations are moving away from the US dollar and financial system. Grommen simply explains what happened after WWII with two options to create a new world reserve currency. The option was made to use the US dollar pegged to gold and then later pegged to the price of oil. After 2005 and especially with the 2008 financial crisis, the US started to mismanage the world's reserve currency to protect the US economy. Hence, BRICS nations were motivated to start moving away from the dollar as a matter of national security. Russia and China started to protect themselves by dumping US treasuries and buying gold (other countries are now doing the same). The conclusion is that the national debt is now a national security issue for the United States!

It's not working for anyone accept the Military-Industrial complex. Gromen talks about the paper gold market being wound-down because it seems the price of gold needs to be reset much higher.

Comment: This is brilliant! Even in the first 5 minutes there is some serious revelations that explains the motivation for BRICS. The BRICS nation have literally resurrected the original WWII aftermath alternative for a world reserve currency made up of a basket of commodities. The original idea proposed was a neutral reserve asset known as BANCOR which facilitates a self regulating trade system, that is more balanced and less crisis prone. If you are short on time, the 1st ~25 minute Grommen monologue is excellent.

BRICS developing new global reserve currency – Putin

It will be based on a currency basket of the five-nation bloc, according to the Russian president

RT News (alternative URL), 22nd June 2022

President Vladimir Putin said on Wednesday that the BRICS countries – Brazil, Russia, India, China, and South Africa – are currently working on setting up a new global reserve currency.

“The issue of creating an international reserve currency based on a basket of currencies of our countries is being worked out,” he said at the BRICS business forum.

Comment: Take note! Dollar dominance will soon be over.

|

Click image for link

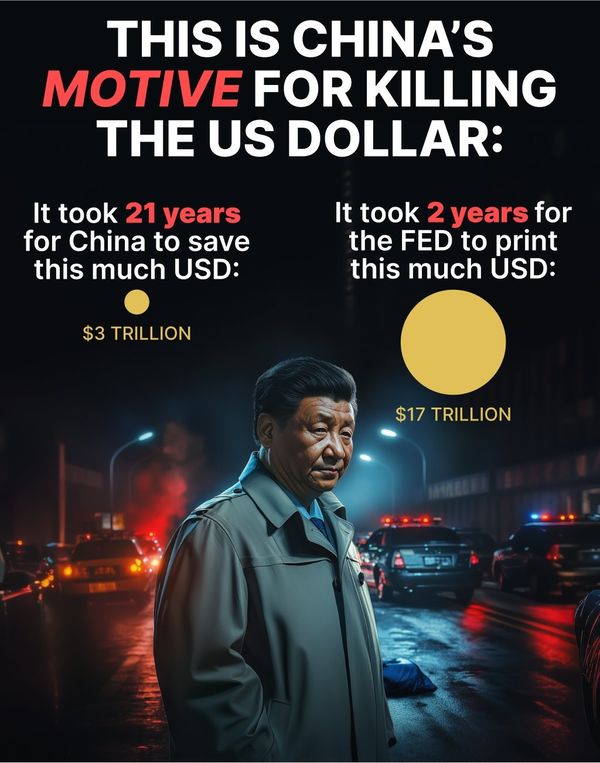

Comment: Whatever, happens, it is easy to understand why China and other major players are very unhappy about the current world financial system.

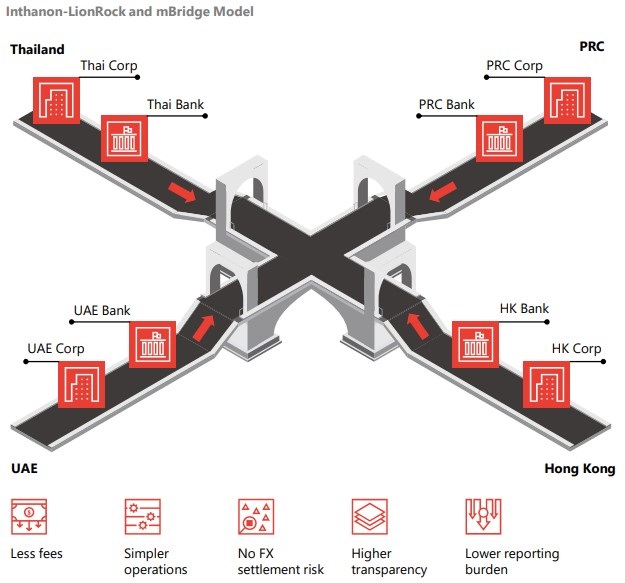

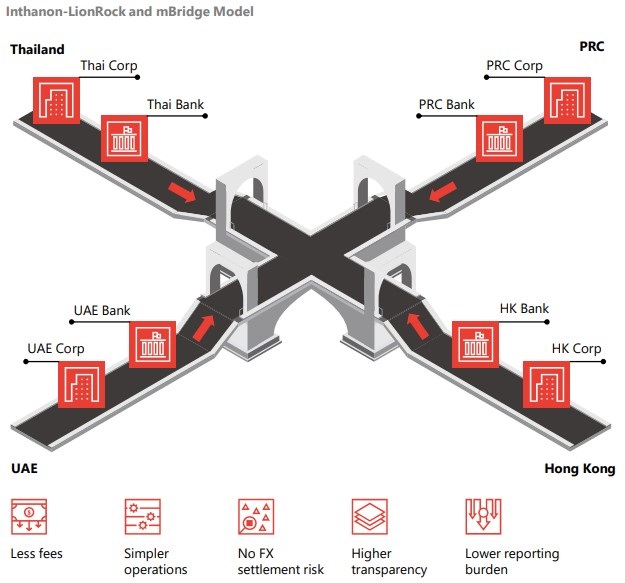

The mBridge Financial Model

There Will Be 2 More Central Banks Negotiate To Join mBridge

Crypto Rank, Jun, 19, 2023

The network is built on a novel blockchain dubbed the mBridge Ledger and is meant to facilitate real-time, peer-to-peer, cross-border payments and foreign exchange transactions utilizing CBDCs. The platform is intended to assure adherence to jurisdiction-specific policy and legal standards, laws, and governance requirements.

China, Hong Kong, Thailand, and the United Arab Emirates are all in talks to join. Other central banks are expected to participate before the MVP.

He also said that, in addition to the four central banks, mBridge presently has 15 central banks or international organizations as observer members, with two more negotiating to join; more information would be disclosed later.

|

West Panic: China Takes Over mBridge, Saudi Oil For RMB Next, Gold Is Leaving London

YouTube, 4th Nov 2024

Comment: This is another analyst saying that BRICS will take over mBridge and that the West have made a BIG mistake.... Well, I am starting to think this is all smoke and mirrors. The world was happy with the dollar as the world's reserve currency until 1/ the United States took advantage by printing too much money 2/ weaponising the dollar and 3/stealing Russians international savings (which has never been done before in history.... Not even with Hitler did Germany's have it's money taken away). So, a major crisis is coming and it will be resolved by putting the dollar back on the gold standard. Since, BRICS nations have been buying up gold and silver, a massive commodities re-evaluation will make them very very happy. This will be win-win for EVERYBODY.... Trump will say that the Dollar never lost it's world reserve status and the United Status will go back to consituational money. If Trump has sourced serious amounts of gold, then everybody accept the Cabal will be happy.

BIS Abandons Project M-Bridge As Russia and China Take Globalists for a Ride.

YouTube, 4th Nov 2024

ECONOMIST ARTICLE: A surprise new twist in Putin’s currency wars:

Comment: Maneco64 provides some much needed clarity on the BIS/MBridge debarcle and quotes from the Economist. The private BIS (Central Bank of Central Banks) was working with BRICS with the idea that they were going to introduce CBDCs into those countries. Unfortunately, they were asleep at the wheel because BRICS wanted to use it to create a currency backed by commodities and gold that they could use to trade among themselves, nothing to do with ripping off the citizens of those countries. It looks like the mBridge project code will be copied and used..... The Chinese are experts at knocking off other people's technology. Hilarious.... To save time, you can skip the first 8.5 minutes link

BRICS Loads A $200 Silver Bullet - LFTV Ep 197

YouTube, 1st November 2024

In this week’s Live from the Vault, Andrew Maguire examines the transformative impact of BRICS’s latest currency initiatives, as the multi-polar alliance positions gold at the heart of international trade, bypassing conventional financial systems.

As the world’s largest economies shift from the dollar, Andrew reveals how central banks are fortifying their reserves with gold and silver to hedge against market instability, setting the stage for substantial impacts on precious metals prices.

Comment: According to Andrew McGuire, MSM are painting the Kazan BRICS 2024 summit as a dud, but nothing can be further from the truth.... The explanation of the US FED vs BIS [US Federal Reserve vs the Bank of International Settlesments] is a revelation to me.... The nearer to $200 price of physical silver may be hard for some to believe, but when real supply and demand action starts to take place (silver paper market is dead), then the process of real physical silver discovery will be shocking.

Alasdair Macleod: US Fearful Debt Trap as Russia Plans to Ignite Silver

YouTube, 2nd Nov 2024

Comment: A new BRICS membership status called “Partner” was announced. This new status will include almost 70% of the world and over 50% of GDP. Oh dear! This has been underreported.....

Click image for link

Comment: BRICS is going from strength to strength. Hence the CEO of America's largest bank, Jamie Dimon, says the global order (bankster order) is at risk. Sorry this article is behind a paywall.

Click image for link

Comment: Find the Threadreader unroll here

Click image for link

Click image for link

Putin calls for alternative international payment system at Brics summit

Russian president’s goal to de-dollarize world economy alarms members that do not want bloc to turn against west

The Guardian, Oct 23rd 2024

Vladimir Putin has opened the expanded Brics summit by issuing a call for an alternative international payments system that could prevent the US using the dollar as a political weapon.

But the summit communique indicated that little progress had been made on an alternative payment system.

Click image for link

Caption: President Putin was presented with a “BRICS bill” at the BRICS Summit in Kazan. This is symbolic in nature but it illustrates the direction that the global alliance is moving. The banknote was made in Russia.

Comment: I wonder whether waving a BRICS note about is just a silent threat, a way of making Western bankers panic?

Click image for link

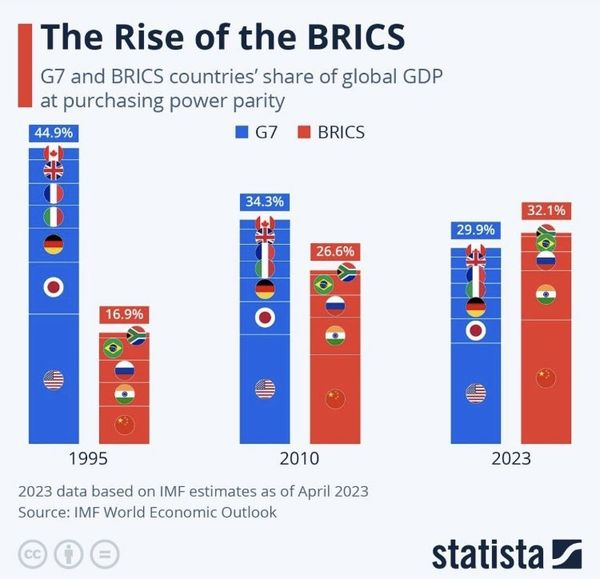

The Shift of Global Power: BRICS Over G7

World Insight, 24th Oct 2024

The End of Western Dominance? BRICS on the Rise

The global economy is on the verge of a massive transformation. According to data from the International Monetary Fund (IMF), Bloomberg reports that the economic influence of BRICS—Brazil, Russia, India, China, and South Africa—will surpass that of the G7 in the next five years. What does this mean? The world is moving away from its traditional Western power centers, and BRICS is becoming the backbone of the global economy. It’s no longer a question of if this shift will happen, but when.

Click image for link

Caption: BRICS will be the next power house and they all know it.

Click image for link

Click image for link

Click image for link

Click image for link

Click image for link

Are the BRICS gearing up to challenge the petrodollar?

De-dollarization gained momentum after the UAE and Saudi Arabia were invited to join the intergovernmental organization

Economy Middle East, 10th Oct 2024

[...] So why has talk of “de-dollarization” resurfaced? According to David Lubin, senior research fellow at Chatham House, the most visible reason people are questioning dollar dominance is the increasing use of the dollar as a weapon, most obviously in the aftermath of Russia’s invasion of Ukraine. Speaking during a webinar on the subject on September 18, he noted that the central banks of Iran, Afghanistan, Libya, and Venezuela have also had their foreign exchange reserves frozen by the United States.

“So this growing sense that the dollar is being weaponized is one reason why dollar dominance is coming under increasing question as more countries might want to escape the risk of having their dollar assets sanctioned or their foreign exchange reserves sanctioned,” he said.

[...] In Lubin’s view, the long-term threat to dollar dominance may come from technology. He mentioned mBridge in particular. It’s an initiative within the Bank for International Settlements involving the central banks of China, Hong Kong, Saudi Arabia, the UAE, and Thailand. It is designed to facilitate the exchange of local currencies on an international platform in digital format, bypassing the SWIFT system.

One possible scenario would be for mBridge to be incorporated into the BRICS, as current rotating president Russia has suggested it might be. The one policy issue that unites the nine current members of the BRICS grouping is a “common desire to escape dollar dominance,” he said. So, it’s not inconceivable to imagine a migration of the mBridge platform as the countries involved are either current or future members of BRICS.

Comment: From this article, these extracts most simply explain why the dollar will lose it's dominance. Simply, BIS created a financial skateboard park to deliver money around different hubs where lots of different skates can be used. Obviously the BRICS unit will be designed to be used, but any othrr else is speculation and that includes XRP because nobody wants to talk technical rules.

Robert Kiyosaki: "America has pissed off the World"

"We print money that we essentially distribute around the world. But the rest of the world produces food, gold, silver, technology"

So this world says: "Enough!" Brazil, Russia, India, China, South Africa, BRICS

Link

BRICS: 12 Countries Ditch US Dollar, Pay 85% Trade in Local Currencies

Watcher Guru, October 9, 2024

After BRICS, a new alliance has kick-started the de-dollarization process and is using local currencies for trade and not the US dollar. The Commonwealth of Independent States (CIS), which consists of 12 countries, has settled 85% of cross-border transactions in national currencies. The CIS bloc, barely used the US dollar for trade settlements this year ushering into a new financial landscape.

Click image for link

Caption: The rise and fall of empires by Ray Dalio.

The US is at Stage 15.

Next is the loss of reserve currency status, which has already started with BRICS expansion and gradual dedollarization.

Click image for video link

Comment: Image edited. Well, when I first saw this, my reaction was not quite as skeptical as the black interviewer who was appeared to be in shock.... Well, there was some initial success of the Zimbabwe gold backed currency that actually strengthened 1% against the U.S. dollar in it's first week. So, if this info about title deeds is true, then all good people should be dancing in the streets for what is to come for the rest of the world.

Click image for link

Comment: There is no reason why so many African nations have had financial problems. Read the book Confessions Of An Economic Hitman among lots of other history books, Africa was subjugated and financially raped, when it has tangible wealth galore, not lots of imaginary wealth on paper.

Click image for link

Sixth Time The Charm? Meet The ZiG: Zimbabwe's New 'Gold-Backed' Currency

ZeroHedge, 25th April 2024

Click image for link

BRICS: 40 Nations Now Seeking Alliance Entry in 2024

Watcher.Guru, 17th April 2024

Following the emergent success of the BRICS bloc over the last two years, 40 nations are reportedly now seeking alliance entry in 2024. Indeed, Russian Federation Council Committee on International Affairs head Girgory Karasin confirmed the number in a recent briefing, according to reports.

Additionally, Karasin confirmed that the number of countries seeking to join the collective is only increasing with every passing month. With the annual summit set to take place in October of this year, there are expectations that the alliance will introduce its second expansion effort in as many years.

Click image for link

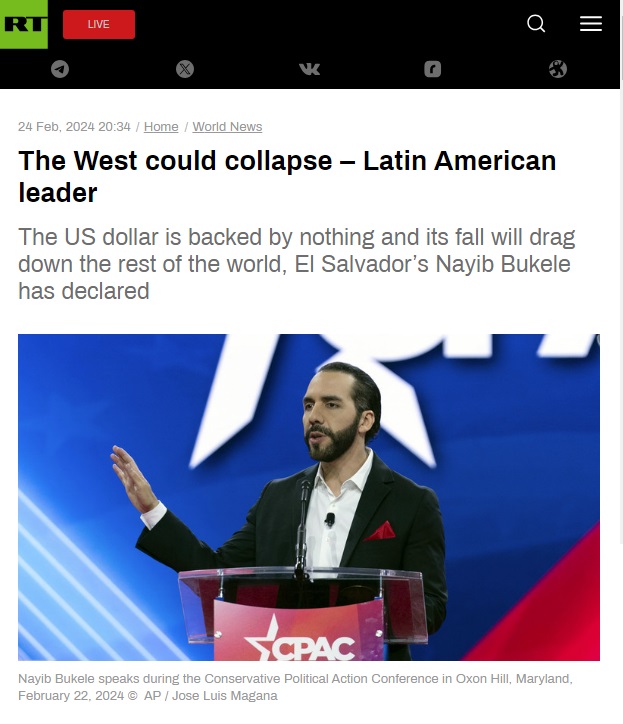

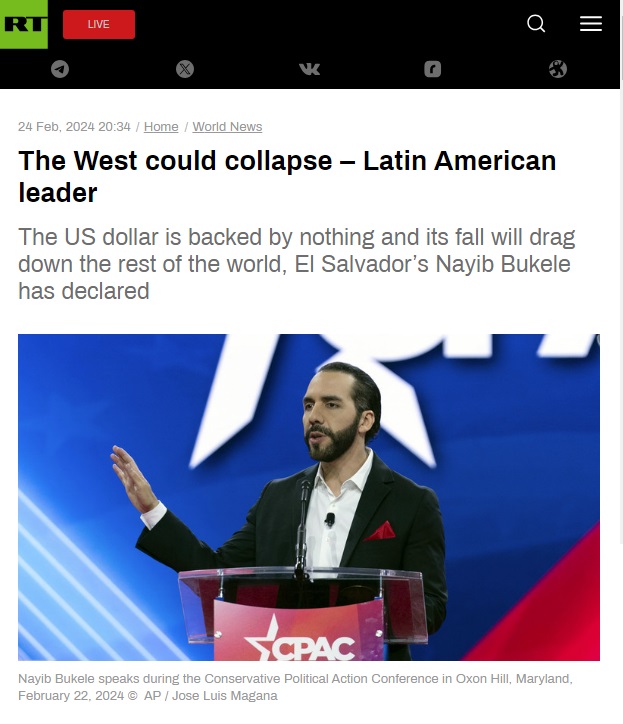

The West could collapse – Latin American leader

The US dollar is backed by nothing and its fall will drag down the rest of the world, El Salvador’s Nayib Bukele has declared

SWENRT News (RT News alternative URL), 24 Feb 2024

The US economy is based on the “farce” of printing unlimited amounts of money, and Western civilization will collapse when that bubble “inevitably bursts,” Salvadoran President Nayib Bukele warned American conservatives on Thursday.

Fresh from winning a second term in office with 84% of the vote, Bukele arrived at the Conservative Political Action Conference (CPAC) in Maryland to a hero’s welcome. Hailed by American right-wingers for his adoption of Bitcoin as legal tender and his iron-fisted crackdown on gang crime, Bukele closed his speech with a call for massive structural changes to the US economy.

Comment: ~26 minutes full length speech video link & ~3 minutes video clip

Link

BRICS nations know what is happening and they are protecting themselves from the fallout. I am thinking we will see a controlled demolition fairly soon. So, that's not the same as a collapse. Furthermore, that is why there is talk of CBDCs (Central Bank Digital Currencies). However, this seems inconsistent with the Central Bank frenzy to buy gold. How can Central Banks offer to control finances if they don't have any real money? GOLD = REAL MONEY. PAPER FIAT IS USELESS IN A COLLAPSE SCENARIO.

BRICS states ditch USD in 95% of trade

The Herald, 21st Feb 2024

MOSCOW. – In a sign of growing de-dollarization efforts, Brazil, Russia, India, China, South Africa (Brics) have ditched the US dollar in 95 percent of their trade.

MOSCOW. – In a sign of growing de-dollarization efforts, Brazil, Russia, India, China, South Africa (Brics) have ditched the US dollar in 95 percent of their trade.

The secretary general of the International Chamber of Commerce (ICC) Tatiana Mohaghan, revealed the massive shift in currency usage in Russia’s dealings with the two countries.

The shift was defined by a massive increase in local currency usage in the trade between Russia and the two Brics nations.

Moreover, the ICC reported that Russia’s export settlements in either the US dollar or the Euro also fell drastically. Specifically, it has fallen from more than 85 percent in 2021 to just 34 percent last year.

Over the last year, the Brics economic alliance has not been shy about its de-dollarisation plans.

Indeed, amid increased Western sanctions on Russia, the country shifted its trade focus.

As a result, the bloc has increased its overall usage of local currencies in bilateral trade.

That transition has led to some massive changes in the overall usage rate of different currencies by the three biggest nations. Specifically, for Brics countries they have ditched the US dollar in 95 percent of trade.

Comment: It is not just the dollar that is now unpopular, the Euro is in trouble too.

West could upend global financial system – Russian central bank

The seizure of the country’s reserves would jeopardize the “immunity” of national assets worldwide, Elvira Nabiullina warns

RT.com (Internet Archive), 17 Feb, 2024

The global financial system would be disrupted if Brussels and Washington go through with threats to use Russian sovereign assets to help Ukraine, the head of the Bank of Russia, Elvira Nabiullina, warned on Friday.

Comment: I think this is a warning that if frozen Russian reserves are taken, there will be reprisals any drastic move will finish off an already dying dollar. Update 22nd Feb 2024: G7 finds ‘experts’ to declare theft of Russian assets legal | Ten lawyers have argued that the seizure would be legitimate due to the Ukraine conflict

BRICS Driving Emerging New Global Architecture

Modern Diplomacy, Feb 5 2024

[...] Despite dozens of applications to join, BRICS added only five new members on January 1, 2024. Unsurprisingly, Argentina turned down its invitation, citing sovereign right to make such as a final decision based on domestic problems and limited internal resources. At present, Algeria, Bahrain, Bangladesh, Belarus, Bolivia, Cuba, Honduras, Indonesia, Kazakhstan, Kuwait, Morocco, Nigeria, Pakistan, Palestine, Senegal, Thailand, Venezuela and Vietnam are all awaiting an invitation to join BRICS after filing an official membership application.

[...] He further touched other important issues such as finances, deepening of cooperation in such areas as investment and trade, industrial transformation, the use of ICT [information and communications technologies] for the interest of development, boosting maritime transport, logistics, as well as solution of problems of the lack of food and energy security.

Tehran expects the shift to payments in national currencies within BRICS to increase during Russia’s chairmanship, Iranian Deputy Foreign Minister on economic issues, the republic’s BRICS Sherpa Mehdi Safari said at the meeting. It was connected with ways to more actively use national and local currencies and payment tools in cross-border transactions in order to reduce the negative side effects of the current dollar-dominated global economic system.

Comment: Dollar dominance is doomed. This is a longish article.

BRICS: 21 Countries Officially Agree to Ditch the US Dollar in 2023

Watcher Guru, 7 Sep 2023

The US dollar is facing challenges from developing countries that are threatening its status as the global reserve currency. A handful of alliances in Asia, Africa, and South America are looking to end dependency on the U.S. The BRICS and ASEAN groups are at the forefront of challenging the US dollar’s status.

Developing countries fear U.S. sanctions could hurt their economies and, therefore, want to strengthen their local currencies and economies. The de-dollarization efforts are in full swing in 2023, and nearly two dozen countries want to ditch the U.S. dollar.

Comment: This is NOT JUST about NOT using the dollar. Countries are also de-dollarising by not buying US debt in the form of treasuries and bonds, but buying gold instead. There is a lot of articles on this website which seems to be dedicated to BRICS news.

|

Click image for link

Click image for video link

|

BRICS bank can create ‘honest’ currency anchored to gold – economist

This could help challenge the dollar and the current fiat system, Chris Hart has told RT

RT News (Internet Archive), 23rd Aug 2023

The New Development Bank is helping to multilateralize the world of finances, Chris Hart, executive chair of the Impact Investment Group, told RT.

The New Development Bank is helping to multilateralize the world of finances, Chris Hart, executive chair of the Impact Investment Group, told RT.

According to Hart, a future BRICS common currency would potentially take global finances away from a specific power group based in Western countries.

[...] Hart also noted that the financial organization, launched by the BRICS nations back in 2014, is considering the idea of a common currency that could potentially be gold-backed.

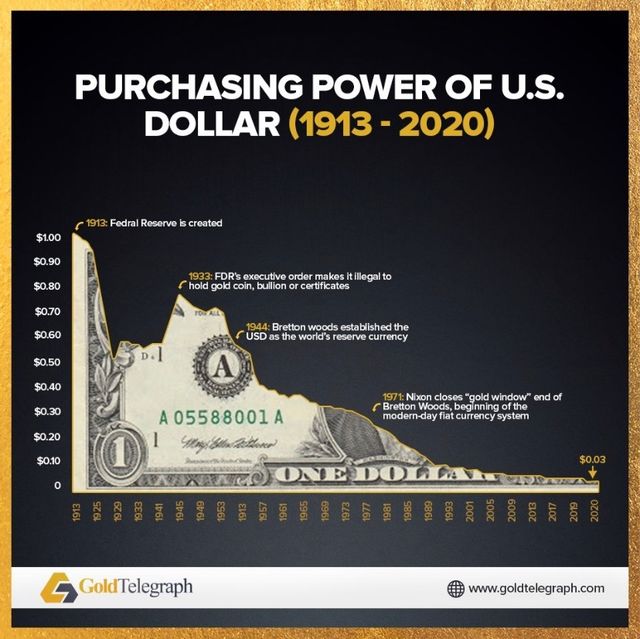

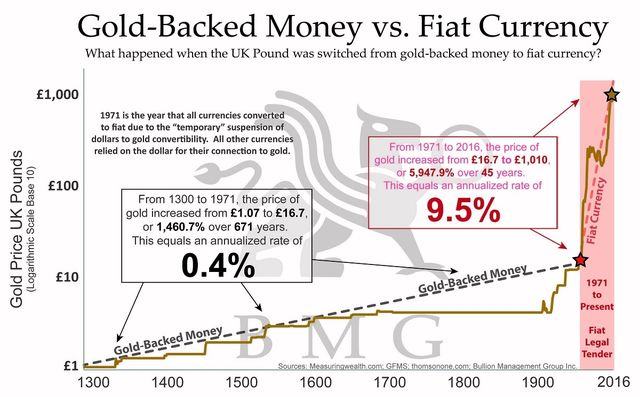

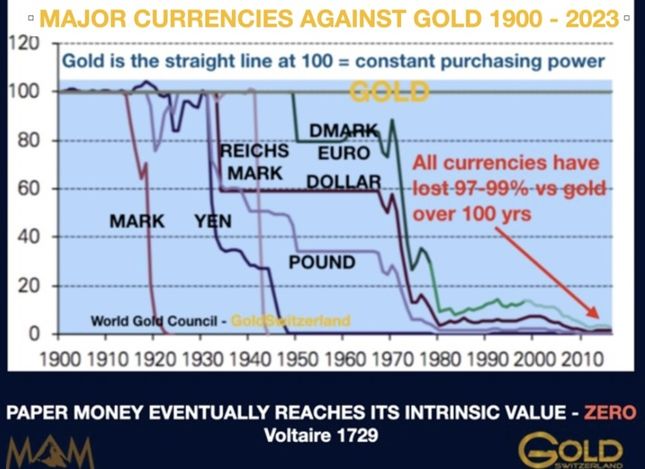

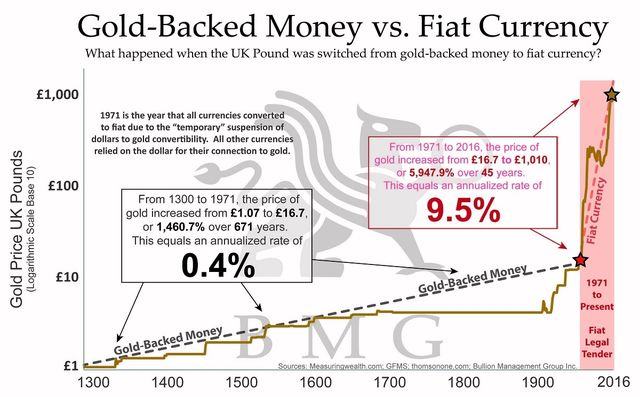

He claimed the foundation of the current global financial system is on quicksand since the US eliminated the gold standard in 1971. “You could print any currency out of thin air and inflate it into the system... And since then, there has been no proper anchor.”

According to Hart, if a future BRICS currency is pegged to gold, this would provide an enormous improvement to the "honesty" of the financial system.

Click image for video link

'BRICS is now the hottest club in the world' - senior African diplomat

RT News/SOTT, 21 Aug 2023

[...] Maj Gen Gaudence Salim Milanzi said BRICS is "the hottest club in the world" and although Tanzania has not yet applied for membership, it sees opportunities in working with the bloc. A Tanzanian delegation will be attending the BRICS Summit in Johannesburg from August 22 to 24.

Comment: SOTT.net copy Link & Way Back Machine Internet Archive copy Link

Click image for video link

Comment 1: How much clearer can the above headline be? The developing countries are tired of being robbed by use of the worthless dollar (fiat money in general) and want the gold standard back.

Comment 2: IMPORTANT! BRICS don't want to create a new currency at the moment because they know it will be attacked and destroyed by George Soros et al. The BRICS nations will initially use a digital token backed by gold that they can exchange amongst themselves and anything that is owed will be settled in gold. That is the only way they will be successful.

The current fiat system (money created out of thin air and backed by nothing) is denoted in dollars and favours the United States. However, "dollars" is more a generic term and too complicated to explain here. Moreover, international piggy banks were held in dollars (FOREX reserves). So, when the United States froze (stole) Russia's money as punishment for the Ukraine offensive, then many countries took fright and are now looking for an alternative system. BRICS is now looking very promising, but this means very bad news for the United States.

The current fiat system (money created out of thin air and backed by nothing) is denoted in dollars and favours the United States. However, "dollars" is more a generic term and too complicated to explain here. Moreover, international piggy banks were held in dollars (FOREX reserves). So, when the United States froze (stole) Russia's money as punishment for the Ukraine offensive, then many countries took fright and are now looking for an alternative system. BRICS is now looking very promising, but this means very bad news for the United States.

The current system is close to collapse (this is dealt more thoroughly in the section on GOLD & SILVER | Commodities Backed Money), so central banks all over the world are aiming to maintain their position in world finance by hoarding gold. It is not just BRICS nations who want to be able to settle in gold. Unfortunately, the average man in the street is oblivious to what is going on, but they will find out very soon. There is a lot of talk about US hyperinflation (all fiat currencies?) but bank failures and bail-ins might come first.

A new world is under construction. A second chance that the world must not miss

NATOEXIT, 11 May 2023

Much of the world is rearranging itself. The goal is collaboration, on many different floors, between countries/sovereign civilizations that intend to emancipate themselves from the toxic addiction imposed on the world, since the last post-war period, from US hegemonic domination. [...]

Click image for link

Over the past year, Beijing has given birth to new political initiatives, especially the Global Development Initiative (GDI) and the Global Security Initiative (GSI). The Shanghai Cooperation Organization (SCO) shares with the BRICS three founding members – Russia, China and India – all inspiring multilateral initiatives.

Comment: This article is included to demonstrate that there is a serious world re-organisation taking place. It's NATO vs SCO now. Although the SCO is not exclusively a military alliance, its member states do participate in joint military exercises and war games. With the induction of India and Pakistan, four SCO members have significant nuclear capabilities and this has definitely strengthened the bloc against NATO. Yet, SCO is also about trade.... There are countries in SCO that are NOT in BRICS, see

Russia and the Shanghai Cooperation Organisation (SCO) Are Considering Using Gold for Pan-Asian Trade | 27 Jan 2023

Click image for link

BRICS Gold-Backed Trade Pushing Deep State Desperation at All-Time High

Europe Reloaded, 21st April 2017 (Internet Archive)

It appears that the real reason why Trump has capitulated to the Deep State in so short a time is the final BRICS leadership’s decision to start the dumping of the fiat dollar in matters of mutual trade and economic cooperation between the BRICS member countries.

This measure puts Donald Trump’s most ambitious campaign promise of “Making America Great Again” through economic recovery and military upgrade in grave danger, as the BRICS Alliance starts requiring the US government to pay for BRICS resources with real, hard currencies only.

Comment: This is a highly informative no gloss history lesson. (I had to find the archive version because the images on the

original article

are missing and they provide good educational information). However, it is too simplistic to talk about China this and China that.... China is not the same as the dark Khazarian mafia led CCP. Anyway, this article appears to back up claims by Jim Willie that US goods are being paid for in tankers of oil. Certain countries (not necessarily BRICS) don't want the worthless dollar.

Click image for link

Many people thought it was very strange that Trump consistently pointed out a man wearing a brick suit during his presidential-run rallies. For many, the penny has now dropped that Trump knew all along that the BRICS countries would re-organise themselves to create the dream of a level playing field for all countries to trade between themselves without a failing dollar and interference from the nefarious banking cartel (Cabal). Truther Intel that Trump has secured a huge amount of gold so that the U.S. can join BRICS at some point in the near future now makes a lot of sense.

|

XTwitter | @BRICSINFO

Link

Search term 'BRICS' for ~475 articles at SOTT.NET |

Link

|

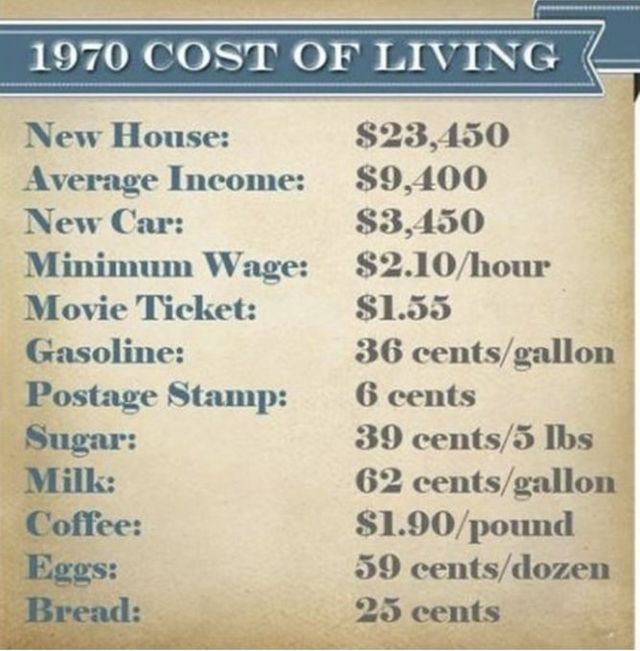

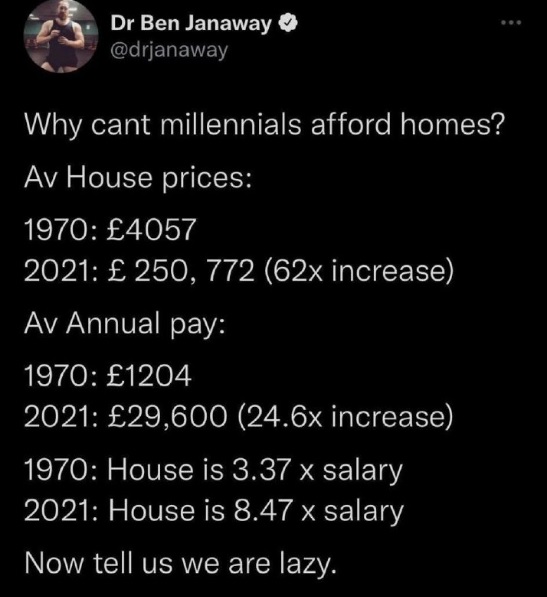

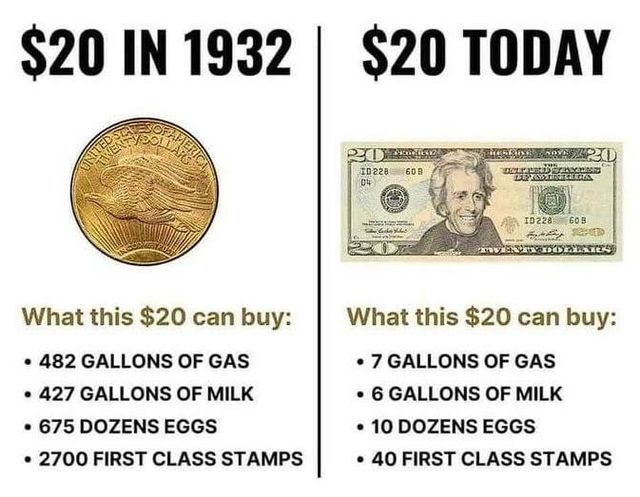

The Gold Standard: Commodities backed money

(The Return to Sound Money)

The following is a short blog that explains why the world is returning to real sound money. In short, sound money ensures economic stability, where major items (like food and a home) retain their value and are not subject to inflation or currency devaluation. Additionally, it limits the ability of governments to manipulate the money supply for political purposes. There is a lot more that can be explained including the accumulation of government debt, so the article Sound money: The Gold Standard: Upholding the Principles of Sound Money can be recommended in this regard.

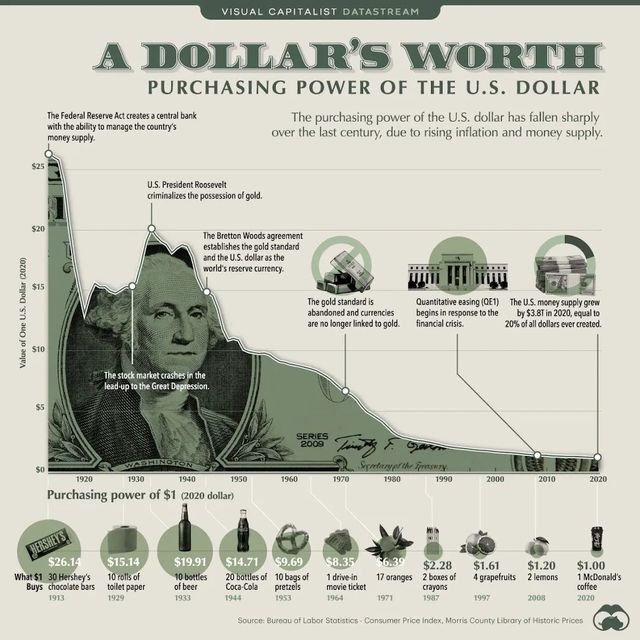

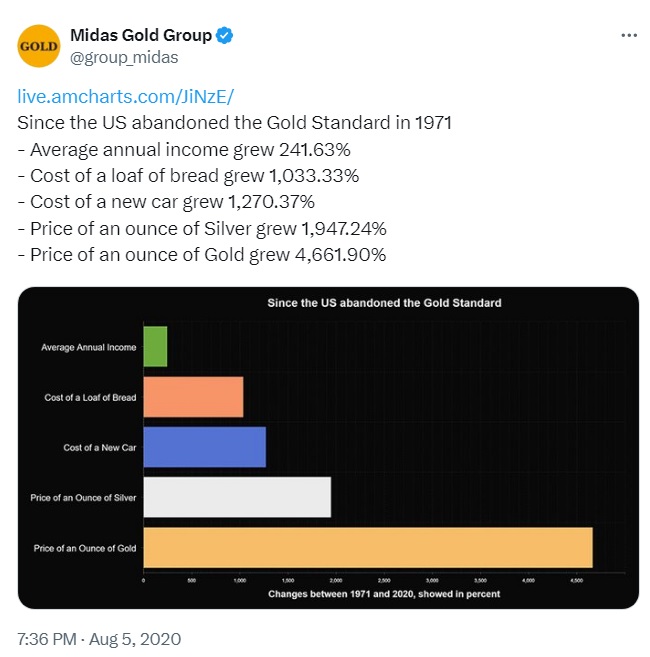

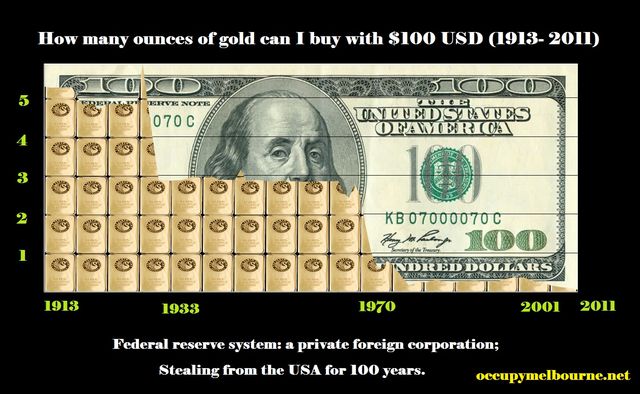

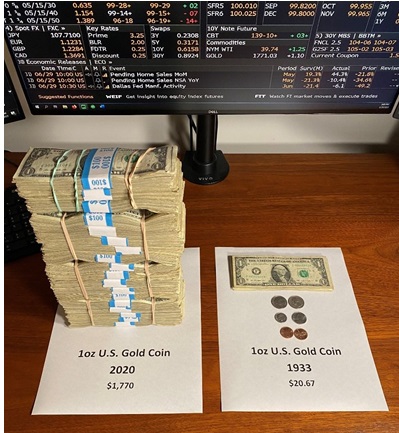

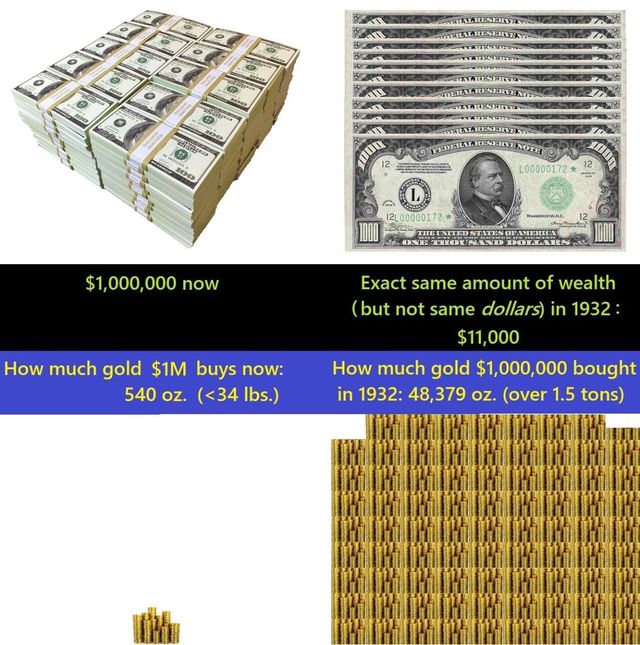

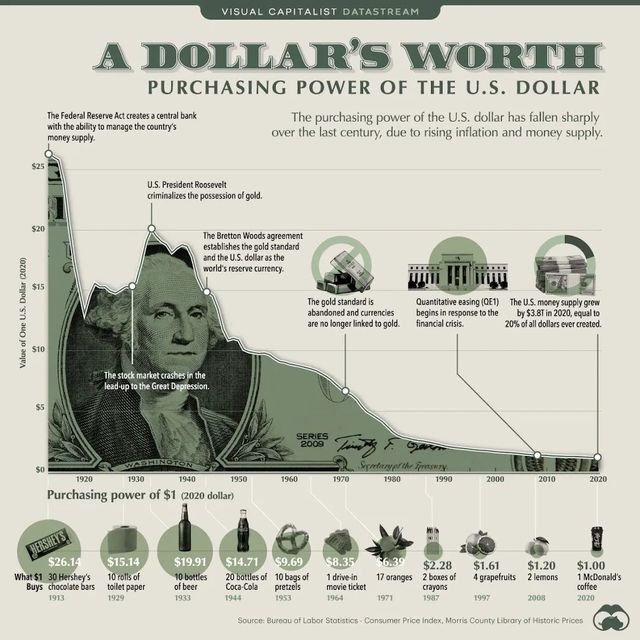

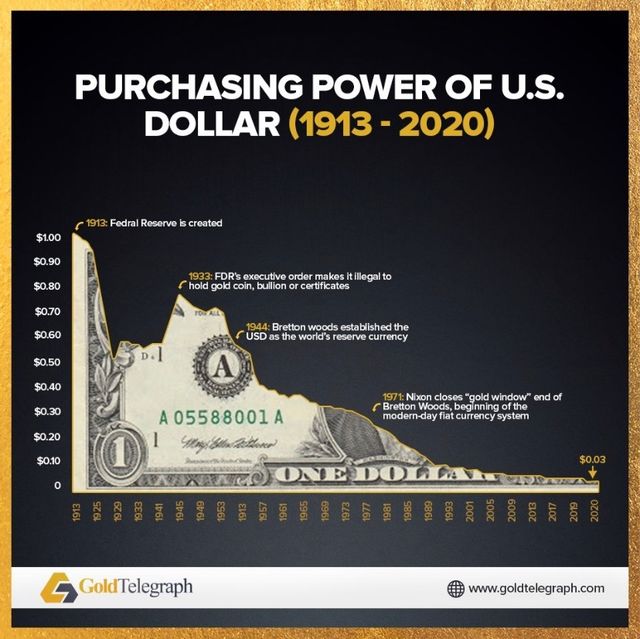

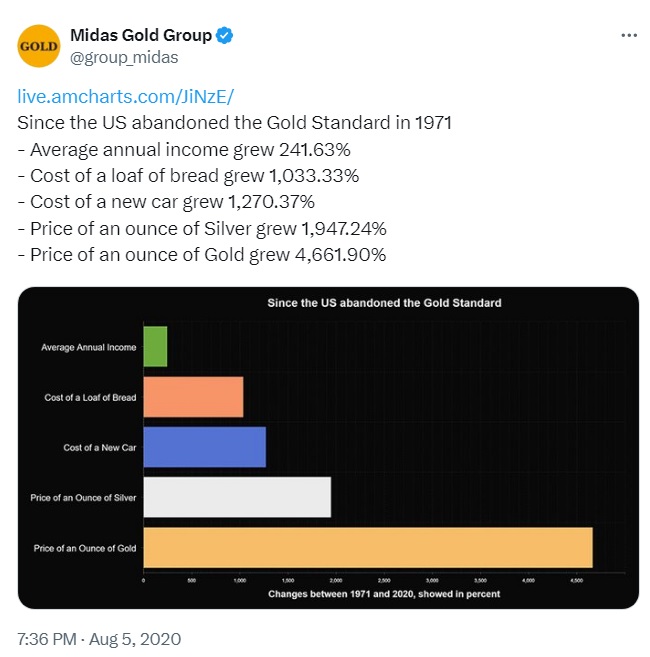

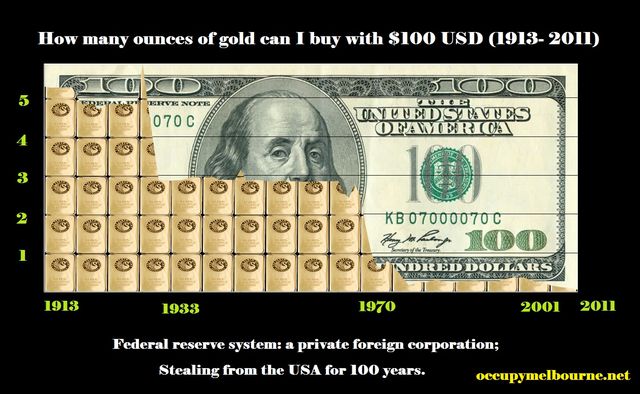

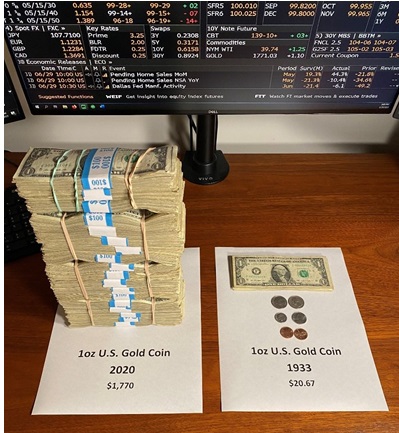

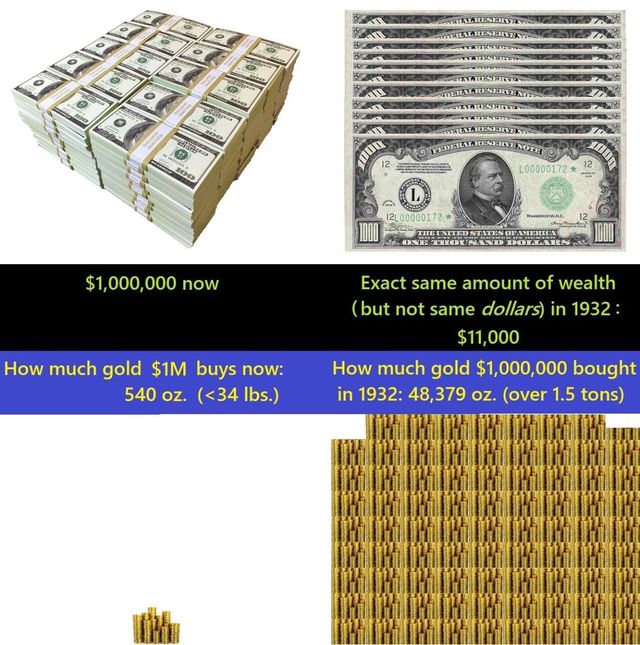

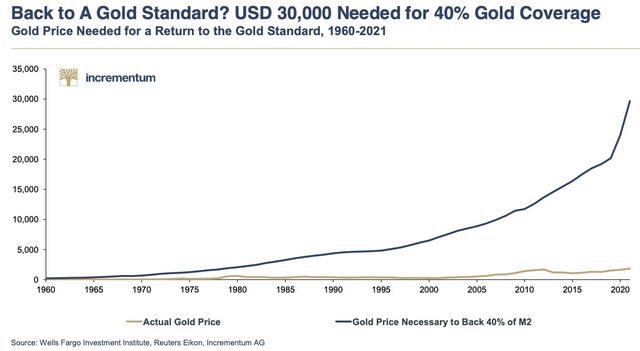

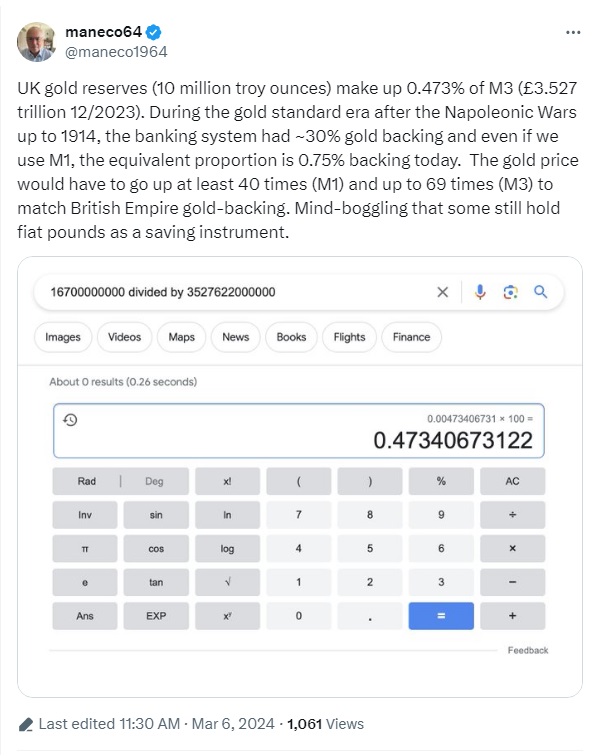

Here, the main focus is using infographics to demonstrate our money is becoming worthless and how this relates to huge amounts of national debt and continuous money printing. Various experts have tried to estimate what the true price of gold and silver will have to be to create a worldwide level playing field for economic trade.

At the same time, we do have a central banker openly stating that a gold re-evaluation is likely to happen. Hence, even if these guesstimates are only 50% right, then it is obvious the price of gold and silver are going to skyrocket. Hence, the following guesstimates are worthy of some consideration for those looking for a financial once in a lifetime opportunity.

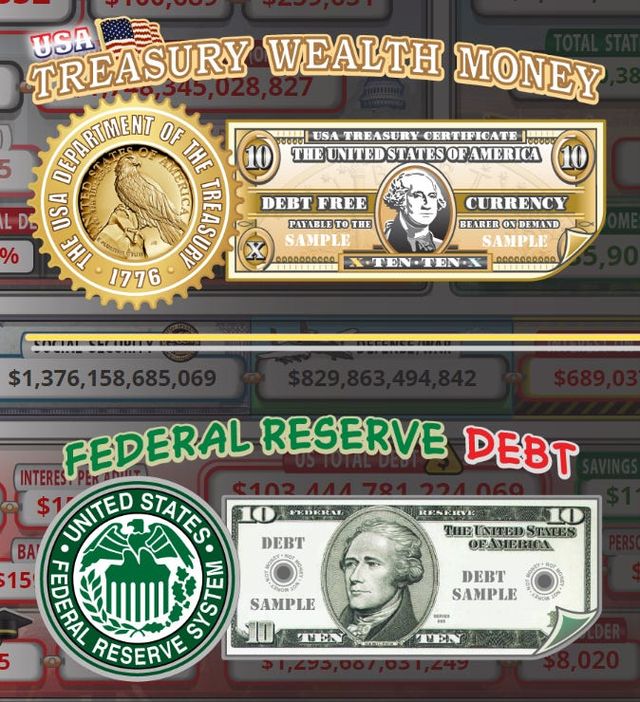

There is also some additional related information about efforts to resurrect the gold standard in the United States, but the main visible effort is being made by the BRICS nations. In this regard, it seems that a new US Treasury note (gold backed money) has already been devised and being advertised by the revamped US Debt Clock, which will be dealt with separately.

Dollar (Fiat) Currency Devaluation

Even though the following provides dollar and pound examples of currency devaluation, this applies to all fiat currencies as they are all pegged to the dollar.

Purchasing Power Of the Dollar and Gold in 1913 vs 2023

YouTube Short | April 2023

Lynette Zang demonstrates what you could have bought with gold and silver in 1913 as opposed to what you can get today.

Source: The US National Debt Clock | Episodes 10-18, TheFruitedPlain

Click image for link

Timeline: 150 Years of U.S. National Debt

This interactive visualization uses debt held by the public for its calculations, which excludes intragovernmental holdings.

Visual Capitalist, December 16, 2021

MAJOR REVALUATION OF GOLD & PRECIOUS METALS IS IMMINENT

The Burning Platform, July 3, 2023

The time has now come for the 99.5% of financial assets which are not invested in gold, silver or precious metals mining stocks to grab both the investment and wealth preservation opportunity of a life time.

[...] There was a time when the US dollar was “As Good as Gold” and until 15 August 1971, sovereign nations could exchange dollars for gold at $35 per ounce.

But sadly most leaders whether of countries or corporations eventually resort to GREED when real money runs out. So this is what Nixon did in 1971 when he closed the gold window.

Comment:

Credit: gold-eagle.com @2016. Click image for link

Comment: Found on Yandex, but not available elsewhere. Not even through the Way Back Machine internet archive.

WTF Happened In 1971?

Credit: SGT Report. Click image for link

click image for link

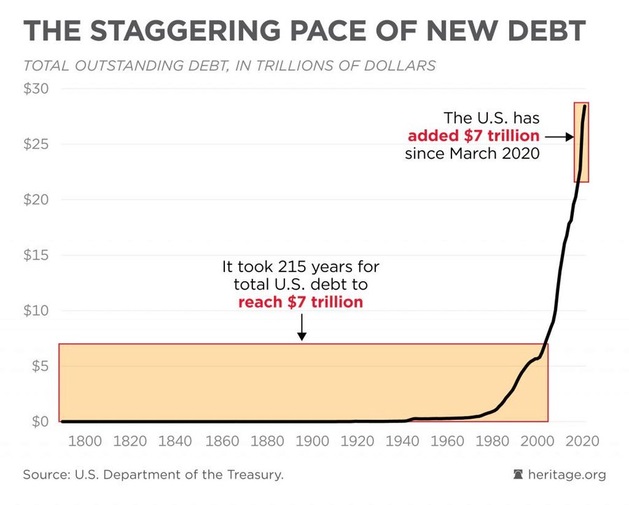

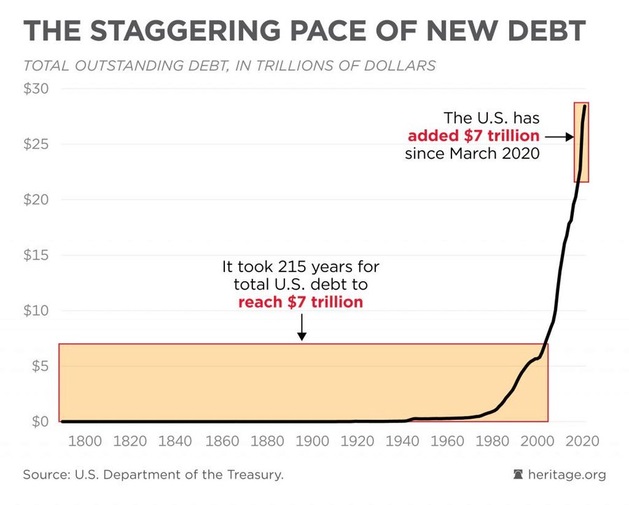

In August 1971, the U.S. national debt stood at $400 billion. So really ~7 trillion was added over 49 years when the gold standard was dropped. Since March 2020 ~27.5 trillion has been added in 4 years. Hence, taking the average, the rate of debt increase since March 2020 has quadrupled. This is absolutely shocking!!

Click image for link (full size image)

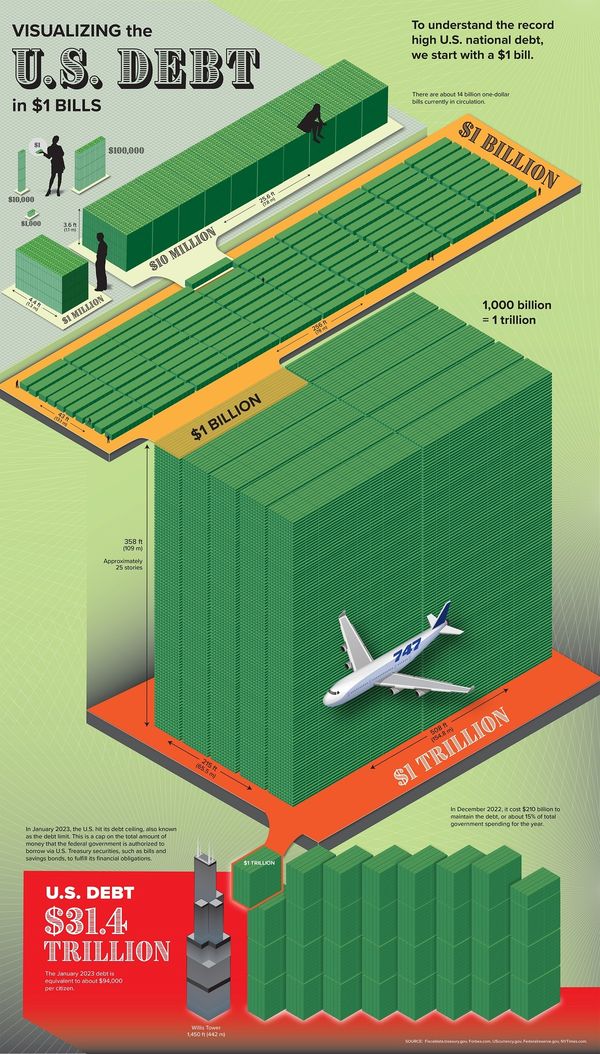

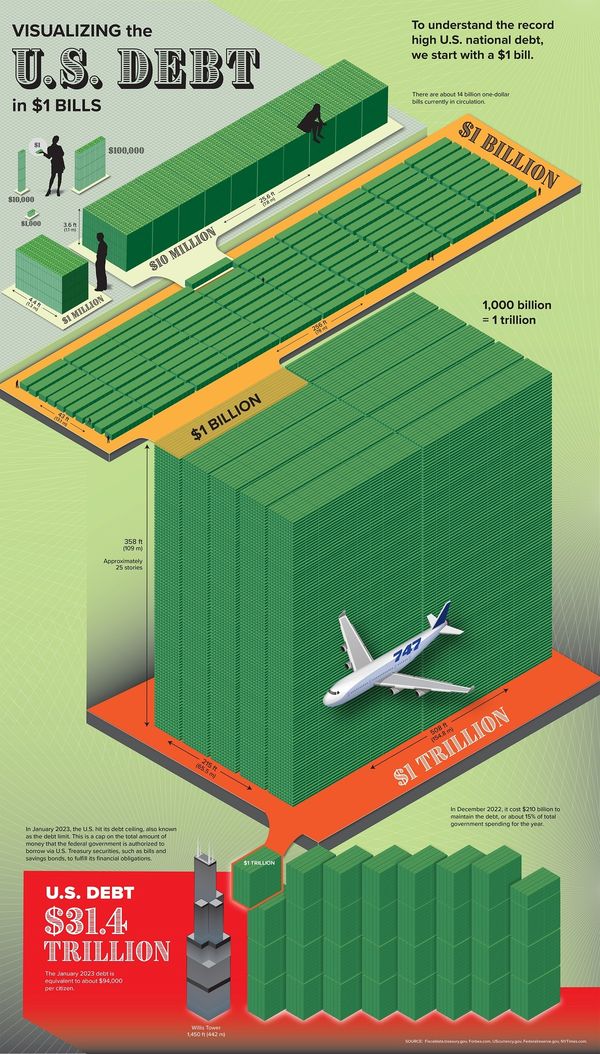

U.S. Debt: Visualizing the $31.4 Trillion Owed in 2023

Visual Capitatlist, 20th Apr 2023

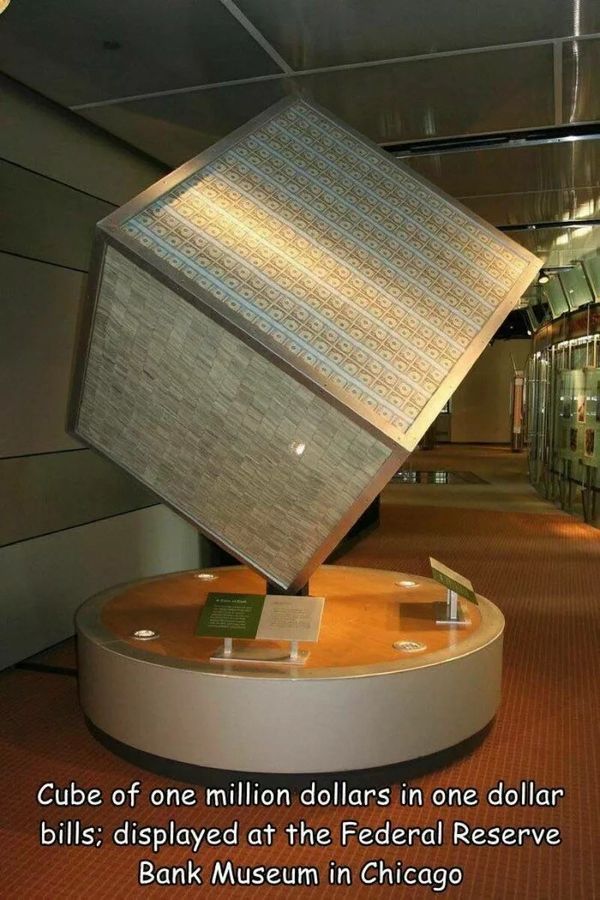

Comment: It is very hard to comprehend the size of the US National Debt. Here is a graphic, but I don't think it beats the thought of a million $1 million cubes, see below.

click image for link

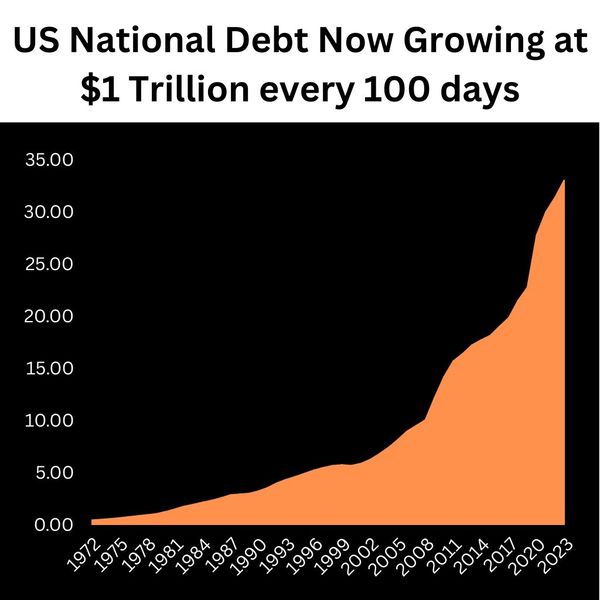

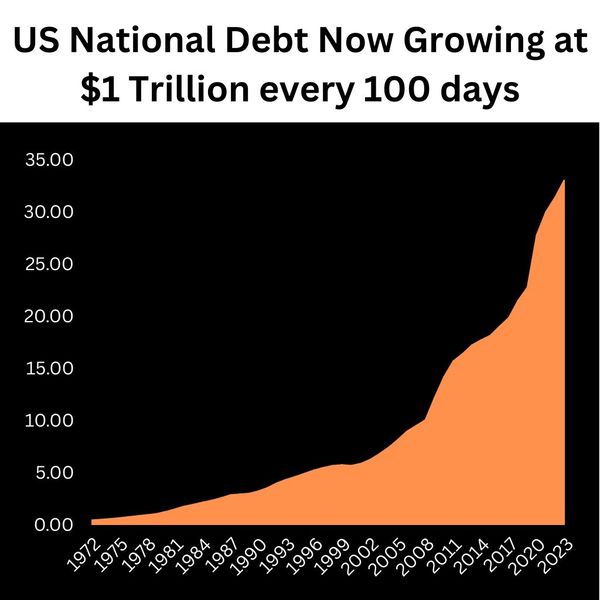

The U.S. national debt is rising by $1 trillion about every 100 days

CNBC, 1st March 2024

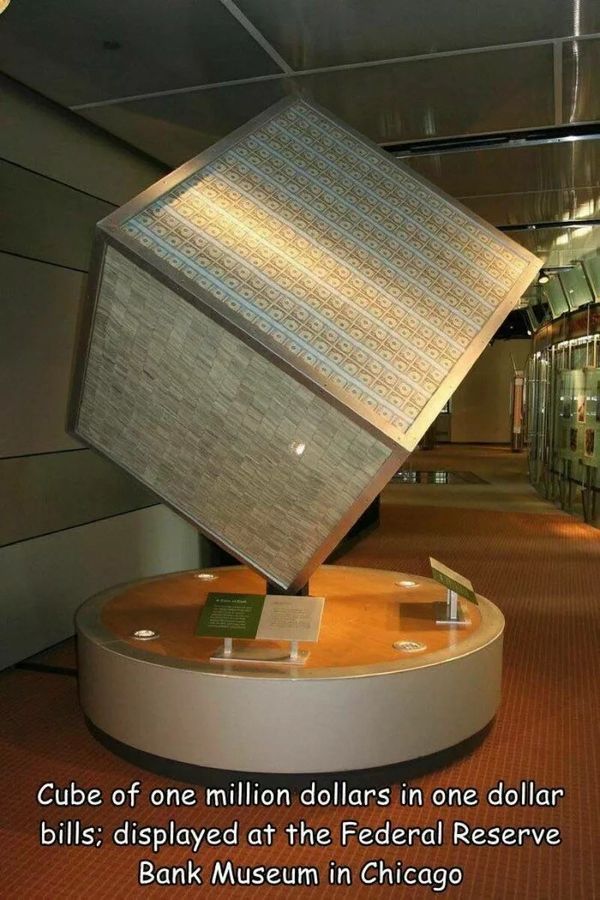

Look at this million dollar cube. The US are printing 1 million of these cubes every ~100 days to fund their debt! Only a few months ago, the guess was this same amount every 5 months....

Look at this million dollar cube. The US are printing 1 million of these cubes every ~100 days to fund their debt! Only a few months ago, the guess was this same amount every 5 months....

This is the world's reserve currency!

Sourced from XTwitter. Click image for link

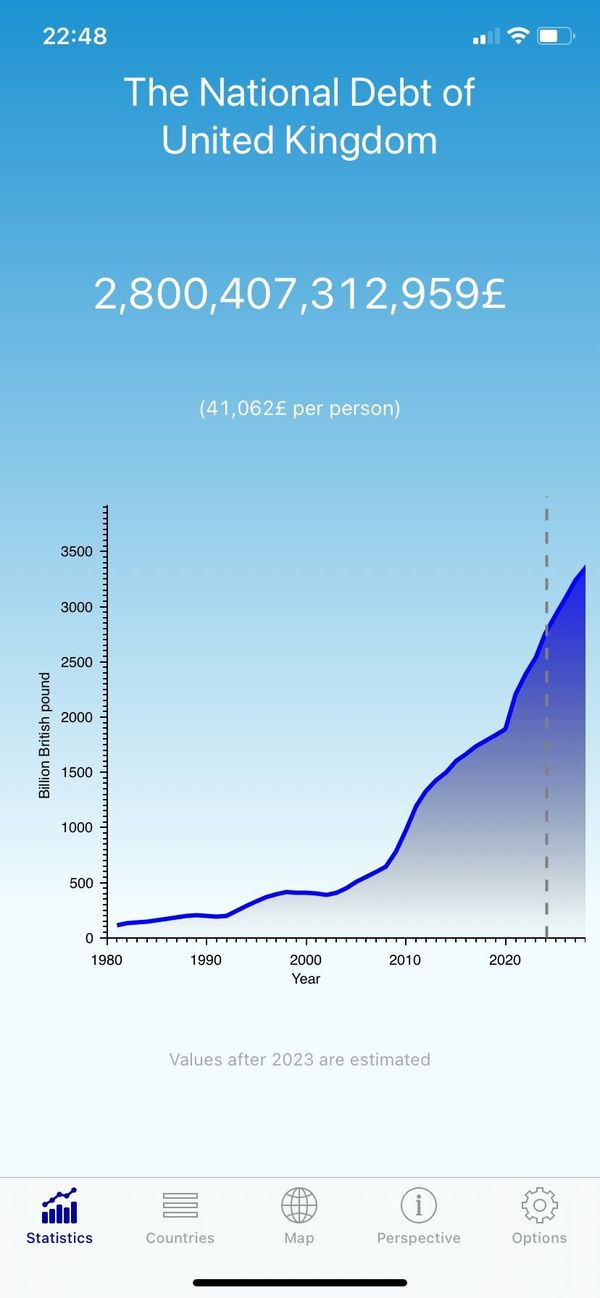

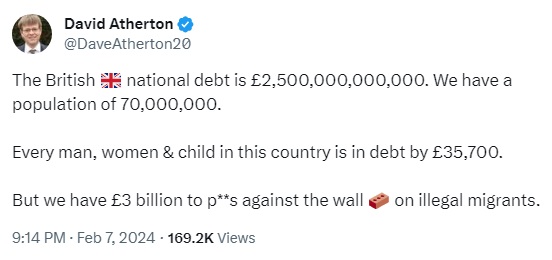

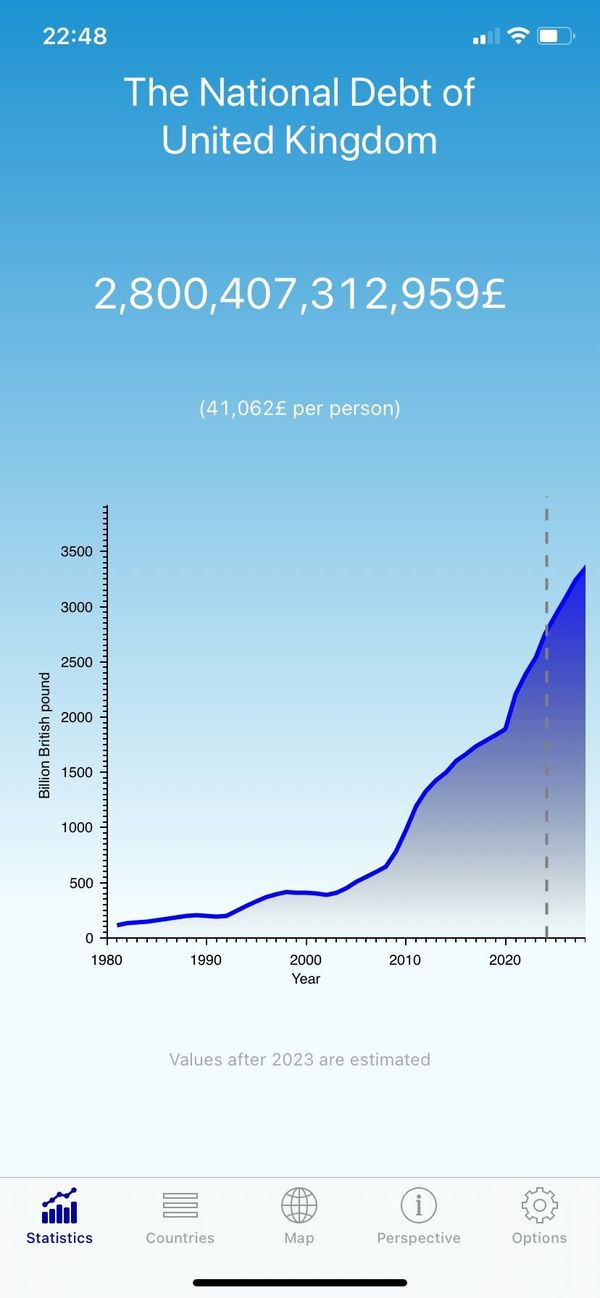

UK Debt 2023 estimate

Comment: Actually it's nearly £3 trillion see below!

Click image for link

This is the UK National debt for 7th March 2024 at approx 2pm.

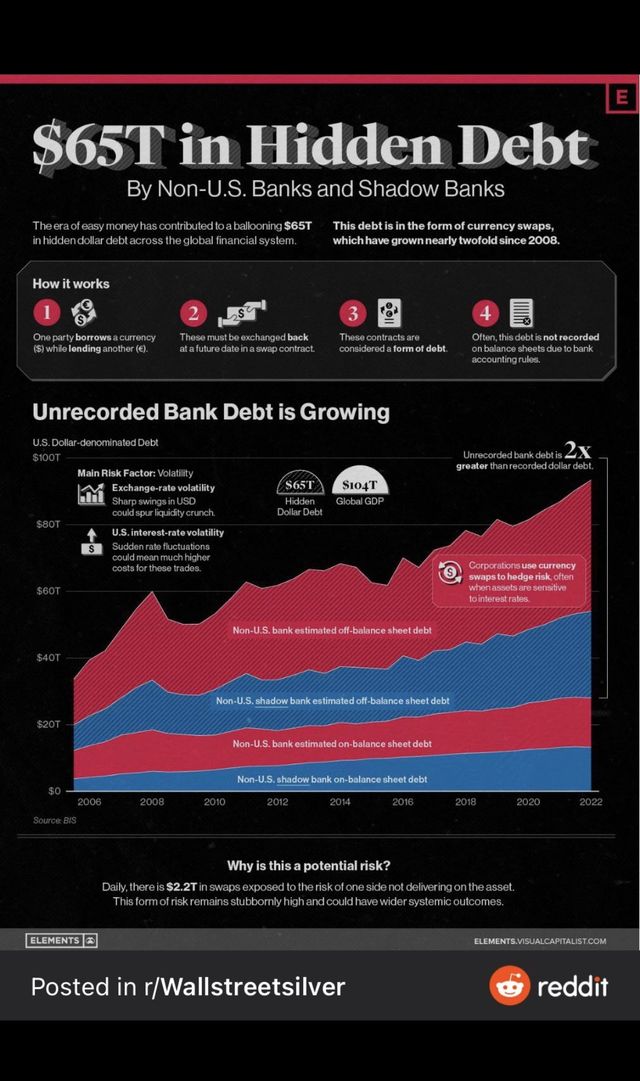

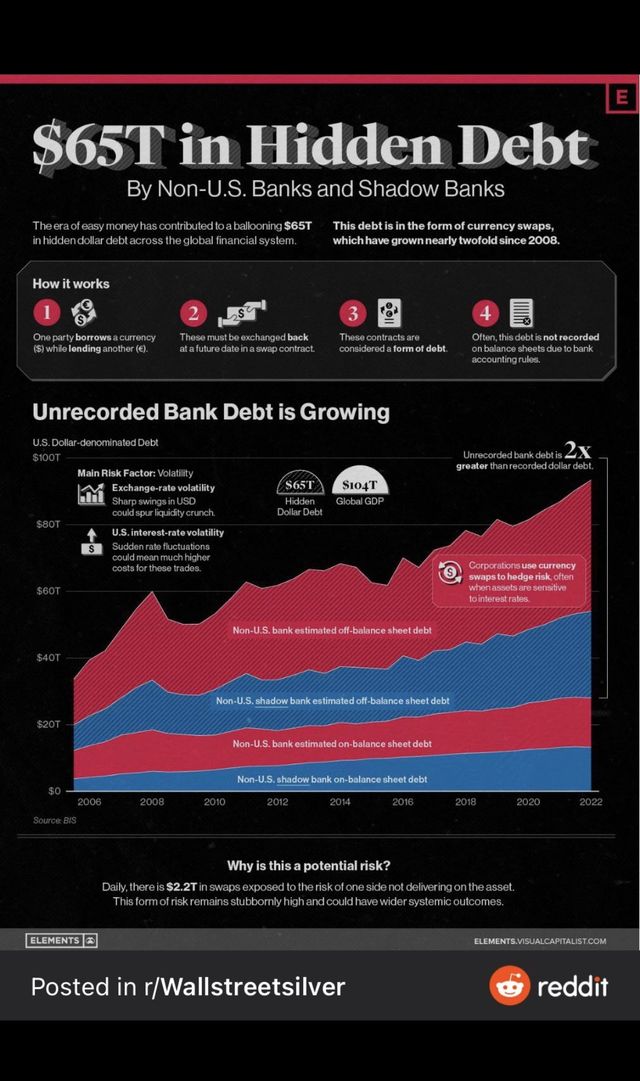

Comment: Once you start looking, there is debt all over the place. This BIS infographic was out of date only a few months later and became $80 trillion, see below:

BIS analysis shines light on persistent risks in foreign exchange trades, hidden dollar debt: BIS Quarterly Review

BIS Quarterly Review, 22nd Dec 2022

•New BIS analysis of the 2022 Triennial Central Bank Survey shows shifts in trading patterns and market structure in foreign exchange and over-the-counter interest rate derivatives markets, identifying risks deserving attention.

•

Foreign exchange swap positions point to over $80 trillion of hidden US dollar debt, reported off-balance sheet.

•The volume of daily foreign exchange turnover subject to settlement risk remains stubbornly high despite mechanisms to mitigate such risks.

Click image for link

Comment: The levels of debt are impossible to pay back. A debt jubilee is coming as well as a new monetary system.

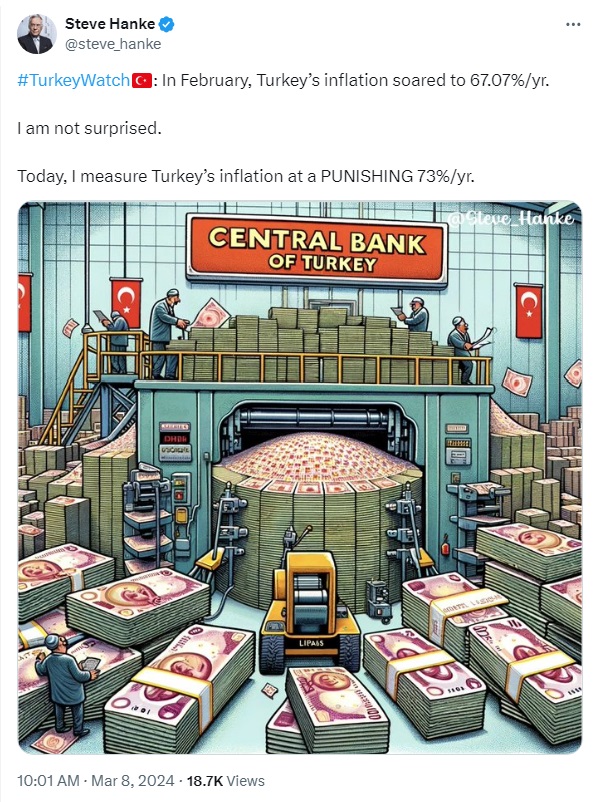

Comment: Obviously it's not just Turkey....

VIDEO 1 | Venezuelans recycle worthless bolivar bills into crafts

link

VIDEO 2 | Venezuela money litter on the street link

Comment: Will the same happen with the dollar, euro and pound?

Guesstimating The Revaluation Price of Gold & Silver

Click image for link

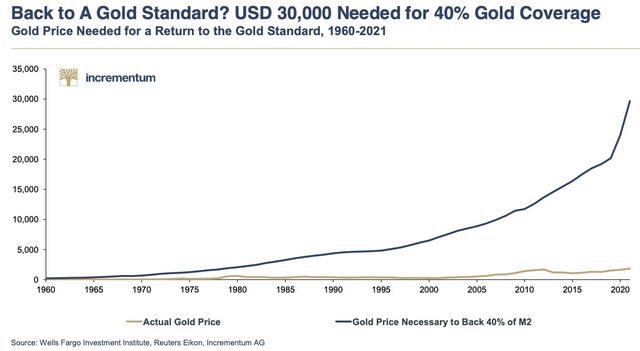

Additional Info: M1, M2, and M3 are classifications of money in the United States.

• M1 consists of all money in circulation as well as deposits in banks.

• M2 money includes M1 money plus savings deposits and money market funds. link

• M3, which has been discontinued, includes M2 plus time deposits, institutional money market funds, short-term repurchase agreements (repo), and larger liquid assets.

The M3 measurement includes assets that are less liquid than other components of the money supply and are referred to as "near money," which are more closely related to the finances of larger financial institutions and corporations than to those of small businesses and individuals.

link

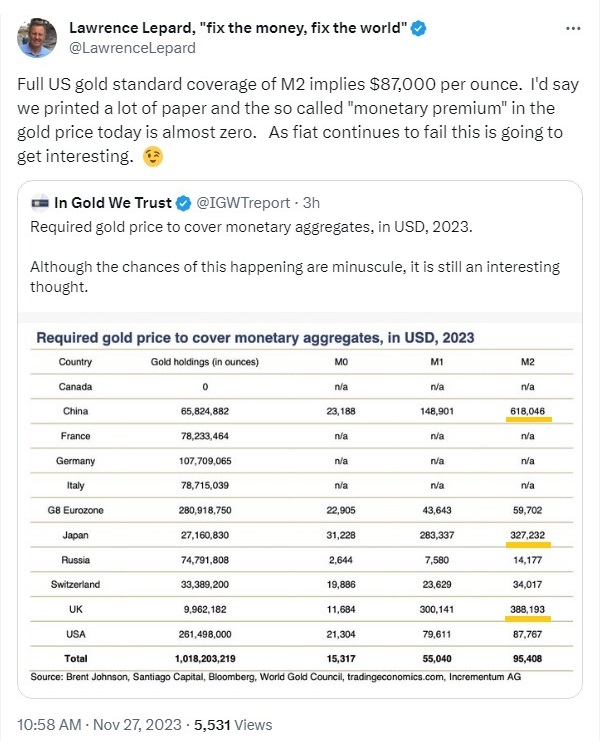

Comment: Very grateful for this X post with historic detail of how gold standard calculations are done. This is rare information.

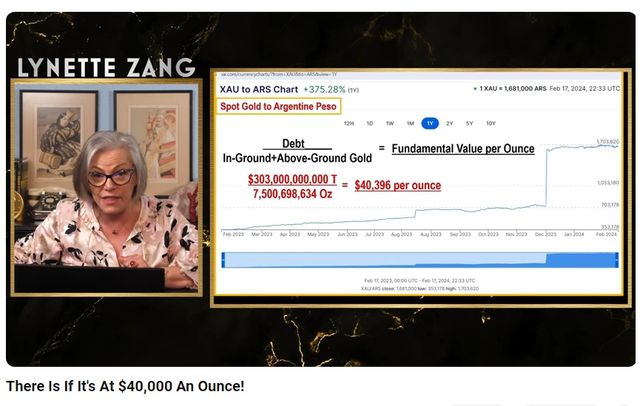

Click image for link

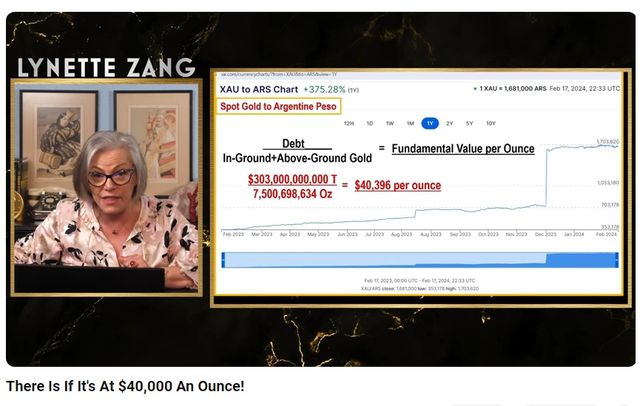

[GOLD] There Is If It's At $40,000 An Ounce!

YouTube, 28th Feb 2024

Lynette Zang is an economist that has been involved in the markets at some level since 1964, as a student, banker, stockbroker and precious metals and currency analyst. She has been studying currency lifecycles since 1987 and discovered similar social, economic, and financial patterns that occur throughout the stages of a currency’s lifetime.

Comment: Lynette knows that history repeats.

How Would the Price of Gold RV in a New “Gold Standard” Today? This Chart Will Surprise You

GCR Real-Time News, November 27, 2023

This is an interesting chart showing what the price of gold would need to be in order to cover the M0, M1, and M2 money supplies for different countries – if they implemented a traditional gold standard today.

The US Dollar would have to be devalued to a whopping $87,767 per ounce of gold to cover the amount of currency in the United States (see chart below).

In other words, the price of gold would revalue (RV) by over 4,300% against the fiat dollar before being anchored to gold.

Comment: So this is using 100% backing of the M2 money supply where before gold was used for a 40% backing. Whatever.... Those in the know are buying gold so efforts have been made to steer retail into crypto and anything rather than gold and silver. Besides that, the M2 related gold price figures for China, Japan and UK are ridiculous.

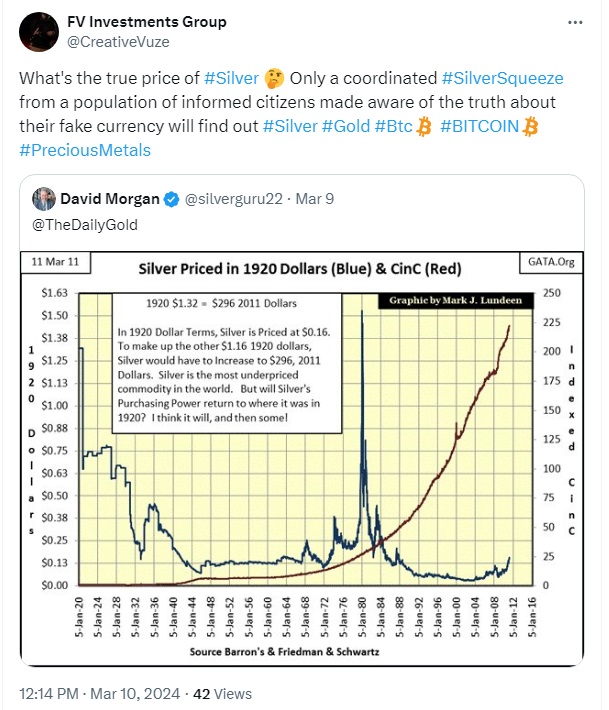

Comment: Even at the 1920 $ worth, the 2011 estimated price of $296 is still very low when we consider the ridiculous amounts of debt accumulation/paper printing since 2011.

Here’s Why $100,000/oz Silver is a Conservative Estimate

RoadToRoota.com, 9 Dec 2012

Nobody should under estimate the COILED SPRING EFFECT that underlies the silver price. 45 years of computer price suppression won't blow off smoothly! I will attempt to quantify the potential price movements in Silver based on my 20 reasons to SELL/BUY from this article:

1) The removal of the gigantic concentrated short position on the COMEX Silver market as reported in the CFTC Commitment of Traders and Bank Participation Reports.

2) The announcement of charges filed by both the CFTC and the FBI in the investigations of Silver market manipulation (as forced at the end of the LBMA "Silver Fix").

3) The shut down of the iShares Silver ETF (SLV) and the subsequent attempt by SLV investors to transfer into physical silver in their own possession.

4) The implementation of COMEX Position Limits in Silver of no more than 5,000 contracts and the enforcement of the Disruptive Trading Practices law.

5) The winding down of the outrageous and manipulative Silver derivative positions held by both JP Morgan and Citibank as reported by the US Office of Comptroller of Currencies.

6) The mass redemption of paper Silver currently held in Pooled Silver Accounts and Silver Certificate Programs into physical silver held in the possession of the owner.

7) The Silver to Gold Price Ratio reflects the true physical relationship between above ground gold and above ground silver that is available for sale on a free and open market.

8) The realization by industrial users of silver that the supply of physical silver is rapidly depleting and with the future of producing their products in jeopardy they begin stockpiling physical silver.

9)The reversal of Silver's ever increasing use in industrial applications due to either high prices or the discovery of a viable substitute with similar physical properties and attributes.

10) The realization by the remaining 99.9% of the investing public that does not currently own any physical that Silver is extremely undervalued and should be held by all investors interested in portfolio safety and value appreciation.

11) Acknowledgment by the Bullion Banks and US Government that they have been involved in the price suppression of Silver for over 50 years in order to support and extend the global confidence in un-backed fiat US Dollar.

12) All Silver statistical reporting companies have completely revised their historical numbers to reflect the true supply/demand realities of the past and admit to the massive annual physical silver deficit going forward.

13) The USGS alerts the world to the reality that at the REAL current Silver consumption rates there is less than 10 years of known below ground Silver reserves remaining in the world.

14) The realization by investors that significant increases in the price of Silver would not curtail industrial demand as silver is mostly used in very small amounts in each product produced.

15) The mainstream media highlights that the investment drivers for Silver far out weight the investment drivers for Gold.

16) The US Mint starts to produce US Silver Eagle coins "in quantities sufficient to meet demand" and no longer illegally rations their dwindling supply.

17) When investors stop saying that silver is "too hard to store" and start worrying that silver is "too valuable to leave in a bank's safe deposit box".

18) When Central Bankers around the world stop printing money every time there is a "bump in the road" on their never ending quest to foster perpetual growth and end the extraordinary transfer of wealth from "the many" to "the few".

19) The US Government and the Citizens of the United States recognize and acknowledge that Article I, Sec. 10 of the US Constitution specifies that only gold and silver coin can be legally used as money and the Coinage Act of 1792 defined the US Dollar as "three hundred and seventy-one grains and four sixteenth parts of a grain of pure, or four hundred and sixteen grains of standard silver."

20) The price of silver has risen so high that it has fulfilled all my hopes and aspirations as an investor and I can now sit back and enjoy those other pleasures of life that I had put off in pursuit of FREEING THE SILVER MARKET FROM THE CLUTCHES OF MANIPULATION!

Comment: N.B. This outline is just Bix Weir's headline bullet points, which are explained in more detailed in this blog post. This covers the impact of all the silver price manipulation by bankers over the last 6/7 decades. More:

JPMorgan to pay $920 million for manipulating precious metals,treasury market | 2020 & Ex-Head Of JPMorgan's Precious Metals Desk Sentenced To Prison For Manipulation | 2023 In reality, the real price of silver will be determined by the removal of banker manipulation and the agreed weight of silver in the future worldwide gold standard/commodities basket.

#silver

World Bank whistleblower - Karen Hudes [VIDEO]

RT News (alt RUL), 7 Oct 2013

[...]

KH: Well, there is terrible currency problem. We’re on the verge of the currency war. The Federal Reserve is printing dollars like there is no tomorrow, and if they keep going, the rest of the world is not going to accept them. As it is, the BRICS countries – Brazil, Russia, India, China and South Africa – have decided that they are going to finance the trade among these countries with assets and pay for the difference in gold. And this is the right move for them... [...]

KH: Well, there is terrible currency problem. We’re on the verge of the currency war. The Federal Reserve is printing dollars like there is no tomorrow, and if they keep going, the rest of the world is not going to accept them. As it is, the BRICS countries – Brazil, Russia, India, China and South Africa – have decided that they are going to finance the trade among these countries with assets and pay for the difference in gold. And this is the right move for them... [...]

KH: The problem is actually when you talk about debt, is that our currency is financed by debt; our currency is issued by the Federal Reserve instead of the Treasury which is unconstitutional. When the Federal Reserve System was instituted in 1913 most of the Congress was on break, they sneaked that legislation through. So the debt is there simply for those bankers to put in interest on it and have it grow and compound every year. The debt is a fabrication, it’s probably should be repudiated. [...]

KH: Well, yes and no, I think gold is probably a wise purchase right now, but more as insurance than investment, because there is actually a great deal of gold, there is even more gold than people know about. For example, the amount of gold in the deposit in the Bank of Hawaii is 170 000 tonnes, this is more than the World Gold Council says is available for all the gold on the Earth. People don’t know how much gold there is, there is a lot of gold.

Comment: I have changed the title. You can quickly read the transcript and ignore the Obamacare stuff. Karen says there is a LOT of gold.... Bix Weir agrees and maybe he is right that silver is more valuable because of it's use in electronics in today's world. Besides, world silver is running out.... Please remember, bankers have been rigging the price for their own benefit and they love to invert.

#silver

Rafi Farber: A House for 75oz Silver is Realistic In the End Game

YouTube, 22 Jul 2022

In Weimar, Germany, in 1923, anyone with a $100 bill could exchange that gold substitute for a swanky house in downtown Berlin.

In Weimar, Germany, in 1923, anyone with a $100 bill could exchange that gold substitute for a swanky house in downtown Berlin.

That's about 5oz of gold, and at a 15:1 ratio, about 75oz of silver. That's not fantasy. It actually happened.

Comment: Cliff High thinks Rafi Farber is right and silver 75oz = $1 million dollars link. The only reason I think this is relevant is that these numbers are close to the Debt Clock Decode values that are being hinted at (depending on the gold/siver ratio used). [Info coming soon...]

|

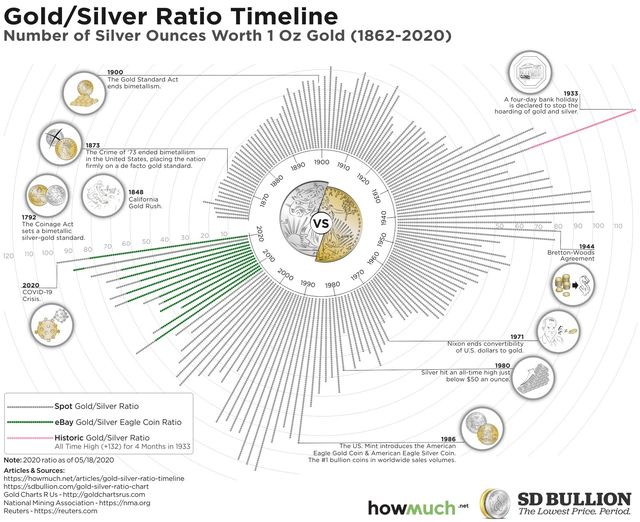

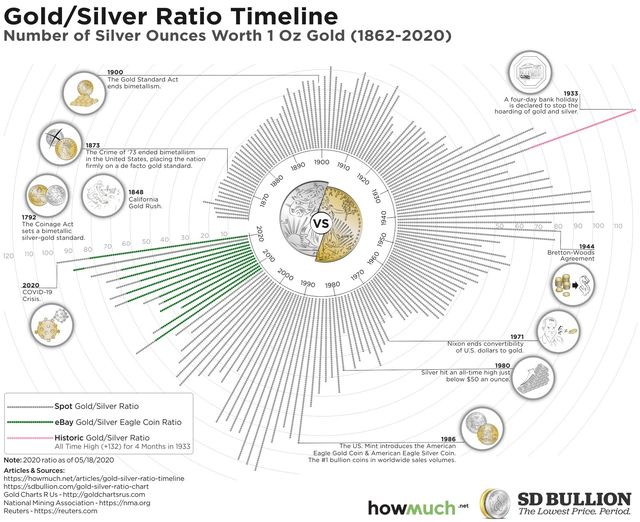

Gold/Silver Ratio Timeline (1862 -2020). Credit: SD Bullion

Click image for link/larger copy.

Comment: The above chart reveals how the ration of gold/silver has varied over time, Currently, many prefer silver because silver is historically very cheap and when it becomes more expensive the ration will nosedive from ~80:1 to a more realistic ~10:1.

|

Jim Rickards: His Gold Price Prediction Explained...($50,000+ IS POSSIBLE!!)

George Gammon / YouTube, 7 Dec 2019

Jim Rickards, legendary gold expert, says soon 👉YOU MIGHT NOT BE ABLE TO BUY GOLD AT ANY PRICE!! 👈I reveal the insider information YOU NEED to understand Jim Rickards reasoning and determine if you should buy gold now or wait. And how gold could go to 100k an ounce!!

[...] Jim Rickards is a heavy hitter in the world of macro economics and gold. He's revered as one of the top thinkers in the country and he's made some huge calls on the price of gold saying it can easily to to $10,000 to $50,000 an ounce. Jim Rickards comes to that conclusion in a very scientific manner. It's really just about math.

Comment: Actually, in this video and on his website, George Gammon makes the case for a $100K Per Ounce Gold Price based on Jim Rickards methodology. This helps to clarify why some people believe the US Debt clock DOLLAR TO GOLD RATIO NOW is $35,147 and DOLLAR TO SILVER RATIO NOW IS $4,909 [2 Mar 2021] is the likely valuation if we go to a gold standard. Personally, I think the known/unknown debt is bigger but the amount of gold available is also higher due to high level criminal gold being confiscated. I have seen people online getting excited about silver at $100, they simply have no idea about what would happen if we go to a gold standard.

Gold Price $50,000 An Ounce Is Possible: Jim Rickards Prediction Explained

In this Jim Rickards article and video, I explain how he arrives at $50,000 an ounce for gold. I then go on to reveal how the price of gold could actually go to $100,000 an ounce. Make sure to click play on the video to follow along.

Georgegammon.com, June 6, 2020

The Return Of The Gold Standard

The Western World is facing the Death Spiral of Debt. The BRICS nations understand the gravity of the situation and are putting themselves on the Gold Standard. They have been buying gold since the 2008 financial crisis, ramping it up dramatically in 2022, increasing it to new records of buying in 2023, and looking to make new records in 2024.

We know that European central banks are buying gold and very wealthy investors are protecting their wealth because gold is real money that can't be inflated away. The efforts to resurrect the Gold Standard in the West appear to be very feeble but the following is only a hint of what has been secretly planned. More analysis link

#GoldStandard

Click image for link

Comment: 2026? But the US can't pay back its debt. The Treasury must roll over $10 trillion by July 1, 2024 Link. Nobody should be surprised when the SHTF and overnight the Gold Standard returns. All those with precious metals will get rich/super rich depending on how much they have. It will be the greatest re-distribution of wealth in history.

Old gold vault of DNB in Amsterdam.

Old gold vault of DNB in Amsterdam.

Click image for link

Dutch Central Bank Admits It Has Prepared for a New Gold Standard

In a recent interview the Dutch central bank (DNB) shares it has equalized its gold reserves, relative to GDP, to other countries in the eurozone and outside of Europe. This has been a political decision. If there is a financial crisis the gold price will skyrocket, and official gold reserves can be used to underpin a new gold standard, according to DNB.

Comment: It's not if, but when.... Long article. It seems that plans have been put in place and central banks are preparing by buying gold at a relatively low price, without the interferance of retail investors. It was a surprise that the Dutch central bank spilled the beans....

Europe’s Gold Agreement and Plans for a Gold Standard Currency (Part 1)

GCR Real-Time News, July 25, 2023

[...] For decades, behind closed doors, Europe had been engaged in strategic preparations to return to a gold-backed currency system, countering the dollar hegemony and forging a new equitable financial order.

[...] For decades, behind closed doors, Europe had been engaged in strategic preparations to return to a gold-backed currency system, countering the dollar hegemony and forging a new equitable financial order.

Comment: It was a surprise to find this article, but it mainly seems to be a history lesson.... I suppose the rationale is that fiat currencies fail 100% of the time. According to answers.com we find:

“No one knows for sure how long the Fiat currency will last. The average life expectancy for a fiat currency is 27 years. The shortest time was one month and the longest is the British pound Sterling at 317 years. Every 30 to 40 years the reigning monetary system fails and has to be retooled.”

link

Hence why responsible people would create an alternative plan.

Texas Committee Passes Bill to Create 100% Reserve Gold and Silver-Backed Transactional Currencies

Tenth Ammendment Center, May 3, 2023

AUSTIN, Texas (May 3, 2023) – Yesterday, a Texas House committee passed a bill to create 100% reserve gold and silver-backed transactional currencies. Enactment of this legislation would create an option for people to conduct business in sound money, set the stage to undermine the Federal Reserve’s monopoly on money, and possibly create a viable alternative to a central bank digital currency (CBDC).

Rep. Mark Dorazio (R) introduced House Bill 4903 (HB4903) on March 10 and it has since garnered a bipartisan coalition of 42 cosponsors. The legislation would require the state comptroller to establish and provide for the issuance of gold and silver specie and also establish digital currencies that are 100% backed by gold and silver, and 100% redeemable in cash, gold, or silver.

Comment: Are they only preparing for an emergency? There is some online discussion that Texas is serious. They want independence from the United States so that they can join BRICS.... Sounds crazy, but maybe the people in Texas don't want to be part of a ruined country, if something is not done to stop the financial implosion.

Three Congressmen Introduce Gold Standard Bill to Stabilize the Dollar's Value

Money Metals, April 2023

Washington, DC - As America faces the twin threats of inflation and bank failures, three U.S. congressmen introduced a pivotal sound money bill that would enable the Federal Reserve note “dollar” to regain stable footing for the first time in more than half a century.

Washington, DC - As America faces the twin threats of inflation and bank failures, three U.S. congressmen introduced a pivotal sound money bill that would enable the Federal Reserve note “dollar” to regain stable footing for the first time in more than half a century.

Rep. Alex Mooney (R-WV) - joined by Reps. Andy Biggs (R-AZ) and Paul Gosar (R-AZ) - introduced H.R. 2435, the “Gold Standard Restoration Act,” to facilitate the re-pegging of the volatile Federal Reserve note to a fixed weight of gold bullion.

Upon passage of H.R. 2435, the U.S. Treasury and the Federal Reserve are given 24 months to publicly disclose all gold holdings and gold transactions, after which time the Federal Reserve note “dollar” would be formally re-pegged to a fixed weight of gold at its then-market price.

Comment: Again, are a few responsible U.S. congressmen preparing for an emergency? Nothing has happened so far, but things could turn very nasty very quick. Congress Bill H.R.2435 - Gold Standard Restoration Act (3/30/2023)

Bill Introduced in Congress to Restore Gold Standard

New American, October 26, 2022

Legislation has been introduced in Congress to restore the gold standard — a major step toward adhering to the U.S. Constitution and bringing back sound-money policies.

H.R. 9157, titled the Gold Standard Restoration Act, is sponsored by U.S. Representative Alex Mooney (R-W.Va.). If enacted, it would be a significant step to restoring sanity to U.S. monetary policy.

Comment: Congress Bill H.R.9157 - To define the dollar as a fixed weight of gold, and for other purposes.

The quiet campaign to reinstate the gold standard is getting louder

Yahoo! Finance, July 3, 2019

[...] Since 2011, at least six states have passed laws recognizing gold and silver as currency; another three are presently contemplating bills of their own. The surprising success of Ron Paul, a Texas Republican Congressman and ardent gold bug, in the 2008 and 2012 elections showed the potency of these ideas among the electorate. In its 2012 and 2016 campaign platforms, the Republican Party called for a commission to investigate the viability of a return to a gold standard system. The Republican-controlled House of Representatives passed a bill including such a commission in both 2015 and 2017, but both times the proposals died in the Senate.

[...] Some argue returning to the gold standard is a legal imperative.

There is a basis in the US Constitution for this, at once specific and quite vague: Sections 8 and 10 of Article I state that Congress has the “Power…to coin Money, regulate the Value thereof, and of foreign Coin,” while “no state…shall make any Thing but gold and silver Coin a Tender in Payment of Debts.”

It’s entirely possible that this was supposed to guarantee convertibility between state currencies, rather than asserting anything intrinsic to gold. But these two mentions in the country’s founding document have served as ammunition for constitutionalists

Comment: There is a lot of information here. It does make you wonder, all the money prnting and there are still LOTs of poor peopls still around....

You may be wondering where the gold and other precious metals are coming from. I have seen at least 5 explanations. I believe that the Deep State has been hoarding gold for centuries (possibly under the Vatican). Then IMF trustee Karen Hudes claims the existence of trust fund accounts with trillions of dollars, monies available for humanity left at the world bank. Please note all the executive orders confiscating money from those convicted of crimes against humanity. These Cabal members do have trillions from being involved in the most heinous crimes imaginable.

Debt Clock Decodes: Highlights & Insights

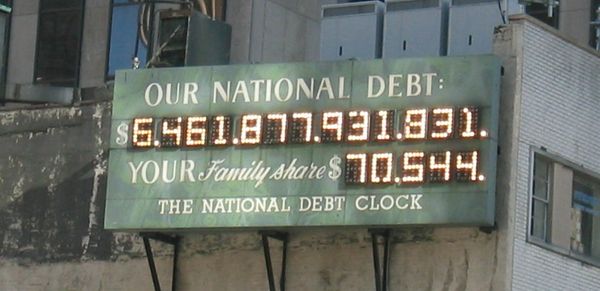

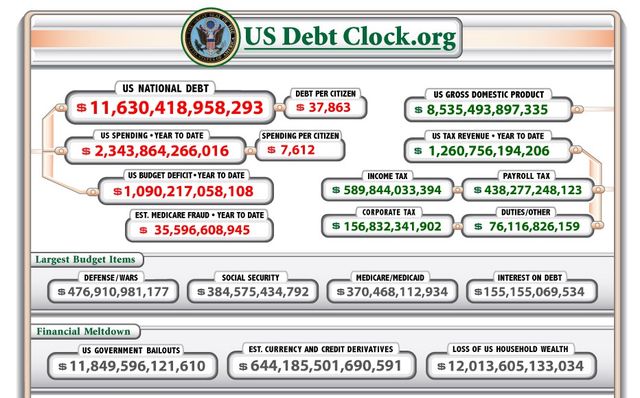

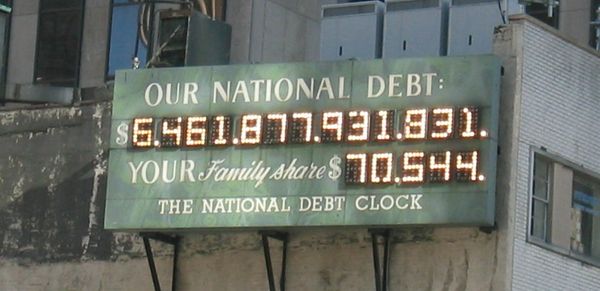

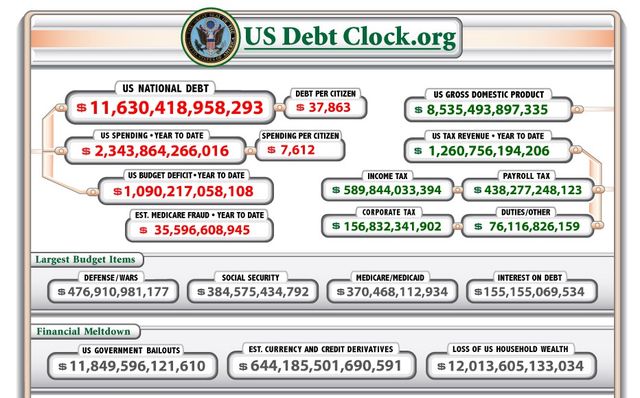

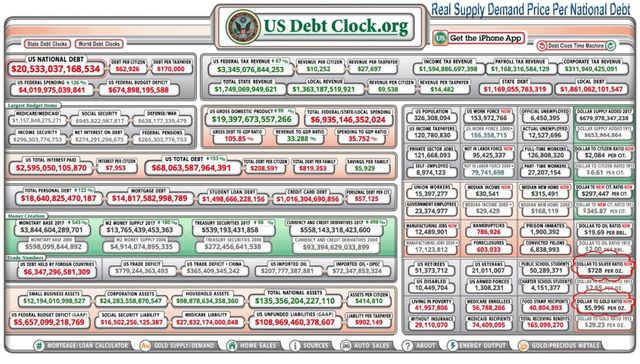

In the early 1980s, the U.S. National Debt clock was first envisaged by real estate developer Seymour Durst, to call attention to the country's soaring debt. In 1989, Durst set up an electronic billboard in Times Square, New York utilising 306 light bulbs to highlight the fact that the US national debt was nearing $3 trillion. In 2008, the old electronic billboard ran out of digits and the '1' had to be squashed into the same space as the dollar sign. There is still a debt clock in New York, but an internet online version www.usdebtclock.org was also set up. According to the Way Back Machine Internet archive, www.usdebtclock.org went live on 11 December 2008 .

www.usdebtclock.org, August 2009.

Click image for link (enlarged image)

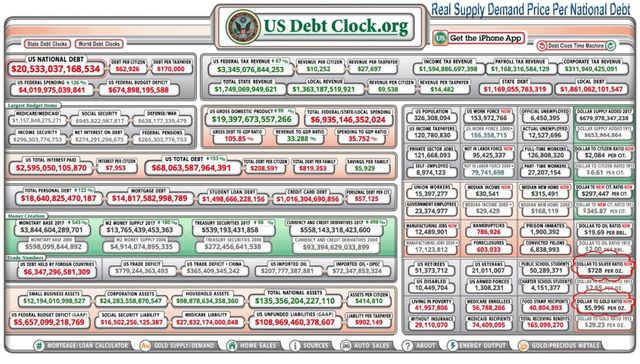

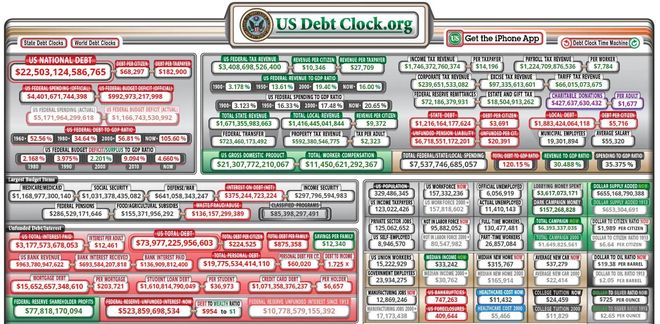

www.usdebtclock.org, Dec 2017.

Click image for link (enlarged image)

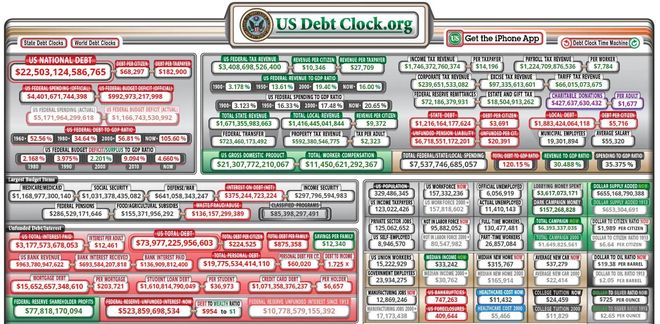

www.usdebtclock.org, August 2019.

Click image for link (enlarged image)

The following is a basic summary of the online US Debt Clock contents:

The U.S. national debt is the sum of all outstanding debt owed by the federal government. It's an accumulation of each year's budget deficits. About three-fourths of the national debt is public debt, which is held by individuals, businesses, and foreign governments that bought Treasury bills, notes, and bonds. The government owes the rest to itself, mainly to Social Security and other trust funds, and that's known as intragovernmental holdings.1

The debt clock shows how much the U.S. government owes its citizens, other countries, and itself.

US National Debt Clock: How Its Warning Affects You

thebalancemoney.com, October 4, 2022

Click image for link (article and enlarged images)

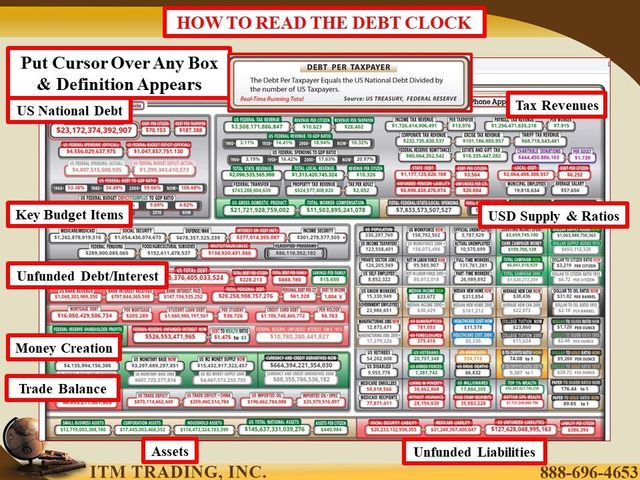

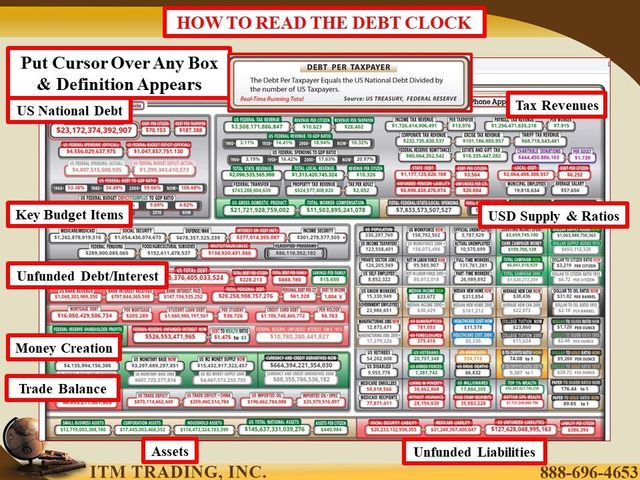

HOW TO READ THE DEBT CLOCK: And What The Debt Clock is Revealing Right Now By Lynette Zang

ITM Trading, Jan 15, 2020

Comment: This tutorial is still useful even though the Debt Clock has now changed. Start at 3 minutes.

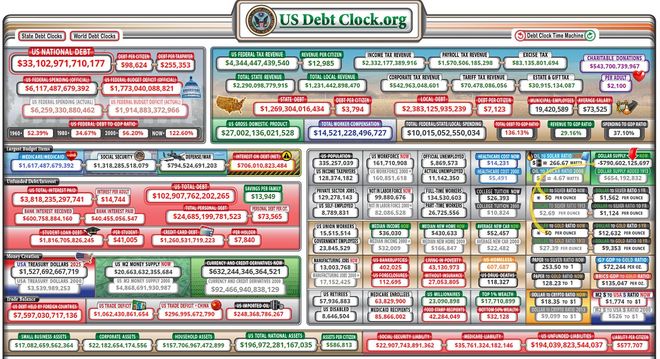

U.S. National Debt Clock : Real Time.

Click image for link

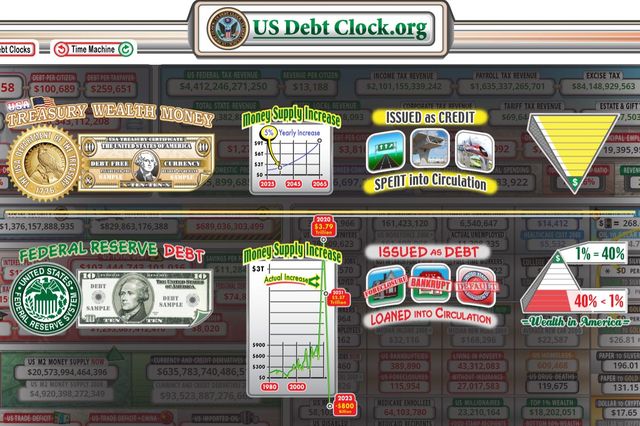

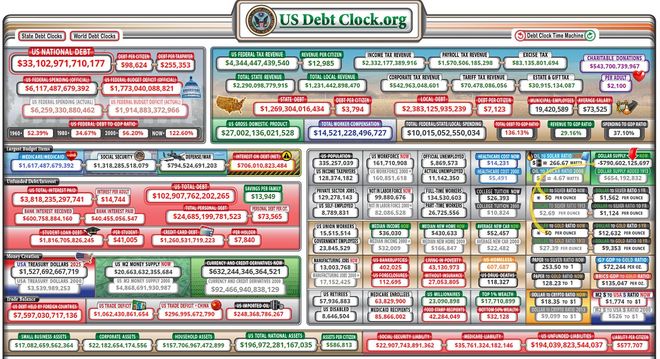

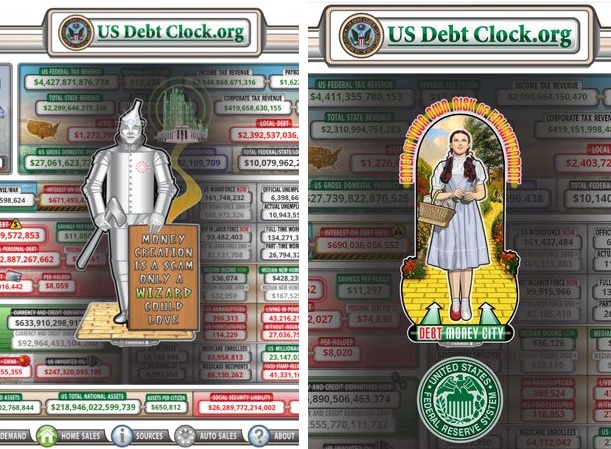

In September 2023, the online Debt clock received a major revamp. The new version was somewhat simplified, but new more relevant information to today's world was provided. Interesting emojis were placed alongside various elements in the graphics that bloggers subsequently attempted to decode.

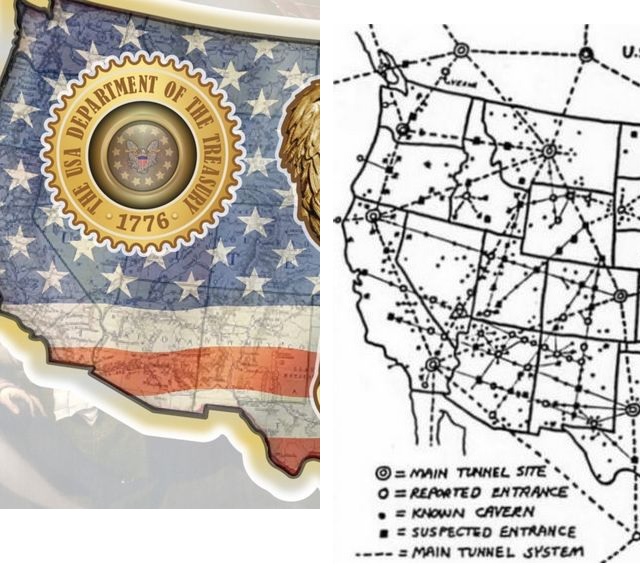

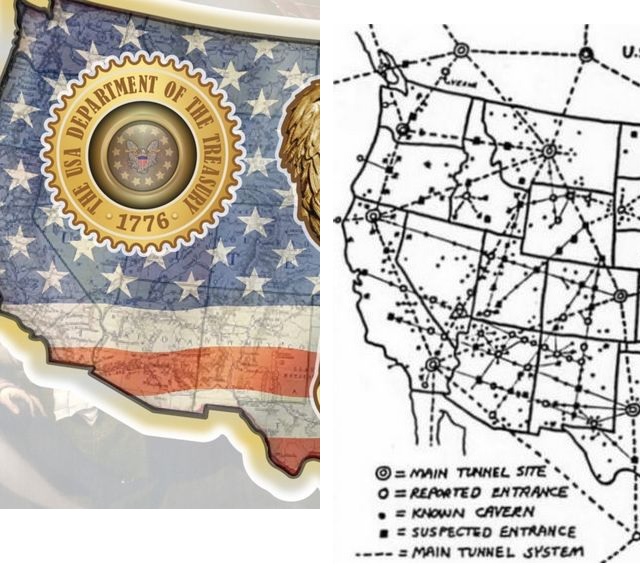

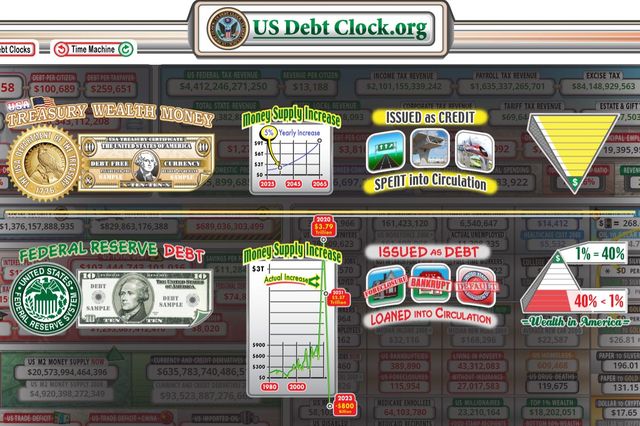

Furthermore, many were delighted to see a map of the USA outlined in gold, marking Money Creation with new USA Treasury Dollars. Note the difference: these are not listed as US Treasury dollars, but as USA Treasury Dollars. (The US corporation is dead and the original constitution has been restored.) The forecast date of 2025 also generated speculation.

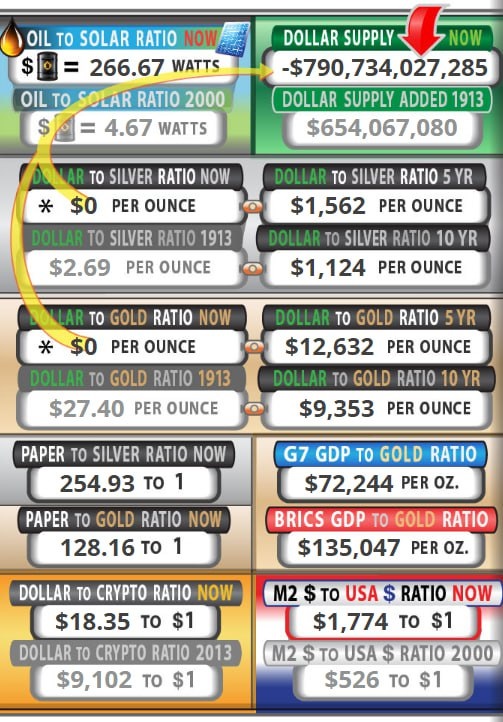

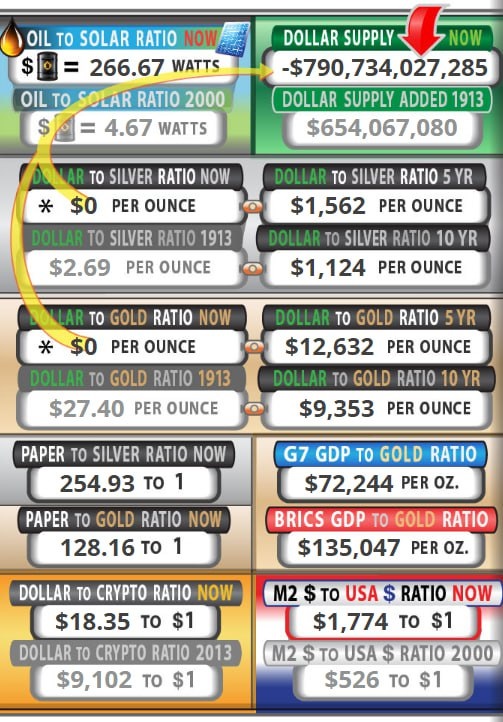

Top right: This change sparked debate by drawing attention to the reversal in dollar Supply. Top left: US dollar to gold/silver/oil ratio are all at zero on the US debt clock. This is because M2 money supply growth is now 0 or negative y/y (see yellow arrows). Interestingly, the US National Debt Clock is now tracking BRICS GDP [Gross Domestic Product] & G7 GDP figures separately in terms of gold and silver supply.

Secret Window Messages

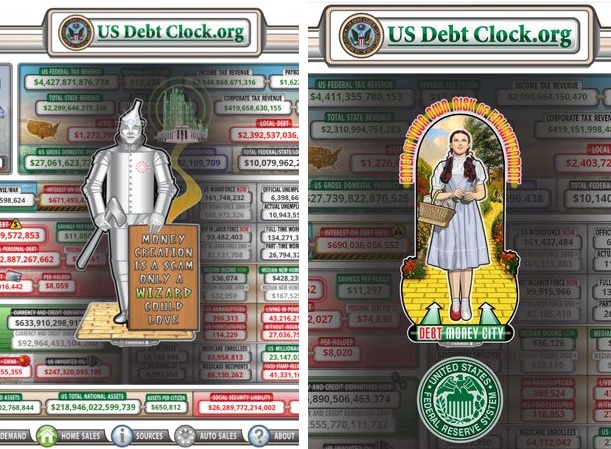

For quite some time, insider sources have revealed that something BIG is happening in the background and that two financial systems are now operating side by side with the goal of phasing out the old financial system. Hence, on 1st October 2023, there was a lot of excitement when the US Debt Clock promoted a “secret window” that went on to provide meaningful and entertaining messages using high quality images. It seems that the unknown owners of this website have made a great effort, to steer those interested into a greater understanding of the old and new monetary systems.

In summary, the new debt clock messages used historical, political, religious and astrological themes to contrast the past with the future.

Since all these messages have been copied and laid out on different websites, the effort here is to highlight the most interesting messages that seem to indicate a new golden era for mankind.

24th October 2023 | Episode 11 & 30th November 2023 | Episode 26.

Left: The Tin Man does not have a heart and cares not for the people. They will be scammed mercilessly!

Right: Dorothy (Wizard of Oz) on the Yellow Brick road (Gold Bars) walking away from Debt Money City.

Comment: The US Debt Clock Secret Window uses the iconic Wizard of Oz characters to instil some home truths. There are numerous videos decoding the real meaning of the Wizard of Oz and a few have been provided on this website here. In the Hollywood Wizard of Oz movie, the silver shoes were replaced by red shoes, Cabal symbolism for how they were going to do business. The artistic licence here of one shoe red and one shoe silver is reference to two systems running in parallel.

28th September 2023 | Episode 25.

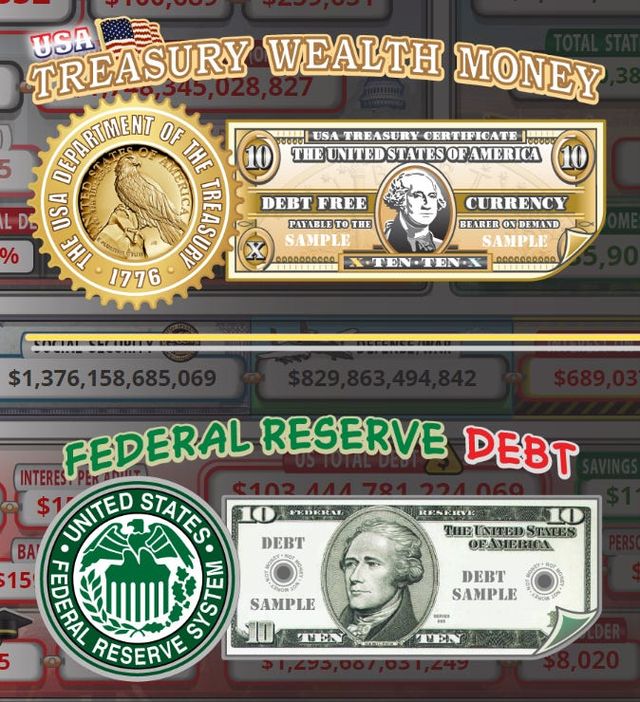

Here we are presented with symbolism for two monetary systems operating side by side.

Wealth and money supply increases with USA treasury notes, while it appears that in 2023, the money supply has crashed under the Federal Reserve debt system.

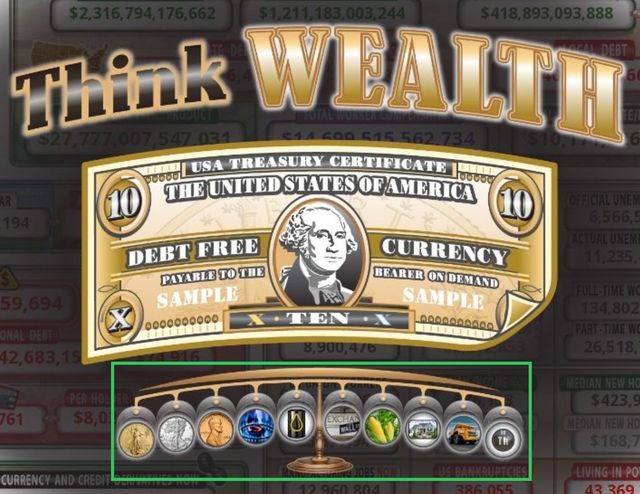

The term “PAYABLE TO THE BEARER ON DEMAND” is only seen on the USA Treasury certificate, while the Federal Reserve debt sample says “NOT MONEY” in small print around the circle.

Massive Wealth Transfer: The pyramid showing the # of people who obtain great wealth in America is flipped under the path involving the USA Department of the Treasury 1776.

OLD MONEY VS NEW MONEY | US DEBT CLOCK DECODE - 28th January 2024

Unlocking the potential of Real World Assets (RWA) through blockchain technology is set to revolutionize the creation of innovative treasury certificates. Join me on a deep dive into the intricacies of this transformative process, as I break down the details on the most recent recent secret window from the US debt clock with some meme.

Unlocking the potential of Real World Assets (RWA) through blockchain technology is set to revolutionize the creation of innovative treasury certificates. Join me on a deep dive into the intricacies of this transformative process, as I break down the details on the most recent recent secret window from the US debt clock with some meme.

Comment: @echodatruth deep dive. Also:

FED Scam - 30th January deep dive

19th December 2023 | Episode 35

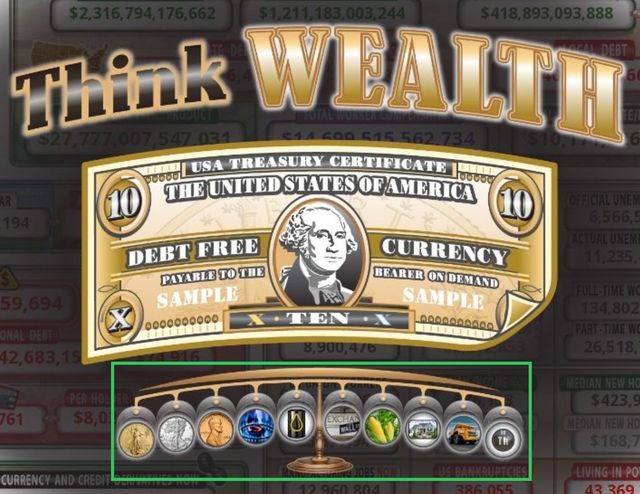

This Debt Clock image with the headline 'Think Wealth' provides a weighted and balanced basket of commodities. From left to right, gold, silver, copper, natural gas, natural oil, stocks and bonds, farming and agriculture, real estate, infrastructure (roads and other construction), and Thorium 90 (TH 90).

Comment: The appearance of Thorium 90 was quite a revelation to most people as it turns out it is a clean low radiation nuclear fuel. In the past, it was discarded in favour of uranium as nuclear fuel, because it was not suitable for military purposes.

Thorium Nuclear Power - Simpler, Safer, Cleaner, Cheaper, and Greener

Texas Thorium LLC

28th December 2023 | Episode 40

Here a contrast is provided between the “Old Money” system of perpetual debt and the coming “New Money” system that involves “asset based wealth creation.” The 2024 silver eagle coin found under the lower right fold of the gold colored USA treasury certificate. This implies silver will play a critical role in the new financial system.

It is believed that this new financial system will be adopted by countries across the world. What's more, a major transition from perpetual debt creation to an asset based financial system (gold included in a basket of commodities) will create a new golden era.

4th January 2023 | Episode 43

Again we see a comparison between the old and new. The ball and chain is represents the “old kingdom” monetary system with the constant need to create cash that quickly evaporates with inflation. Instead the “new kingdom” is designed to allow people to thrive. There is a spiritual message here with the super hero character on the right with an open third eye (pineal gland activated). Wealth creation will allow people to have the freedom to seek spiritual enlightenment.

Comment: Please note this image was only available on the Debt Clock phone App.

Right: This is the ratio of existing US fiat dollar supply (M2) to the new USA treasury dollars (date 14th March 2024), but this value can vary by +/- 1 or +/- 2. It can be found in the far right Debt Clock column associated with other precious metal ratios.

Right: This is the ratio of existing US fiat dollar supply (M2) to the new USA treasury dollars (date 14th March 2024), but this value can vary by +/- 1 or +/- 2. It can be found in the far right Debt Clock column associated with other precious metal ratios.

So, many truthers believe that due to

Trump's executive orders, the United States have seized $2.3 quadrillion in assets. I don't know how the accounting works, but a long time ago, I learnt the Cabal have been hiding assets that actually belong to the United States. World Banker and whistle blower Karen Hudes also states that there is massive amounts of money left in trust for the world. Just think! The lies that we have been told just go on and on....

Do the math for recaptured assets ....

Internet hearsay | $2.3 x 1015 ÷ 1175 = $1.957 x 1012 New Treasury dollars

Debt Clock Hidden Wealth infographic | $7.5 x 1012 New Treasury dollars

Well, this Debt Clock secret window message reveals that there has been ~3.8 x more assets seized than internet hearsay....

1st February 2023 | Episode 55

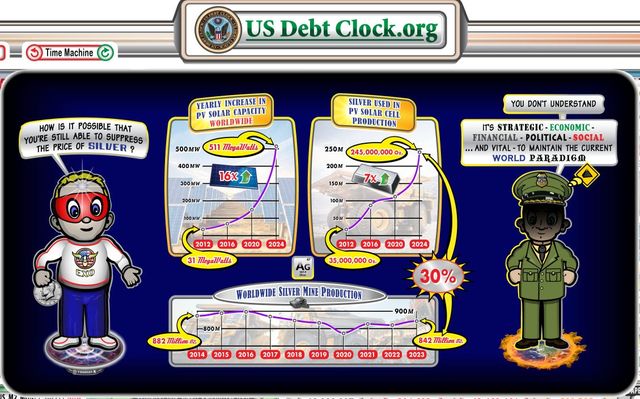

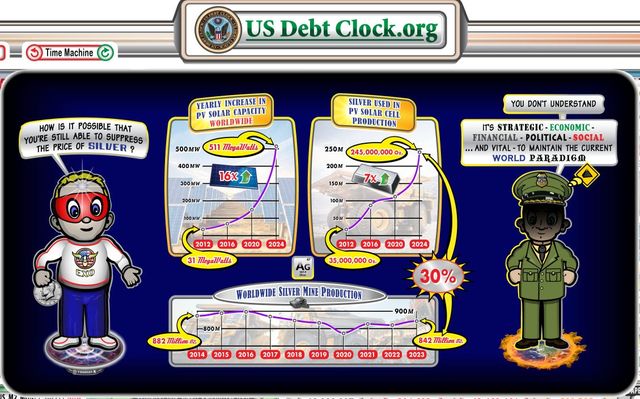

Episode 55 asks the simple question of how the silver price is suppressed, especially as demand has increased in recent years. The US CIA warden standing on the right seems to be claiming that this suppression of silver prices is strategic and intentional to maintain “control” worldwide. This same US CIA “game” warden is also standing on what appears to be a symbolic depiction of the world on fire under his feet. Meanwhile, our super hero seems wide awake now and finds himself standing on solid ground with Thorium/Tesla energy under his feet.

SILVER PRICE SUPPRESSION | US DEBT CLOCK DECODE - 1st February 2024

SILVER PRICE SUPPRESSION | US DEBT CLOCK DECODE - 1st February 2024

Comment: @echodatruth deep dive. The last minute is information about how Thorium 90 is going to be part of our new future. Also:

US Debt Clock: Unveiling the Value of God's Money

As we delve into USA Treasury Certificates backed by tangible assets, a paramount question arises: What might be the potential value of Gold and Silver?

Comment: @echodatruth deep dive. Sorry, this is a spoiler: From the Debt Clock Secret Window we find:

• 1 oz gold = 100 USA Treasury dollars

• 1 oz silver = 10 USA Treasury dollars

• 1 oz gold = 100 USA Treasury dollars x 1775

= $177,500 (US fiat dollars)

• 1 oz silver = 10 USA Treasury dollars x 1775

= $17,750 (US fiat dollars)

The whole point of the reset in precious metal prices is that these metals will truly become "precious" again. So, even though these valuations seem fantastic, the current fiat dollar is virtually worthless. Hence, why those who understand that we are going back to a gold standard, are stacking precious metals.

Click image for link

On Superbowl Sunday 11th Feb 2024, the US Debt Clock took its next step and joined XTwitter. Its message from the website was simple - follow us on X.

Comment: Only following 17 accounts. This is a 'Q' account.

28th Feb 2024 |

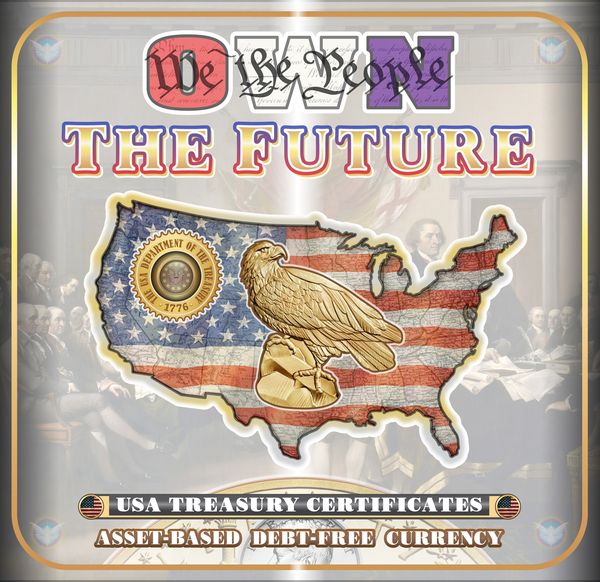

Episode 66

The theme of episode 66 was “We The People” now OWN THE FUTURE! The background of this post is a famous painting depicting the signing of the Declaration of Independence in 1776.

Click image for link

Click image for link

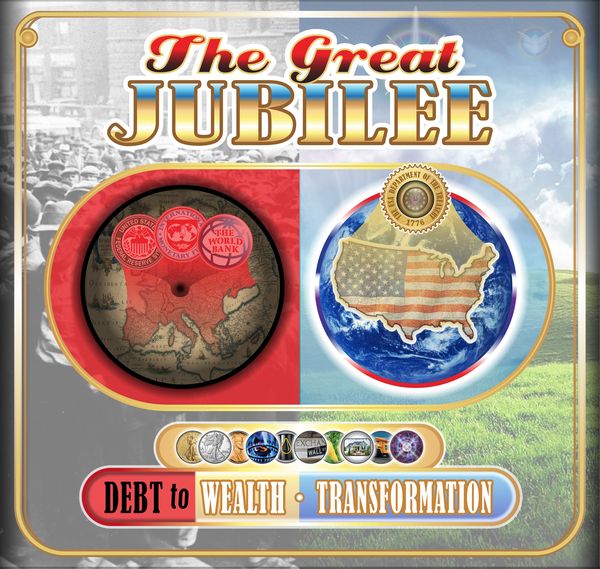

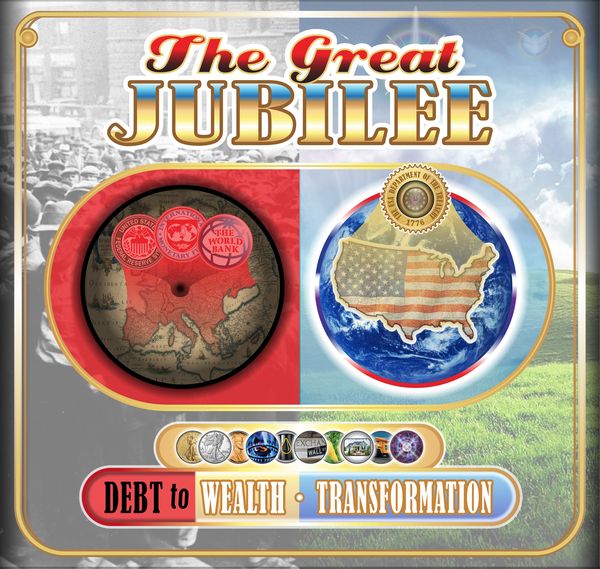

Posted on XTwitter on 3rd March 2024 |

Episode 67

US Debt Clock update posted at 3rd March 2024, 3:33 EST.

Click image for link

“The imagery suggested that the US Federal Reserve System, the International Monetary Fund, and the World Bank are being sucked into a black hole somewhere near Germany, Austria, or Switzerland. Meanwhile, the US financial system is being transformed via the USA Treasury 1776 and blanketed in gold. The words “debt to wealth” are cited at the bottom and a contrast is emphasized by a dark to light color pattern. The picture in the background of the debt side appears to be from the Great Depression or some time in the early 1900s showing men lining up outside of a bank.” Source:

link

THE GREAT JUBILEE | US DEBT CLOCK DECODE - 3/3/24

THE GREAT JUBILEE | US DEBT CLOCK DECODE - 3/3/24

XTwitter, 3rd March 2024

Comment: In a Jubilee, THE SLAVES HAVE TO BE FREED. Hence the Episode 66 'Q' reference to the TUNNELS/DUMBS.

A Debt Jubilee Of Biblical Proportions Is Coming Soon... What You Need To Know

Zerohedge, 2nd June 2023

Four thousand years ago, the rulers of ancient Babylon discovered a technique to stave off violent revolts.

In ancient times, there was a tendency for people to become hopelessly in debt to their creditors. Eventually, they would rise up and cause instability that could threaten the entire ruling system.

The rulers of the ancient world recognized this dynamic.

Their solution was to enact widespread debt cancellation—a debt jubilee.

Comment: Surprised to see this article on Zero Hedge. However, it is very clear to many who follow financial matters that the US national debt is unpayable, (plus many other countries in massive debt), so a debt jubilee MUST be enforced.

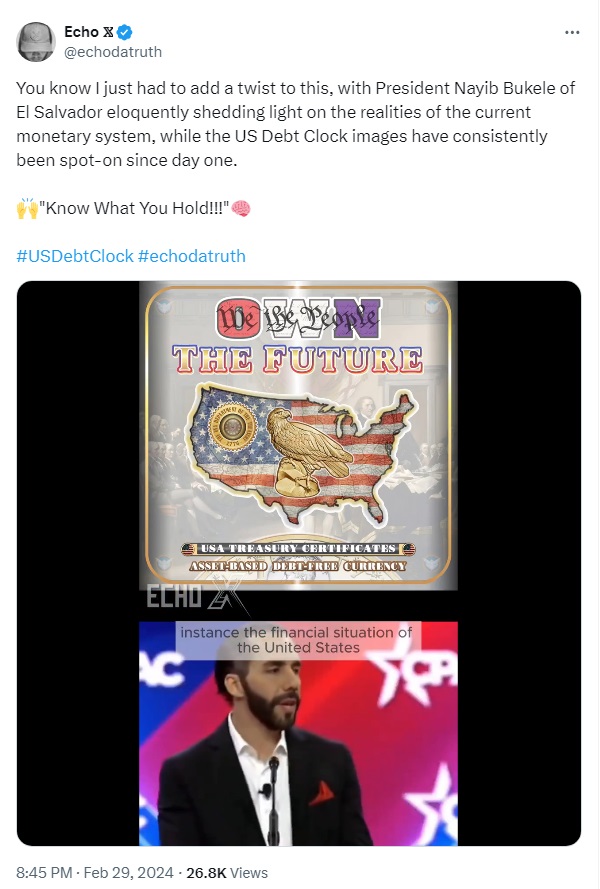

Click image for link

Comment: @Echodatruth has linked US Debt Clock secret window messages alongside a short segment of the CPAC speech given by President Nayib Bukele of El Salvador. These messages mostly relate to the fact that the fiat dollar monetary system is a huge ponzi scheme that only really benefits the 1%. Money does not keep it's value due to inflation and ordinary people are basically slaves.

Further Debt Clock Message Timelines

The Fruited Plain Substack

Comment: The Fruited Plain Substack was used to help sort the Debt Clock Secret Window messages and decipher their meanings, so this website is highly recommended for further research.

US Debt Clock Timeline of the Secret Window

YouTube

Debt Clock Messages 1-51:

Courtesy: @Santasurfing | XTwitter

Debt Clock Messages 51-66:

Courtesy: @Santasurfing | XTwitter

Comment: As usual with these things, the Debt Clock message numbering got confused when images started being posted on the App and on XTwitter.

First Upload: 2nd March 2024

Last Update: 6th November 2024

|

N- National (G- Global)

N- National (G- Global)

MOSCOW. – In a sign of growing de-dollarization efforts, Brazil, Russia, India, China, South Africa (Brics) have ditched the US dollar in 95 percent of their trade.

MOSCOW. – In a sign of growing de-dollarization efforts, Brazil, Russia, India, China, South Africa (Brics) have ditched the US dollar in 95 percent of their trade.

The New Development Bank is helping to multilateralize the world of finances, Chris Hart, executive chair of the Impact Investment Group, told RT.

The New Development Bank is helping to multilateralize the world of finances, Chris Hart, executive chair of the Impact Investment Group, told RT.

The current fiat system (money created out of thin air and

The current fiat system (money created out of thin air and

KH: Well, there is terrible currency problem. We’re on the verge of the currency war. The Federal Reserve is printing dollars like there is no tomorrow, and if they keep going, the rest of the world is not going to accept them. As it is, the BRICS countries – Brazil, Russia, India, China and South Africa – have decided that they are going to finance the trade among these countries with assets and pay for the difference in gold. And this is the right move for them... [...]

KH: Well, there is terrible currency problem. We’re on the verge of the currency war. The Federal Reserve is printing dollars like there is no tomorrow, and if they keep going, the rest of the world is not going to accept them. As it is, the BRICS countries – Brazil, Russia, India, China and South Africa – have decided that they are going to finance the trade among these countries with assets and pay for the difference in gold. And this is the right move for them... [...]

In Weimar, Germany, in 1923, anyone with a $100 bill could exchange that gold substitute for a swanky house in downtown Berlin.

In Weimar, Germany, in 1923, anyone with a $100 bill could exchange that gold substitute for a swanky house in downtown Berlin.

[...] For decades, behind closed doors, Europe had been engaged in strategic preparations to return to a gold-backed currency system, countering the dollar hegemony and forging a new equitable financial order.

[...] For decades, behind closed doors, Europe had been engaged in strategic preparations to return to a gold-backed currency system, countering the dollar hegemony and forging a new equitable financial order.